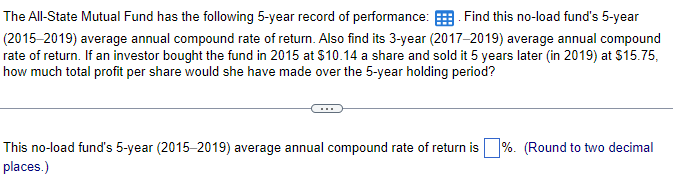

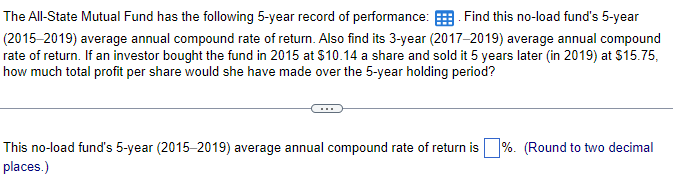

The All-State Mutual Fund has the following 5-year record of performance: Find this no-load fund's 5 -year (2015-2019) average annual compound rate of return. Also find its 3-year (2017-2019) average annual compound rate of return. If an investor bought the fund in 2015 at $10.14 a share and sold it 5 years later (in 2019) at $15.75, how much total profit per share would she have made over the 5 -year holding period? This no-load fund's 5-year (2015-2019) average annual compound rate of return is \%. (Round to two decimal places.) A year ago, the Very Large Growth Fund was being quoted at an NAV of $21.15 and an offer price of $22.03. Today, it's being quoted at $22.91 (NAV) and $23.86 (offer). What is the holding period return on this load fund, given that it was purchased a year ago and that its dividends and capital gains distributions over the year have totaled $0.85 per share? Assume that none of the dividends and capital gains distributions are reinvested into the fund. (Hint: You, as an investor, buy fund shares at the offer price and sell at the NAV.) The holding period return on this load fund is \%. (Round to two decimal places.) The All-State Mutual Fund has the following 5-year record of performance: Find this no-load fund's 5 -year (2015-2019) average annual compound rate of return. Also find its 3-year (2017-2019) average annual compound rate of return. If an investor bought the fund in 2015 at $10.14 a share and sold it 5 years later (in 2019) at $15.75, how much total profit per share would she have made over the 5 -year holding period? This no-load fund's 5-year (2015-2019) average annual compound rate of return is \%. (Round to two decimal places.) A year ago, the Very Large Growth Fund was being quoted at an NAV of $21.15 and an offer price of $22.03. Today, it's being quoted at $22.91 (NAV) and $23.86 (offer). What is the holding period return on this load fund, given that it was purchased a year ago and that its dividends and capital gains distributions over the year have totaled $0.85 per share? Assume that none of the dividends and capital gains distributions are reinvested into the fund. (Hint: You, as an investor, buy fund shares at the offer price and sell at the NAV.) The holding period return on this load fund is \%. (Round to two decimal places.)