Answered step by step

Verified Expert Solution

Question

1 Approved Answer

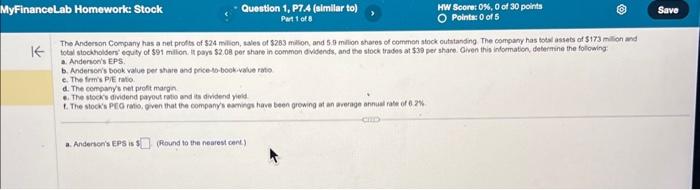

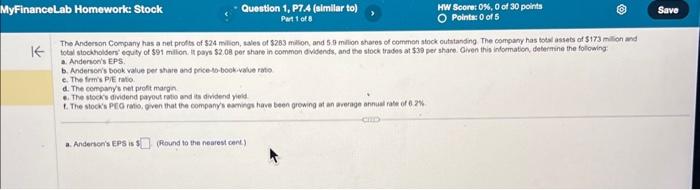

the andeeosn company has a net profits for $24 million, sales of $283 million, and 5.9 million shares of common stock outstanding. The company has

the andeeosn company has a net profits for $24 million, sales of $283 million, and 5.9 million shares of common stock outstanding. The company has total assets of $173 million and total stockholder's equity of $91 million. it pays $2.08 per share in common dividends, and the stock trades at $39 per share. given this information, determine thr following:

The Anderson Compary has a net profts of \\( \\$ 24 \\) milion, wies of \\( \\$ 263 \\) millon, and \\( 5.0 \\mathrm{millon} \\) shares of commen stock outatanding The company has todal assets of \\( \\$ 173 \\) millon med andenon's EPS. b. Anderson's book value per share and price-so-bok-value rato. c. The froms PIE rato. d. The comeary's net proft margn 4. The stocks dividend payout rotio and is dividend vield a. Anderion's EPS is 1 (Pound to the nearest cent) a. anderson's EPS

b. Anderson's book value per share and price-to-book-value ration.

c. The firm's P/E ratio

d. The company's net profit margin.

E. the stock's divident payout ratio and its divident yield.

F. The stock's PEG ratuo, given that ghe company's easning have been growing at an average annual rate of 6.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started