Answered step by step

Verified Expert Solution

Question

1 Approved Answer

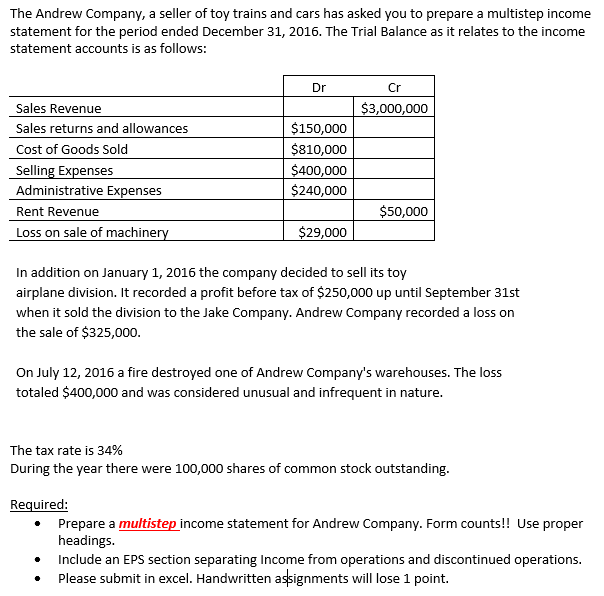

The Andrew Company, a seller of toy trains and cars has asked you to prepare a multistep income statement for the period ended December 31,

The Andrew Company, a seller of toy trains and cars has asked you to prepare a multistep income statement for the period ended December 31, 2016. The Trial Balance as it relates to the income statement accounts is as follows: In addition on January 1, 2016 the company decided to sell its toy airplane division. It recorded a profit before tax of $250,000 up until September 31st when it sold the division to the Jake Company. Andrew Company recorded a loss on the sale of $325,000. On July 12, 2016 a fire destroyed one of Andrew Company's warehouses. The loss totaled $400,000 and was considered unusual and infrequent in nature. The tax rate is 34% During the year there were 100,000 shares of common stock outstanding. Required: Prepare a multistep income statement for Andrew Company. Form counts!! Use proper headings. Include an EPS section separating Income from operations and discontinued operations. Please submit in excel. Handwritten assignments will lose 1 point

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started