Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answer is #23 is C and #24 is C 23. A different prospective commercial real estate investment generated cash flow last year of $500,000.

The answer is #23 is C and #24 is C

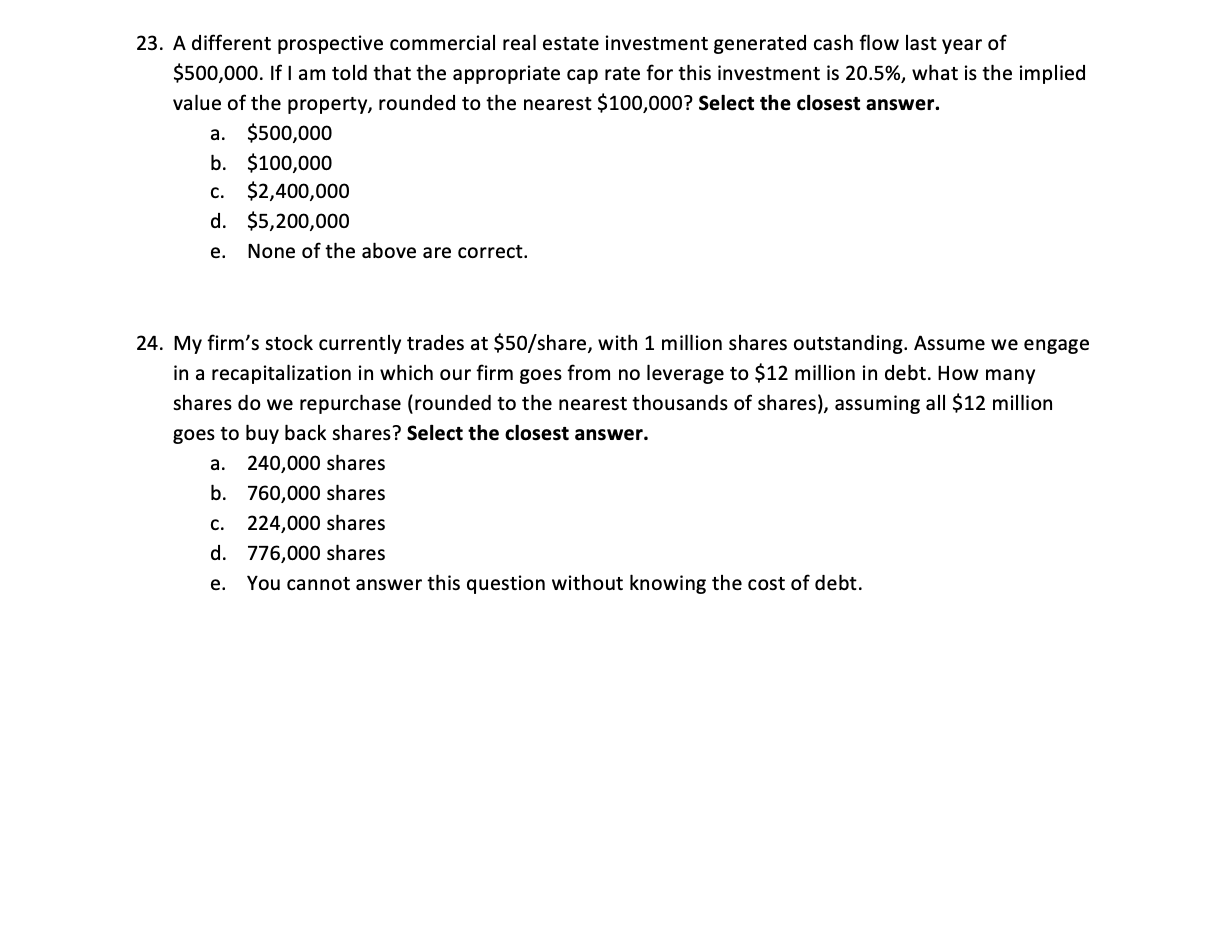

23. A different prospective commercial real estate investment generated cash flow last year of $500,000. If I am told that the appropriate cap rate for this investment is 20.5%, what is the implied value of the property, rounded to the nearest $100,000? Select the closest answer. a. $500,000 b. $100,000 c. $2,400,000 d. $5,200,000 None of the above are correct. e. 24. My firm's stock currently trades at $50/share, with 1 million shares outstanding. Assume we engage in a recapitalization in which our firm goes from no leverage to $12 million in debt. How many shares do we repurchase (rounded to the nearest thousands of shares), assuming all $12 million goes to buy back shares? Select the closest answer. a. 240,000 b. 760,000 shares C. 224,000 shares d. 776,000 shares You cannot answer this question without knowing the cost of debt. eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started