Answered step by step

Verified Expert Solution

Question

1 Approved Answer

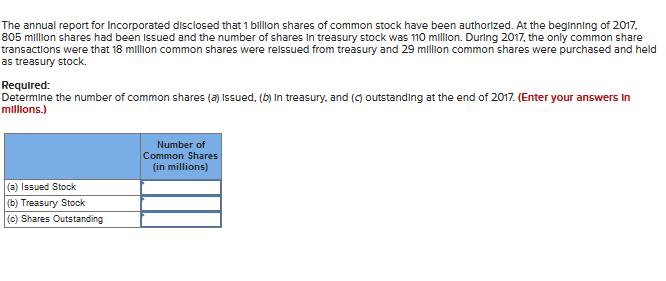

The annual report for Incorporated disclosed that 1 billion shares of common stock have been authorized. At the beginning of 2017. 805 million shares

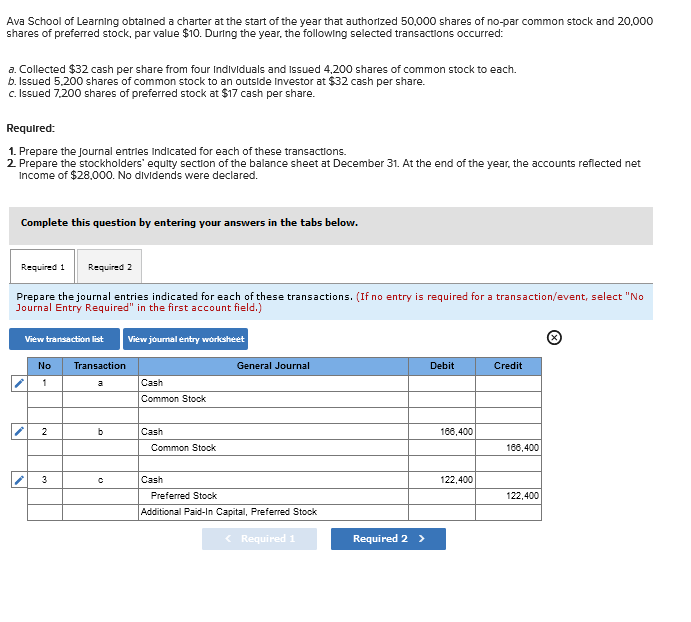

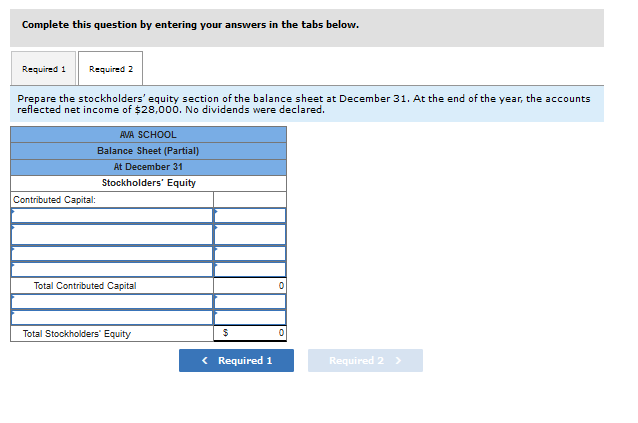

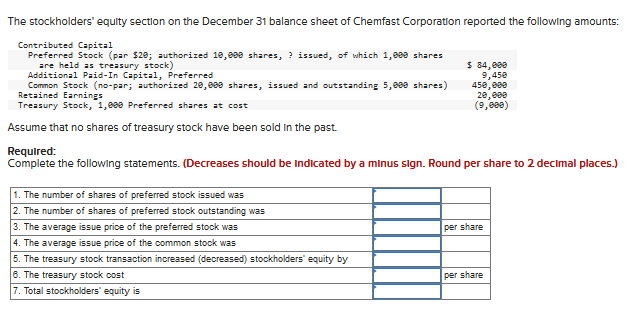

The annual report for Incorporated disclosed that 1 billion shares of common stock have been authorized. At the beginning of 2017. 805 million shares had been issued and the number of shares in treasury stock was 110 million. During 2017, the only common share transactions were that 18 million common shares were reissued from treasury and 29 million common shares were purchased and held as treasury stock. Required: Determine the number of common shares (a) Issued, (b) In treasury, and (c) outstanding at the end of 2017. (Enter your answers in millions.) (a) Issued Stock (b) Treasury Stock (c) Shares Outstanding Number of Common Shares (in millions) Ava School of Learning obtained a charter at the start of the year that authorized 50,000 shares of no-par common stock and 20,000 shares of preferred stock, par value $10. During the year, the following selected transactions occurred: a. Collected $32 cash per share from four Individuals and issued 4,200 shares of common stock to each. b. Issued 5,200 shares of common stock to an outside Investor at $32 cash per share. c. Issued 7,200 shares of preferred stock at $17 cash per share. Required: 1. Prepare the Journal entries indicated for each of these transactions. 2. Prepare the stockholders' equity section of the balance sheet at December 31. At the end of the year, the accounts reflected net Income of $28,000. No dividends were declared. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries indicated for each of these transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No 1 2 3 Transaction a b C Cash Common Stock Cash Common Stock Cash General Journal Preferred Stock Additional Paid-In Capital, Preferred Stock < Required 1 Required 2 > Debit 166,400 122,400 Credit 166,400 122,400 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the stockholders' equity section of the balance sheet at December 31. At the end of the year, the accounts reflected net income of $28,000. No dividends were declared. Contributed Capital: AVA SCHOOL Balance Sheet (Partial) At December 31 Stockholders' Equity Total Contributed Capital Total Stockholders' Equity $ < Required 1 0 0 Required 2 > The stockholders' equity section on the December 31 balance sheet of Chemfast Corporation reported the following amounts: Contributed Capital Preferred Stock (par $20; authorized 10,000 shares, ? issued, of which 1,000 shares are held as treasury stock) Additional Paid-In Capital, Preferred $ 84,000 9,450 Common Stock (no-par; authorized 20,000 shares, issued and outstanding 5,000 shares) Retained Earnings Treasury Stock, 1,000 Preferred shares at cost Assume that no shares of treasury stock have been sold in the past. Required: Complete the following statements. (Decreases should be indicated by a minus sign. Round per share to 2 decimal places.) 1. The number of shares of preferred stock issued was 2. The number of shares of preferred stock outstanding was 3. The average issue price of the preferred stock was 4. The average issue price of the common stock was 5. The treasury stock transaction increased (decreased) stockholders' equity by 6. The treasury stock cost 7. Total stockholders' equity is 450,000 20,000 (9,000) per share per share

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear step by step manner Step 1 Solut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started