Question

The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $250,000 in the current year. It

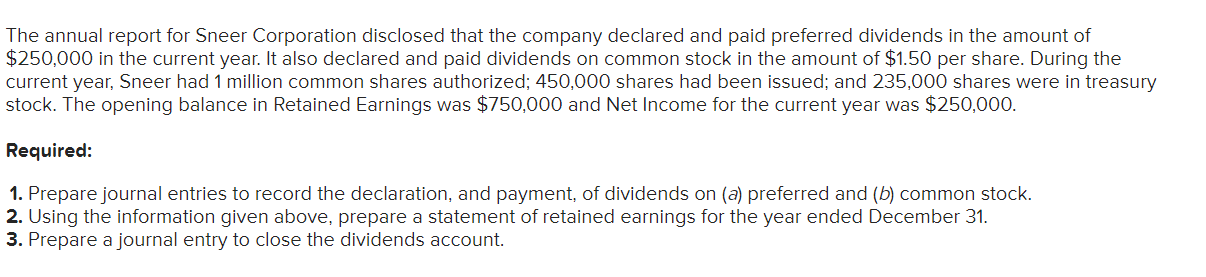

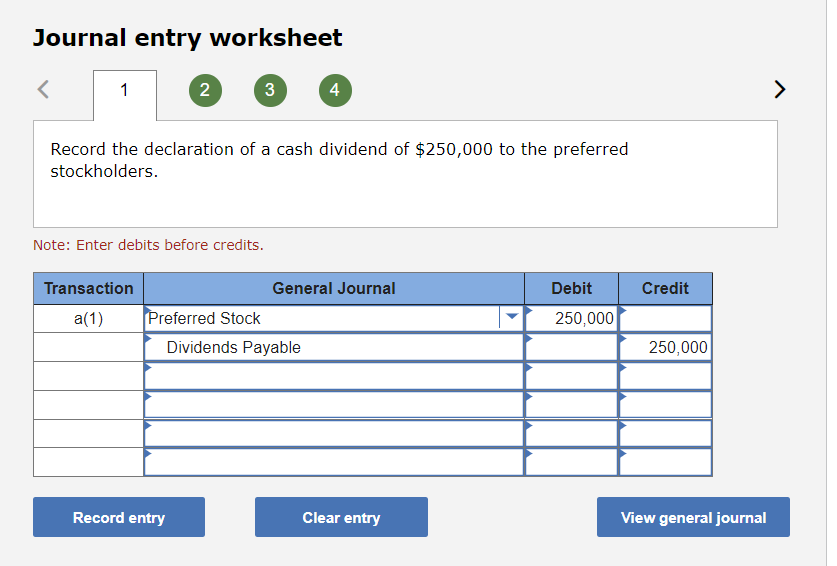

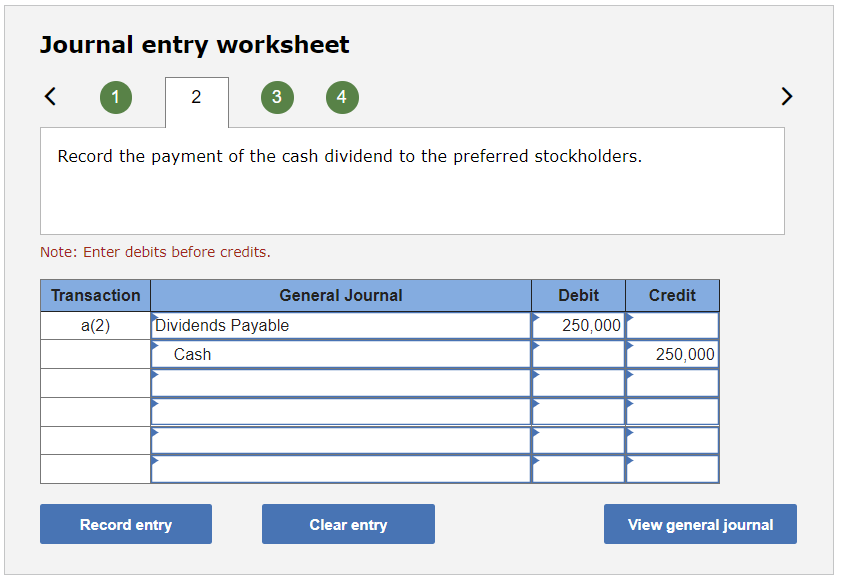

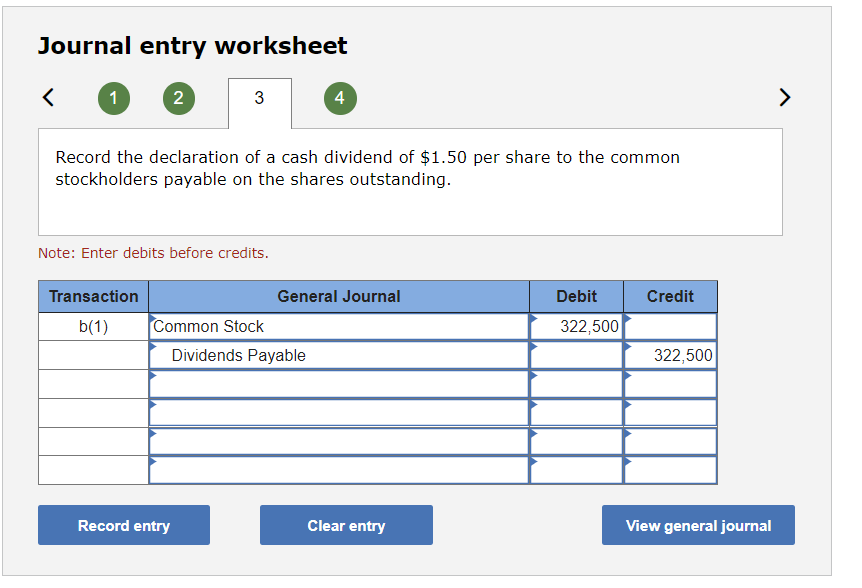

The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $250,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.50 