The answer i got was incorrect, please help me solve this problem

The answer i got was incorrect, please help me solve this problem

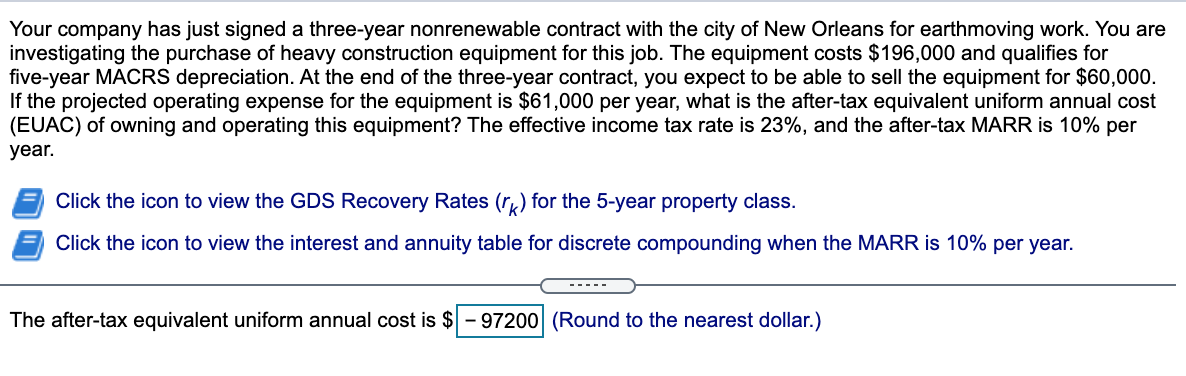

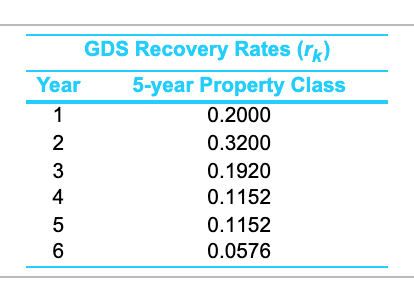

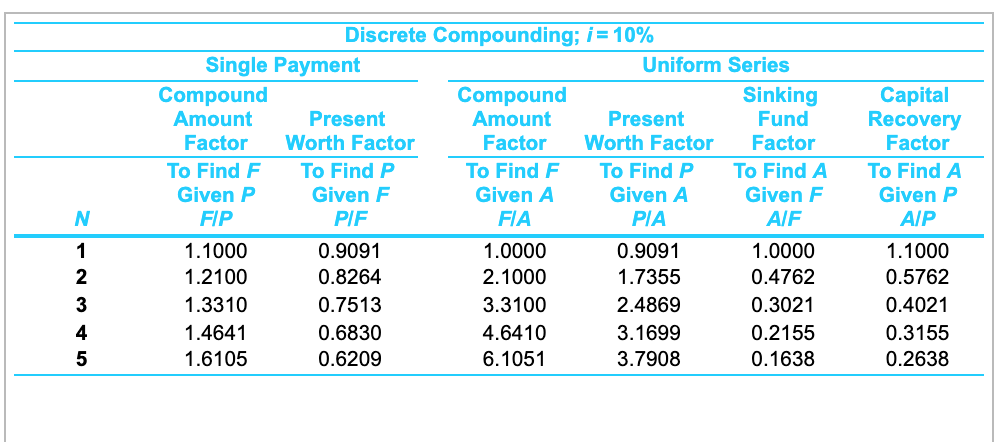

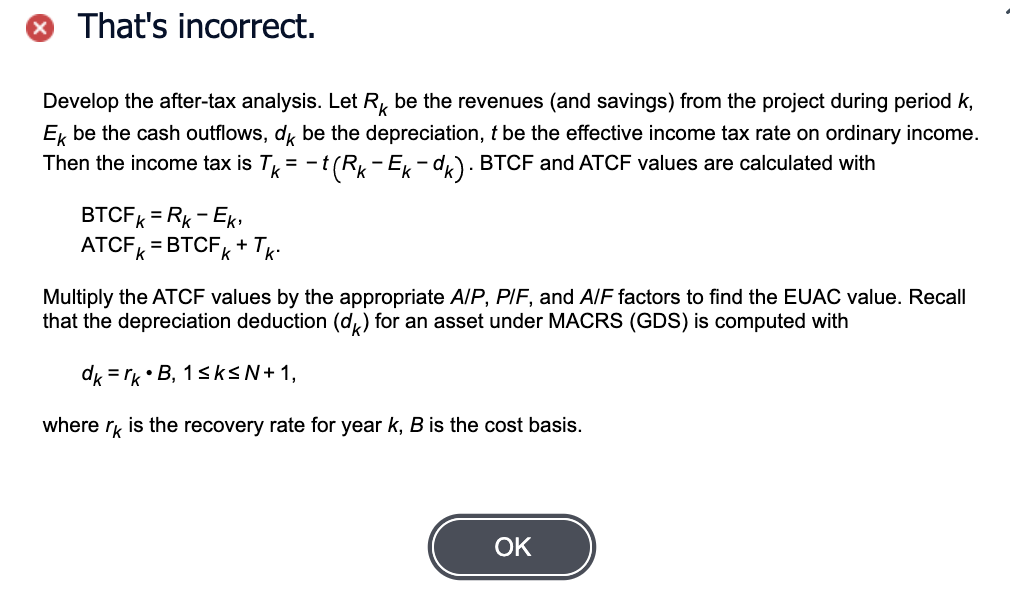

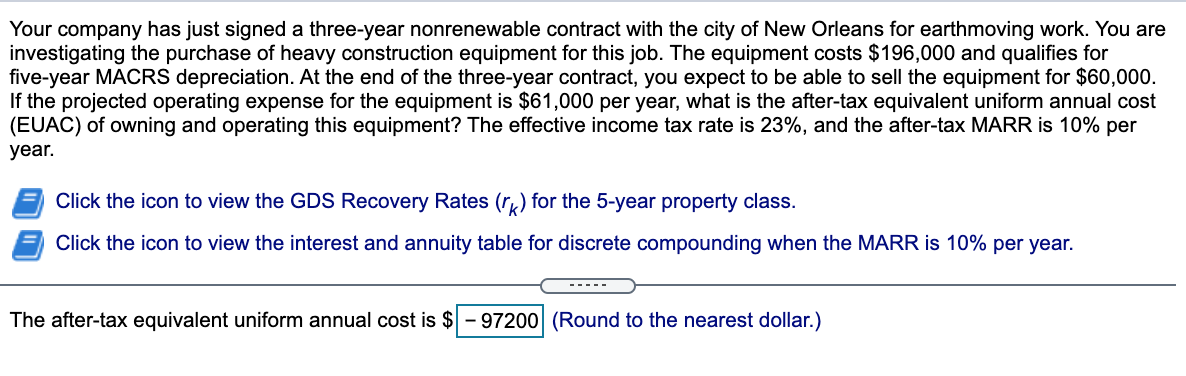

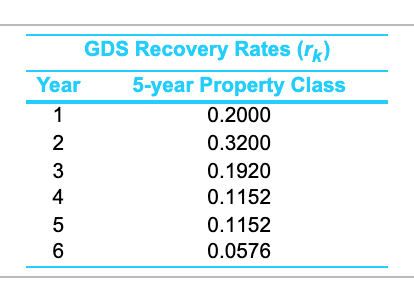

Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $196,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $60,000. If the projected operating expense for the equipment is $61,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 23%, and the after-tax MARR is 10% per year. Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. ----- The after-tax equivalent uniform annual cost is $ - 97200 (Round to the nearest dollar.) GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 Discrete Compounding; i = 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 N Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 1 2 3 4 5 That's incorrect. = -t - Develop the after-tax analysis. Let Rk be the revenues (and savings) from the project during period k, Ek be the cash outflows, dk be the depreciation, t be the effective income tax rate on ordinary income. Then the income tax is Tk -t(Rk - Ek-dk). BTCF and ATCF values are calculated with BTCFK = Rk-Eki ATCFK = BTCFk+ + TK Multiply the ATCF values by the appropriate AIP, PIF, and AIF factors to find the EUAC value. Recall that the depreciation deduction (dk) for an asset under MACRS (GDS) is computed with dk Erk.B, 15ks N+1, where rk is the recovery rate for year k, B is the cost basis. OK

The answer i got was incorrect, please help me solve this problem

The answer i got was incorrect, please help me solve this problem