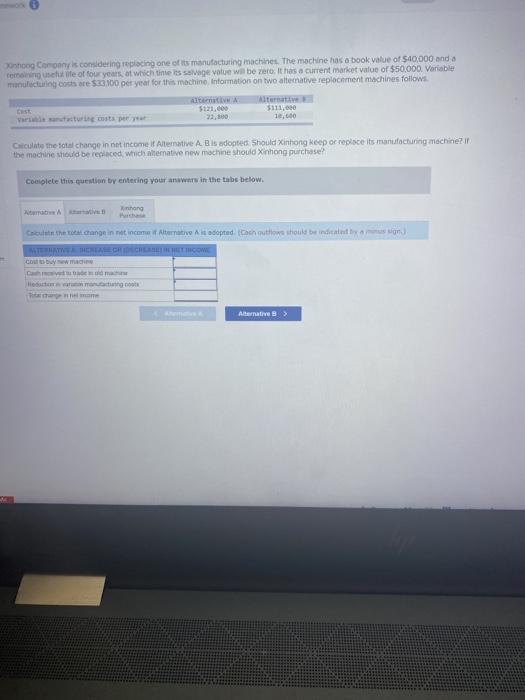

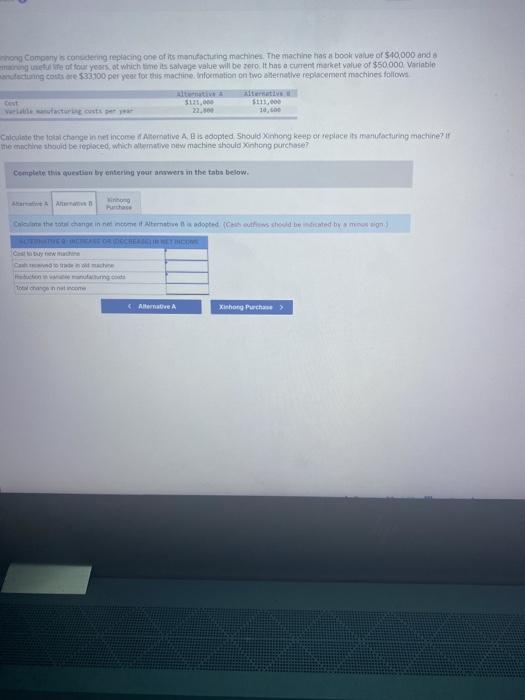

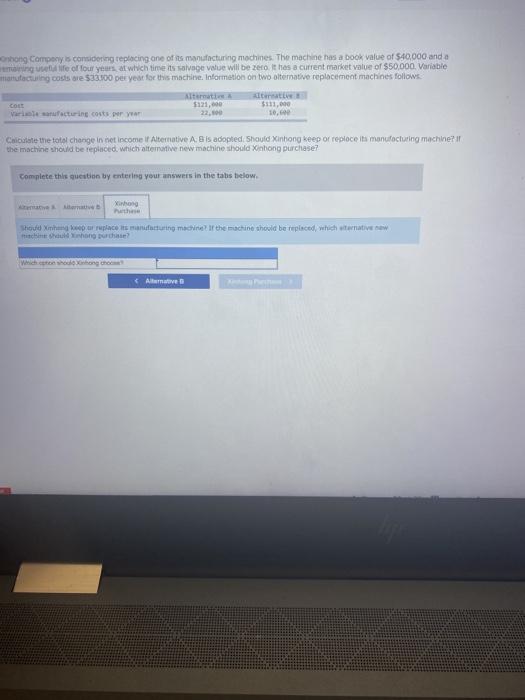

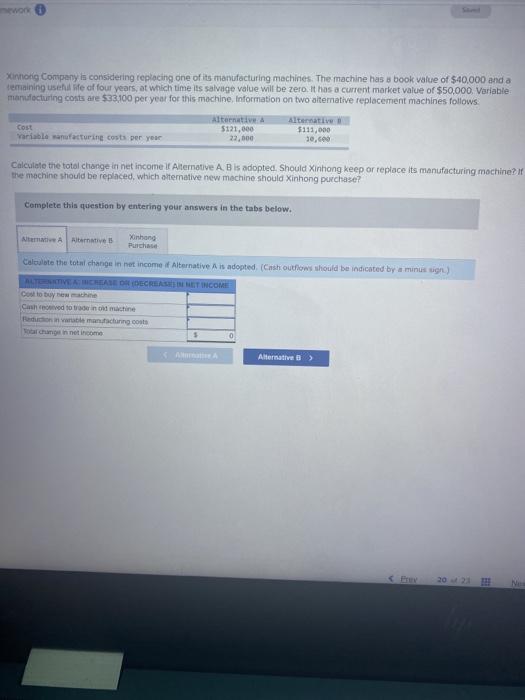

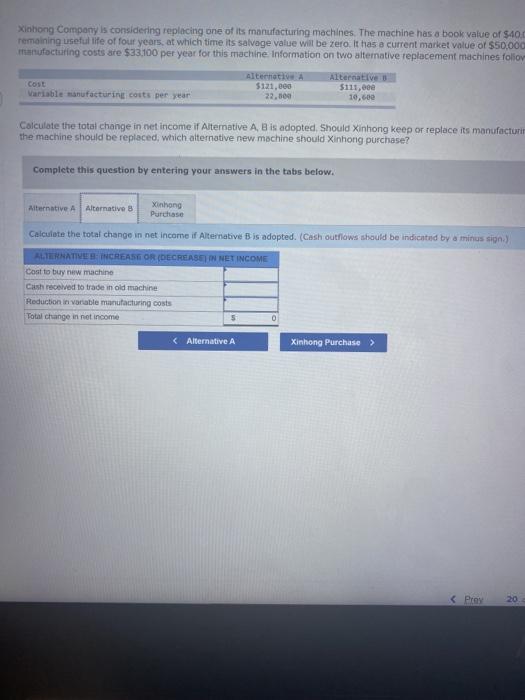

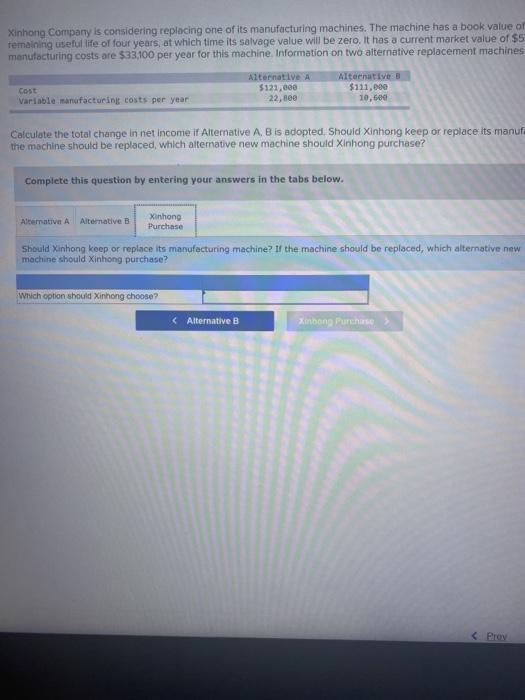

hong Coronny is considering replacing one of its manufacturing machines. The machine has a book value of $40,000 and a ter useful ife of four years, at which time is salvage value will be zero. It has a current market value of $50,000 Variable manufacturing cos se 53300 per year for the machine Information on two alternative replacement machines follows 5121,000 $111.000 Veturing costs per Calculate the total change in net income i Alternative A, B is adopted Should Xinhong keep or replace its manufacturing machine in the machine should be replaced which alternative new machine should Xinhong purchase Complete this question by entering your answers in the tabe below. hong scult that change in net income Alternative is adopted can qutlaws should be indicated sign Cam tang Alternative > hong Company conding replacing one of its manufacturing machines. The machine has a book value of $40,000 and age of four years of which time its salvage value will be roro It has a current market value of $50,000 Variable cung costs are $3100 per year for this machine information on two alternative replacement machines follows ter 5121.00 S. Vastatur custa 22.10 Calculate the total change in net income Alternative A, B is adopted Should Xinhong keep or replace its manufacturing machine? menunchine should be replaced, which tomative new machine should Xinhono purchase Complete this question by entering your answers in the tabs below A Woo Com the total change in net income to adopted the beated by a mo CW Target Alternate Xinho Purchase hong Company is considering replacing one of its manufacturing machines. The machine has a book value of $40,000 and a gee of four years at which time its salvage value will be zero. It has a current market value of $50,000 Variable manufacturing costs are $33.300 per year for this machine. Information on two alternative replacement machines follows mate 1121,000 $111,000 10, Chiculate the total change in net income i Alternative A, B is adopted Should Xinhong keep or replace its manufacturing machine? the machine should be