per share. During the current year, Sneer had 1 million common shares authorized; 450,000 shares had been issued; and 235,000 shares were in treasury stock. The opening balance in Retained Earnings was $750,000 and Net Income for the current year was $250,000. Required:

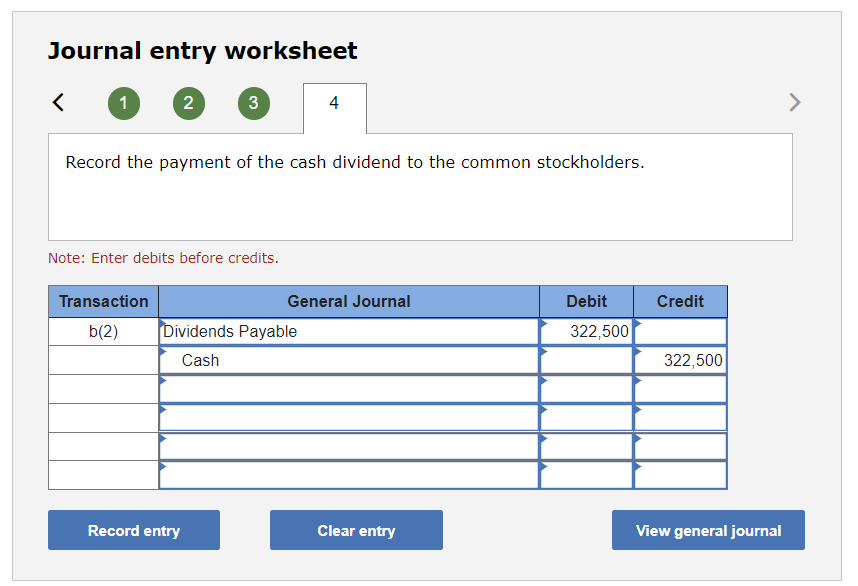

Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock.

