Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The amount paid for the calendars is (relevant or irrelevant). The $988 paid is a (future cost or past cost/sunken cost). That one (should or

The amount paid for the calendars is (relevant or irrelevant). The $988 paid is a (future cost or past cost/sunken cost). That one (should or should not affect the decision.

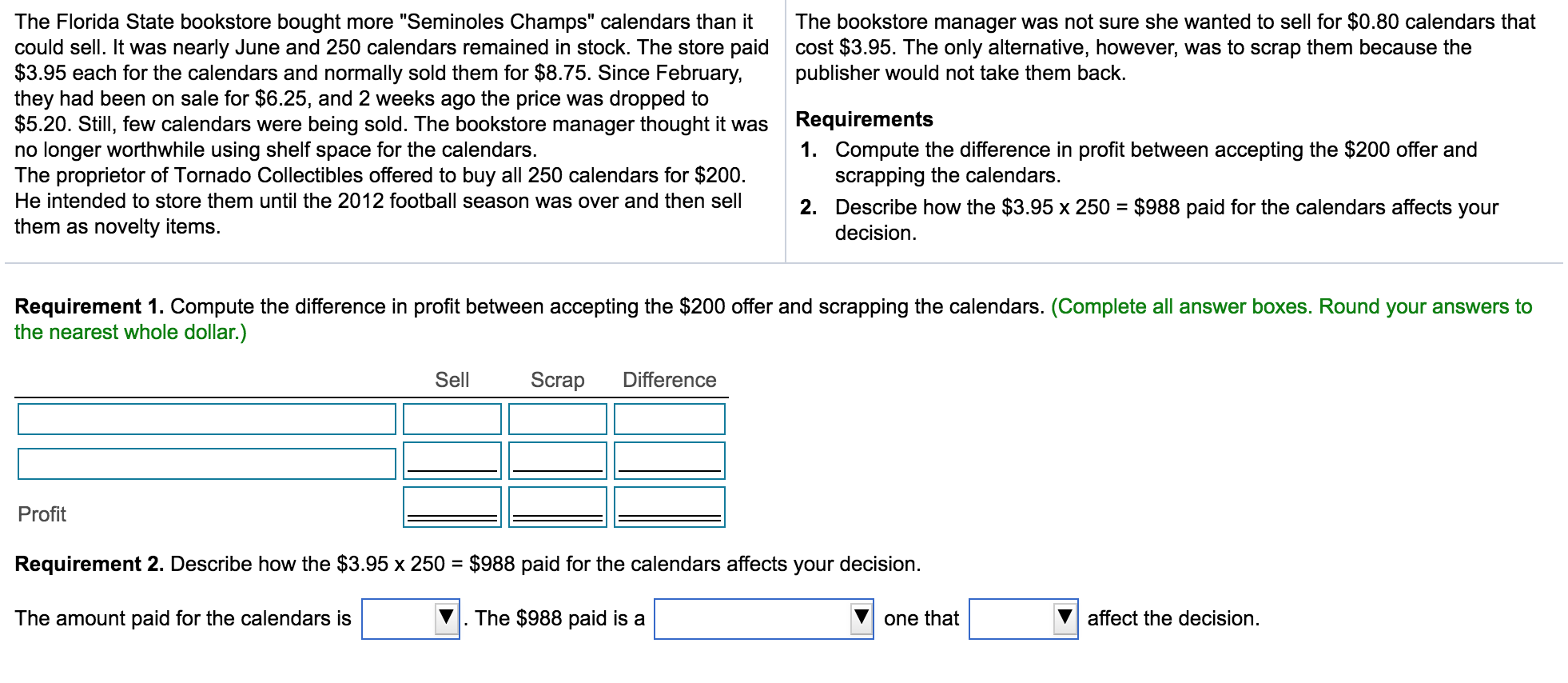

The bookstore manager was not sure she wanted to sell for $0.80 calendars that cost $3.95. The only alternative, however, was to scrap them because the publisher would not take them back. The Florida State bookstore bought more "Seminoles Champs" calendars than it could sell. It was nearly June and 250 calendars remained in stock. The store paid $3.95 each for the calendars and normally sold them for $8.75. Since February, they had been on sale for $6.25, and 2 weeks ago the price was dropped to $5.20. Still, few calendars were being sold. The bookstore manager thought it was no longer worthwhile using shelf space for the calendars. The proprietor of Tornado Collectibles offered to buy all 250 calendars for $200. He intended to store them until the 2012 football season was over and then sell them as novelty items. Requirements 1. Compute the difference in profit between accepting the $200 offer and scrapping the calendars. 2. Describe how the $3.95 x 250 = $988 paid for the calendars affects your decision. Requirement 1. Compute the difference in profit between accepting the $200 offer and scrapping the calendars. (Complete all answer boxes. Round your answers to the nearest whole dollar.) Sell Scrap Difference Profit Requirement 2. Describe how the $3.95 x 250 = $988 paid for the calendars affects your decision. The amount paid for the calendars is V. The $988 paid is a one that affect the decision. Sell Scrap Difference Cost of calendars Number of calendars Revenues x 250 = $988 paid for the calendars affects your decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started