Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer is 1,750 Please show the steps to get the answer 25. On June 31,2022 , OfficeMax sold a loading machine for $120,000. OfficeMax

The answer is 1,750

Please show the steps to get the answer

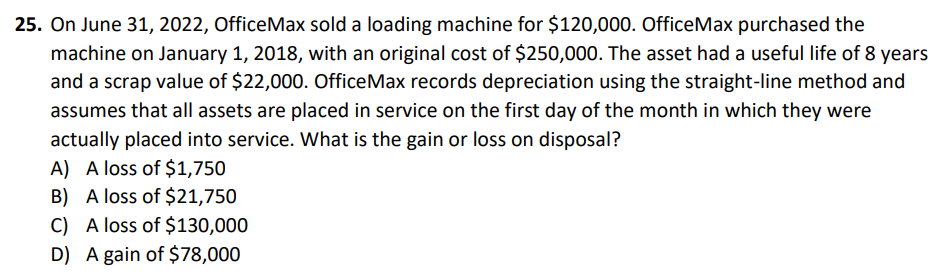

25. On June 31,2022 , OfficeMax sold a loading machine for $120,000. OfficeMax purchased the machine on January 1,2018 , with an original cost of $250,000. The asset had a useful life of 8 years and a scrap value of $22,000. OfficeMax records depreciation using the straight-line method and assumes that all assets are placed in service on the first day of the month in which they were actually placed into service. What is the gain or loss on disposal? A) A loss of $1,750 B) A loss of $21,750 C) A loss of $130,000 D) A gain of $78,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started