replaced, which alternative new machine should Xinhong purchase Complete this question by entering your answers in the tabs below hong The X ar replace is mandaturing machine in the machine should be replaced, which teative Alternative Xinong Company is considering replacing one of its manufacturing machines. The machine has a book value of $40,000 and a remaining usehife of four years, at which time its salvage value will be zero. It has a current market value of $50,000 Variable manufacturing costs are $33,100 per year for this machine Information on two alternative replacement machines follows Alten Alternative Cost $121,000 $113,000 variable manufacturing costs per year 22.000 30, Calculate the total change in net income It Alternative AB is adopted. Should Xinhong keep or replace its manufacturing machine? the machine should be replaced, which alternative new machine should Xinhong purchase? Complete this question by entering your answers in the tabs below. Xinhong Nem Albentive Purchase Calculate the total change in net income of Alternative A is adopted. (Cinsh outflows should be indicated by a munsin) LTETIVE ACHARE ON DECREASE INCOME Cost to buy the Choved to train on machine con le manichining costs changin net income $ 0 Alternative Nu Xiobong Company is considering replacing one of its manufacturing machines. The machine has a book value of $400 remaining useful life of four years, at which time its salvage value will be zero. It has a current market value of $50,000 manufacturing costs are $33,100 per year for this machine Information on two alternative replacement machines folio Cost Variable manufacturing costs per year Alternativ $121,000 22.500 Alternative $111, 10,60e Calculate the total change in net income if Alternative A, B is adopted Should Xinhong keep or replace its manufacturin the machine should be replaced, which alternative new machine should Xinhong purchase? Complete this question by entering your answers in the tabs below. Alternative Alternative Xinhong Purchase Calculate the total change in net income if Alternative B is adopted. (Cash outflows should be indicated by a minus sign. ALTERNATIVE INCREASE OR (DECREASE IN NET INCOME Cost to buy new machine Cash received to trade in old machine Reduction in vorable manufacturing costs Total change in not income 5