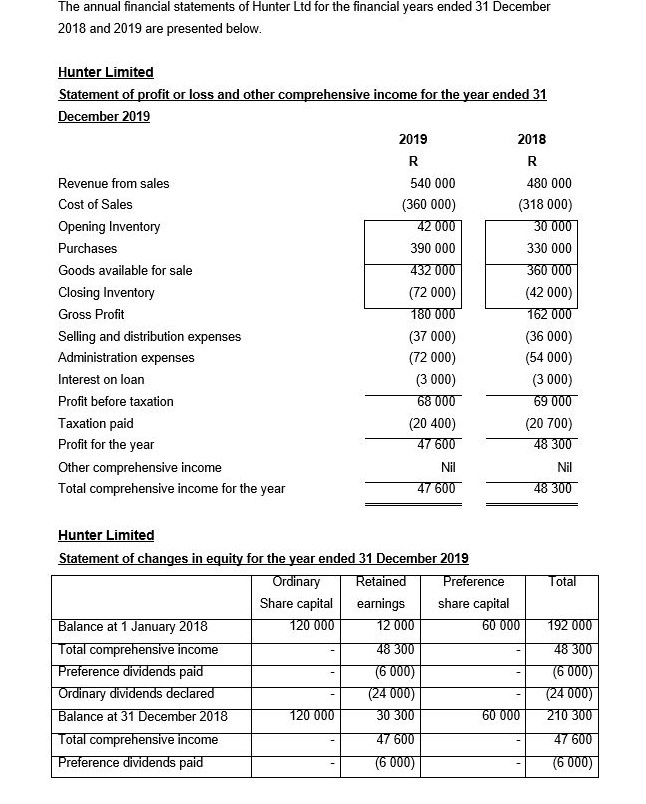

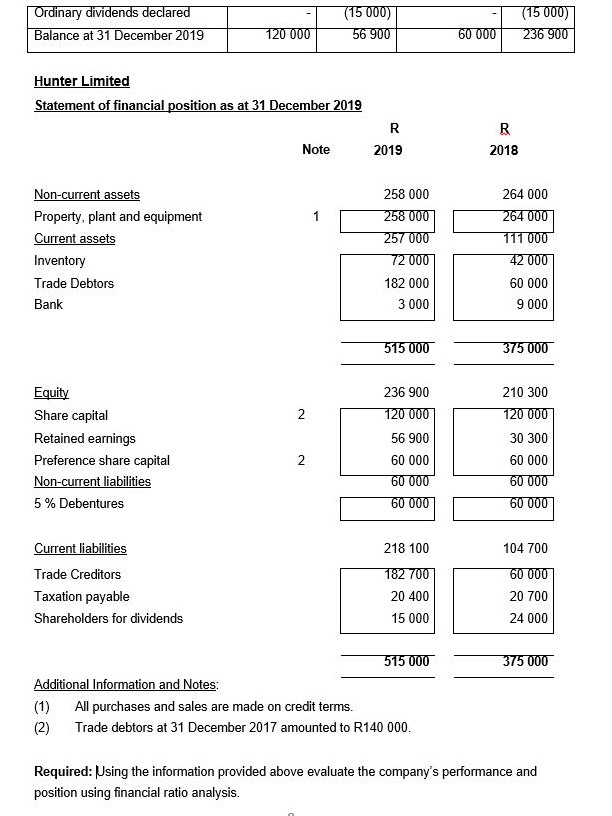

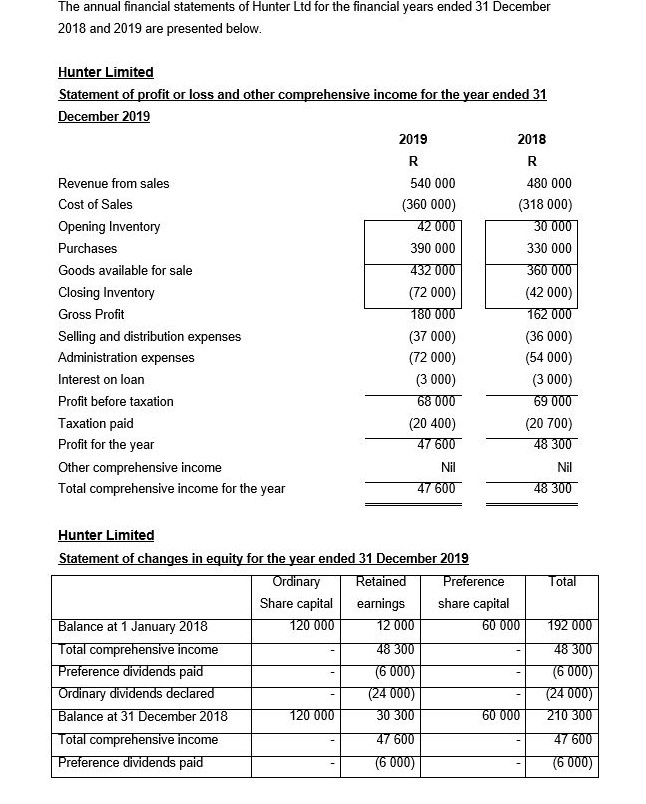

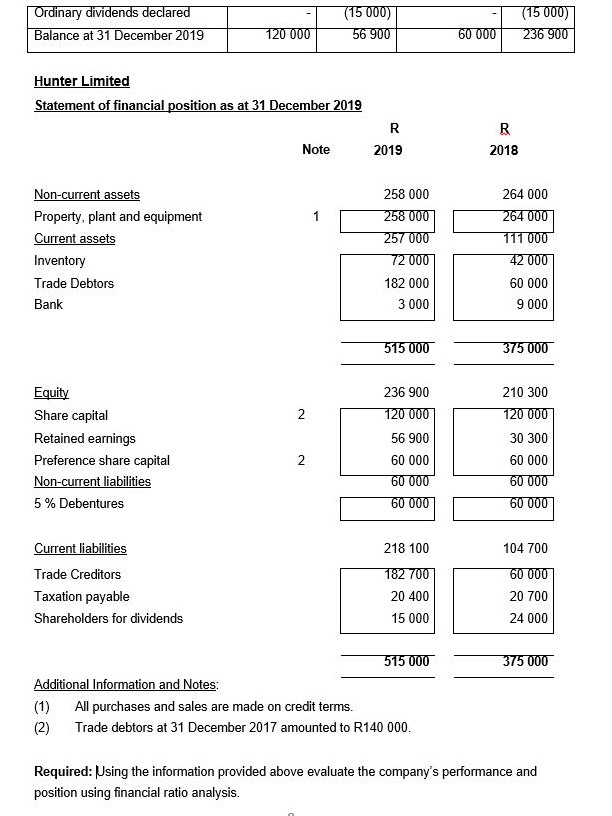

The annual financial statements of Hunter Ltd for the financial years ended 31 December 2018 and 2019 are presented below. Hunter Limited Statement of profit or loss and other comprehensive income for the year ended 31 December 2019 2019 2018 R R Revenue from sales 540 000 480 000 Cost of Sales (360 000) (318 000) Opening Inventory 42 000 30 000 Purchases 390 000 330 000 Goods available for sale 432 000 360 000 Closing Inventory (72 000) (42 000) Gross Profit 180 000 162 000 Selling and distribution expenses (37 000) (36 000) Administration expenses (72 000) (54 000) Interest on loan (3 000) (3 000) Profit before taxation 68 000 69 000 Taxation paid (20 400) (20 700) Profit for the year 47 600 48 300 Other comprehensive income Nil Nil Total comprehensive income for the year 47 600 48 300 Total 192000 Hunter Limited Statement of changes in equity for the year ended 31 December 2019 Ordinary Retained Preference Share capital earnings share capital Balance at 1 January 2018 120 000 12 000 60 000 Total comprehensive income 48 300 Preference dividends