Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The amounts entering the company must be written in front of it (to) and outside in front of it (B) + the first is the

The amounts entering the company must be written in front of it (to) and outside in front of it (B) + the first is the capital.

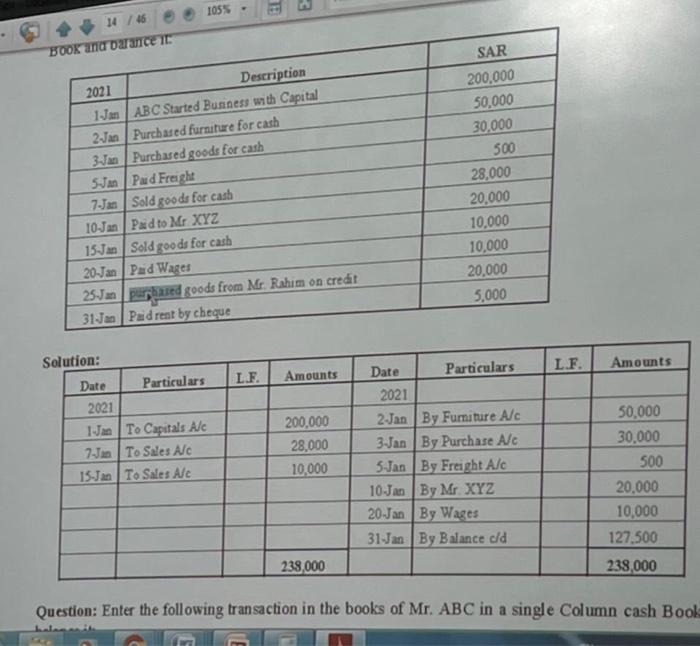

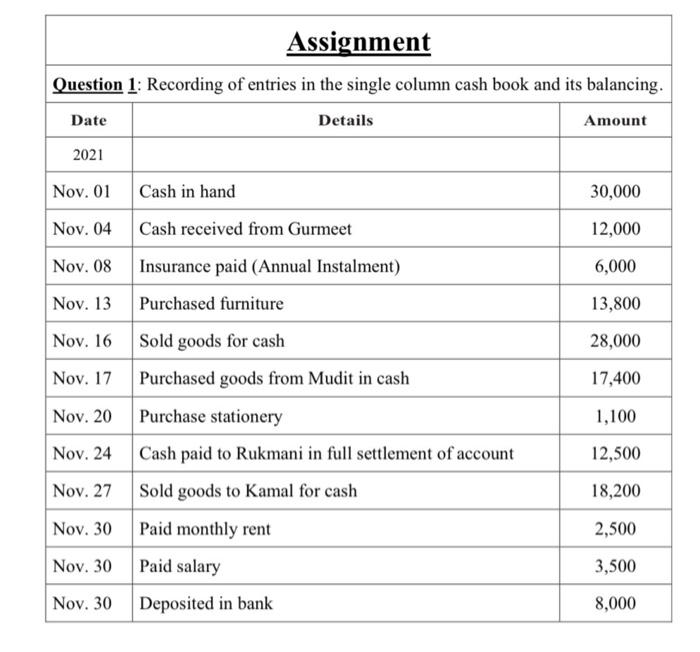

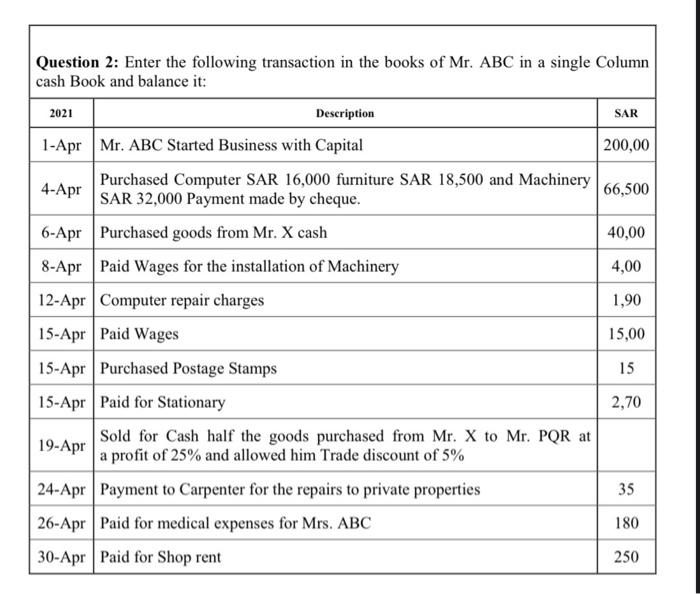

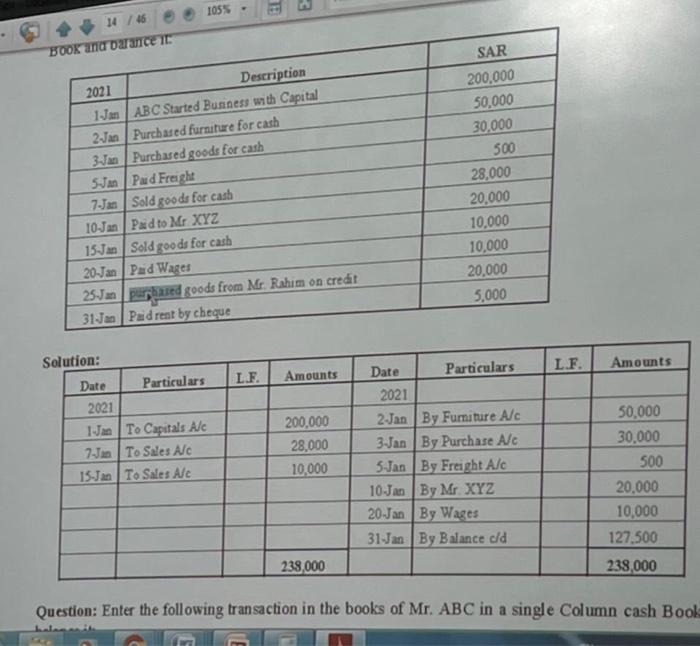

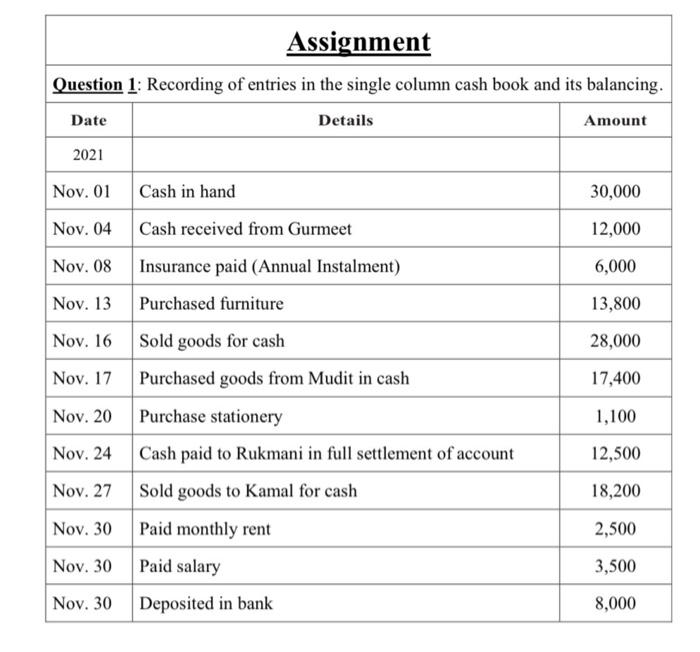

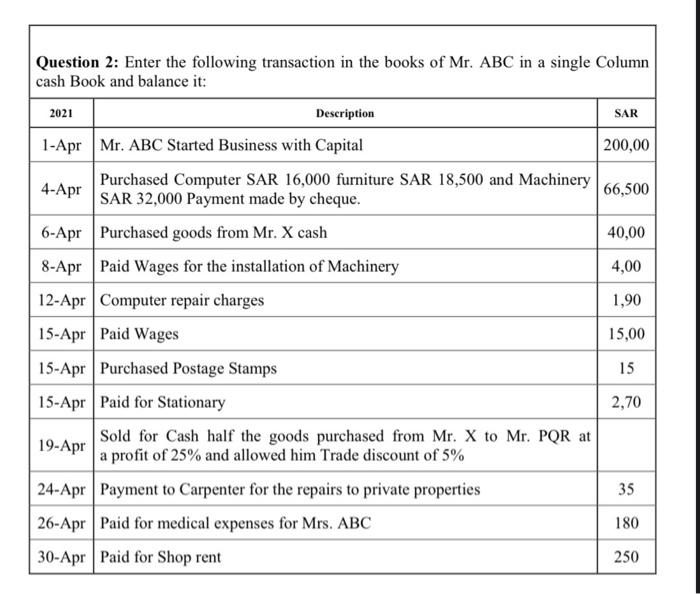

IOSS 14 / 46 Book an Darance 2021 Description 1.JnABC Started Business with Capital 2 Jan Purchased furniture for cash 3.Jan Purchased goods for cash 5 Jan Paid Freight 7.Jan Sold goods for cash 10 Jan Paid to Mr XYZ 15 Jan Sold goods for cash 20. Jan Pad Wages 25 Jan purated goods from Mr. Rahim on credit 31.Jan Paid rent by cheque SAR 200,000 50,000 30,000 500 28,000 20.000 10,000 10,000 20,000 5,000 LE Amounts L.F. Amounts Solution: Date Particulars 2021 