Question

The Alden Oil Company buys crude vegetable oil. The refining of this oil results in four products, A, B and C, which are liquids and

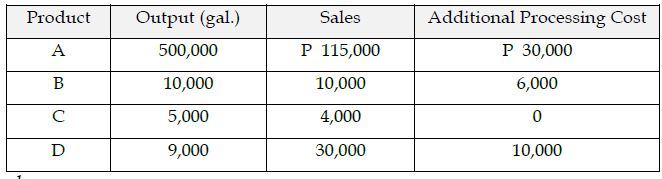

The Alden Oil Company buys crude vegetable oil. The refining of this oil results in four products, A, B and C, which are liquids and D, which is heavy grease. The cost of the oil refined in 19_9 was P27,600 and the refining department had total processing costs of P70,000. The output sales for the four products in 19_9 were as follows:

a) Assume that the net realizable value of allocating joint costs is used. What is the net income for Products A, B, C and D? Joint costs total P97,600. b) The company had been tempted to sell at split-off directly to the other processors. If that alternative had been selected, sales per gallon would have been: A, P0.15; B, P0.50; C, P0.80; and D, P3.00. What would the net income be for each product under this alternative? c) The company expects to operate at the same level of production and sales in the forthcoming year. Could the company increase net income by altering its processing decisions? If so, what would be the expected overall net income? Which products should be processed further and which should be sold at split-off point? Assume that all costs incurred after split-off are variable.

ProductOutput (gal.) 500,000 10,000 5,000 9,000 Sales P 115,000 10,000 4,000 30,000 Additional Processing Cost P 30,000 6,000 0 10,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started