Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $220,000 in the current year. It

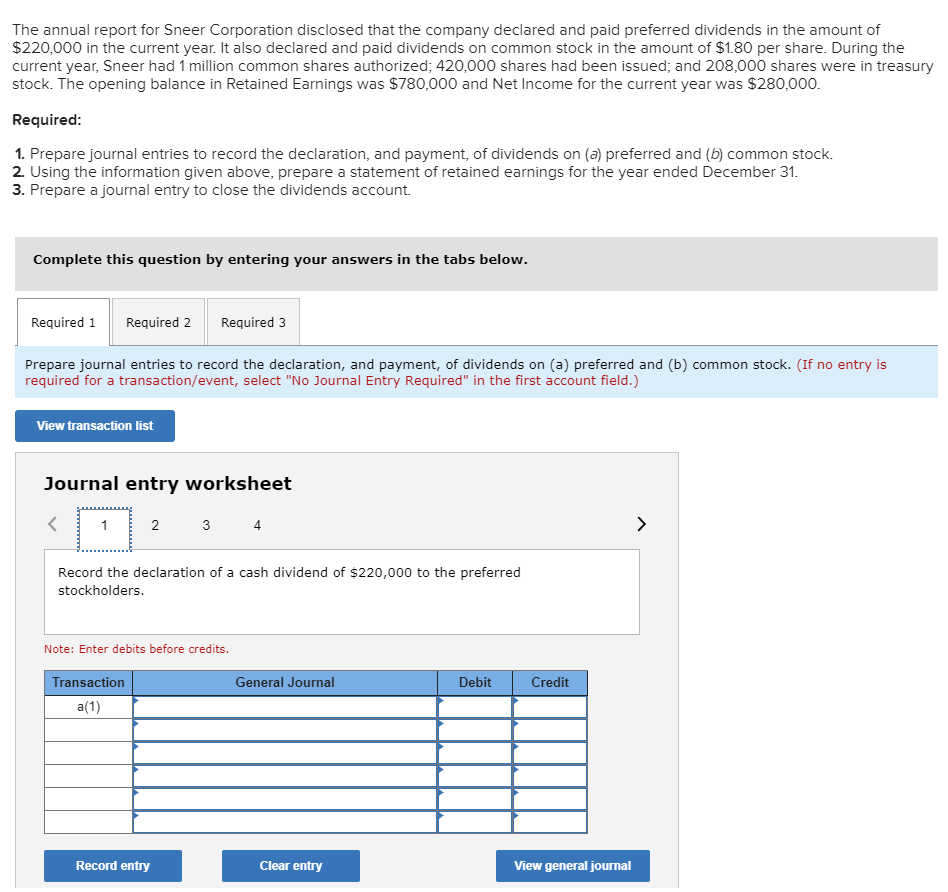

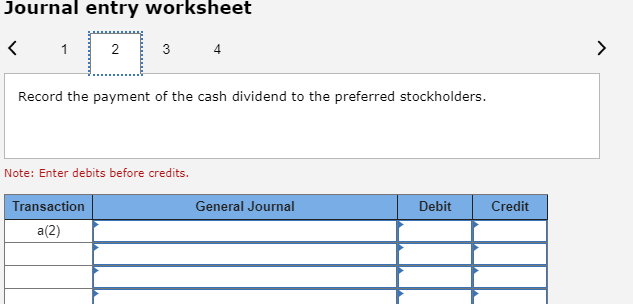

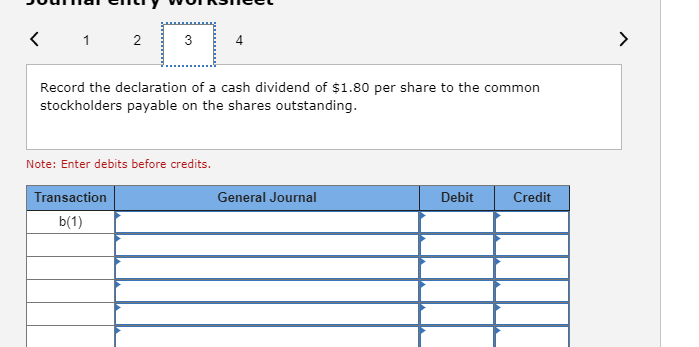

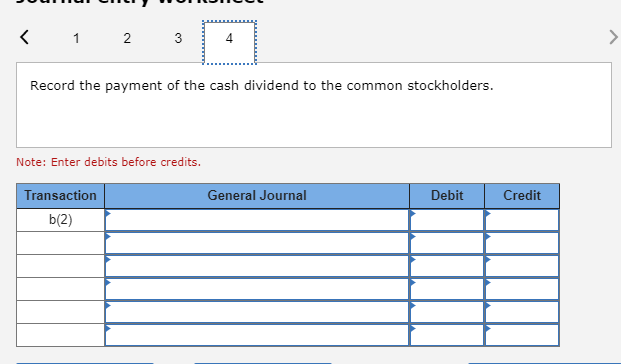

The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $220,000 in the current year. It also declared and paid dividends on common stock in the amount of $1.80 per share. During the current year, Sneer had 1 million common shares authorized; 420,000 shares had been issued; and 208,000 shares were in treasury stock. The opening balance in Retained Earnings was $780,000 and Net Income for the current year was $280,000. Required:

- Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock.

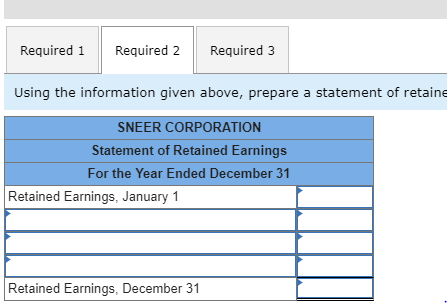

- Using the information given above, prepare a statement of retained earnings for the year ended December 31.

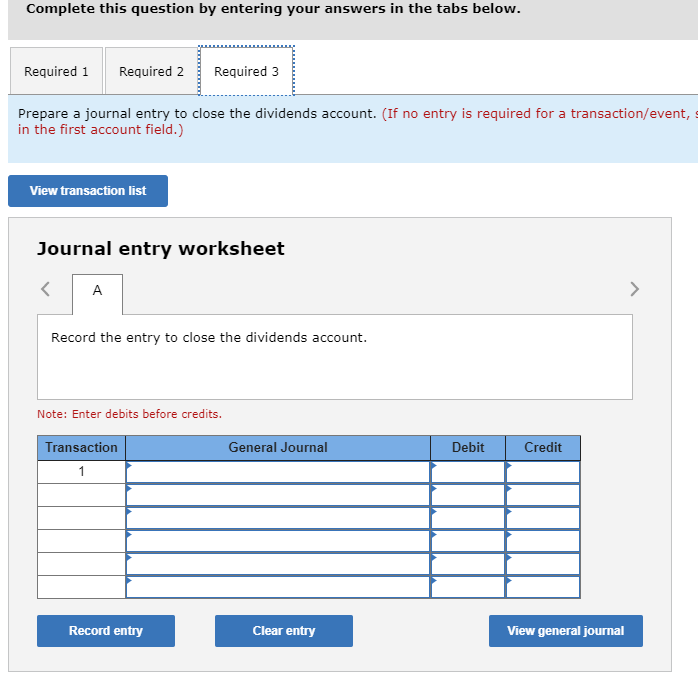

- Prepare a journal entry to close the dividends account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started