1 Jan To Capitals Alc 7-Jan To Sales Alc 15 Jan To Sales Alc 200,000 28.000 10,000 Date Particulars 2021 2 Jan By Furniture Alc 3.Jan By Purchase A/C 3 Jan By Freight Alc 10 Jan By Mr.XYZ 20 Jan By Wages 31 Jan By Balance eld 50,000 30.000 500 20.000 10,000 127,500 238,000 238,000 Question: Enter the following transaction in the books of Mr. ABC in a single Column cash Book with Assignment Question 1: Recording of entries in the single column cash book and its balancing. Date Details Amount 2021 Nov. 01 Cash in hand 30,000 Nov. 04 12,000 Nov. 08 Cash received from Gurmeet Insurance paid (Annual Instalment) Purchased furniture 6,000 Nov. 13 13,800 Nov. 16 Sold goods for cash 28,000 Nov. 17 17,400 Nov. 20 1,100 Purchased goods from Mudit in cash Purchase stationery Cash paid to Rukmani in full settlement of account Sold goods to Kamal for cash Nov. 24 12,500 Nov. 27 18,200 Nov. 30 Paid monthly rent 2,500 Nov. 30 Paid salary 3,500 Nov. 30 Deposited in bank 8,000 Date Particulars L.F.Amounts Date Particulars L.F.Amounts 2021 2021 Question 2: Enter the following transaction in the books of Mr. ABC in a single Column cash Book and balance it: 2021 SAR 200,00 66,500 40,00 4,00 1,90 Description 1-Apr Mr. ABC Started Business with Capital 4-Apr Purchased Computer SAR 16,000 furniture SAR 18,500 and Machinery SAR 32,000 Payment made by cheque. 6-Apr Purchased goods from Mr. X cash 8-Apr Paid Wages for the installation of Machinery 12-Apr Computer repair charges 15-Apr Paid Wages 15-Apr Purchased Postage Stamps 15-Apr Paid for Stationary 19-Apr Sold for Cash half the goods purchased from Mr. X to Mr. PQR at a profit of 25% and allowed him Trade discount of 5% 24-Apr Payment to Carpenter for the repairs to private properties 26-Apr Paid for medical expenses for Mrs. ABC 30-Apr Paid for Shop rent 15,00 15 2,70 35 180 250 Date Particulars L.F.Amounts Date Particulars L.F.Amounts 2021 2021 Look at this example.

I want a correct solution plz

Questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started