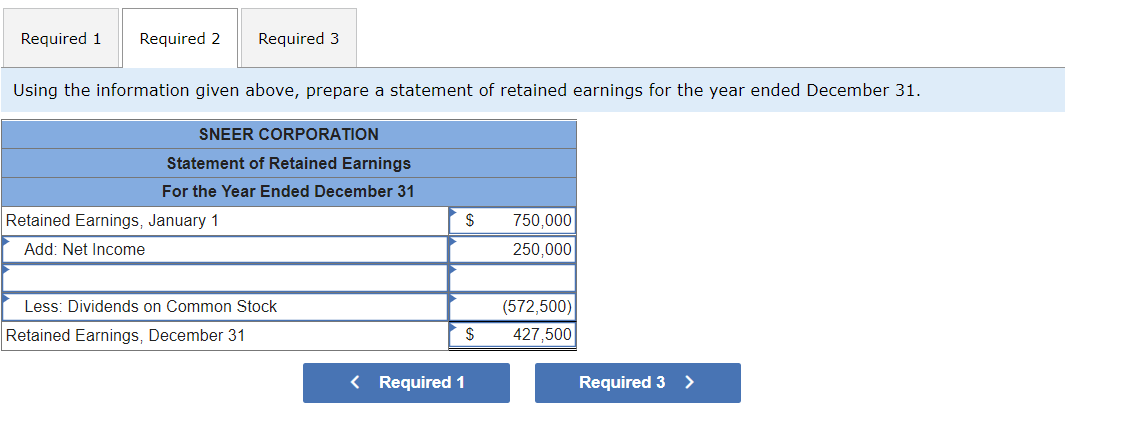

Using the information given above, prepare a statement of retained earnings for the year ended December 31.

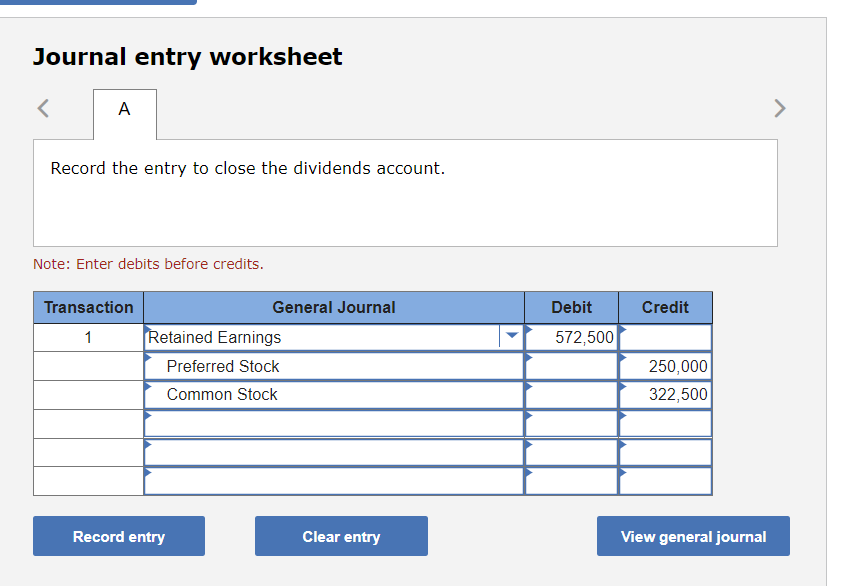

Prepare a journal entry to close the dividends account.

The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $250,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.50 per share. During the current year, Sneer had 1 million common shares authorized; 450,000 shares had been issued; and 235,000 shares were in treasury stock. The opening balance in Retained Earnings was $750,000 and Net Income for the current year was $250,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account. Journal entry worksheet Record the declaration of a cash dividend of $250,000 to the preferred stockholders. Note: Enter debits before credits. Journal entry worksheet Record the payment of the cash dividend to the preferred stockholders. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend of $1.50 per share to the common stockholders payable on the shares outstanding. Note: Enter debits before credits. Journal entry worksheet Record the payment of the cash dividend to the common stockholders. Note: Enter debits before credits. \begin{tabular}{|l|l|l|} \hline Required 1 & Required 2 & Required 3 \\ \hline \end{tabular} Using the information given above, prepare a statement of retained earnings for the year ended December 31. Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started