paid (6 000) Ordinary dividends declared (24 000) Balance at 31 December 2018 120 000 30 300 60 000 Total comprehensive income 47 600 Preference dividends paid (6 000) 48 300 (6 000) (24 000) 210 300 47 600 (6 000) Ordinary dividends declared Balance at 31 December 2019 (15000) 56 900 (15 000) 236 900 120 000 60 000 Hunter Limited Statement of financial position as at 31 December 2019 R 2019 R 2018 Note 1 Non-current assets Property, plant and equipment Current assets Inventory Trade Debtors Bank 258 000 258 000 257 000 72 000 182 000 3 000 264 000 264 000 111 000 42 000 60 000 9 000 515 000 375 000 2 Equity Share capital Retained earnings Preference share capital Non-current liabilities 5% Debentures 236 900 120 000 56 900 60 000 60 000 60 000 210 300 120 000 30 300 60 000 60 000 60 000 2 218 100 104 700 Current liabilities Trade Creditors Taxation payable Shareholders for dividends 182 700 20 400 15 000 60 000 20 700 24 000 375 000 515 000 Additional Information and Notes: (1) All purchases and sales are made on credit terms. (2) Trade debtors at 31 December 2017 amounted to R140 000. Required: 'Using the information provided above evaluate the company's performance and position using financial ratio analysis