Answered step by step

Verified Expert Solution

Question

1 Approved Answer

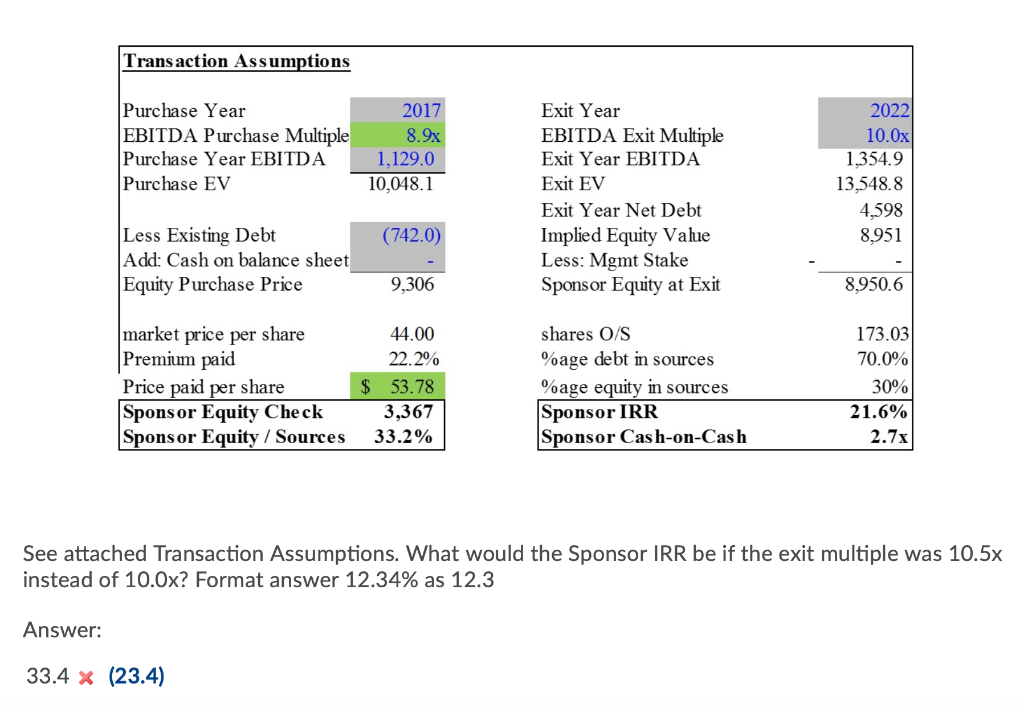

The answer is 23.4 Transaction Assumptions Purchase Year EBITDA Purchase Multiple Purchase Year EBITDA Purchase EV 2017 8.9x 1,129.0 10,048.1 Exit Year EBITDA Exit Multiple

The answer is 23.4

Transaction Assumptions Purchase Year EBITDA Purchase Multiple Purchase Year EBITDA Purchase EV 2017 8.9x 1,129.0 10,048.1 Exit Year EBITDA Exit Multiple Exit Year EBITDA Exit EV Exit Year Net Debt Implied Equity Value Less: Mgmt Stake Sponsor Equity at Exit 2022 10.0x 1,354.9 13,548.8 4,598 8,951 (742.0) Less Existing Debt Add: Cash on balance sheet Equity Purchase Price 9,306 8.950.6 44.00 market price per share Premium paid Price paid per share Sponsor Equity Check Sponsor Equity / Sources 22.2% $ 53.78 3,367 33.2% shares O/S %age debt in sources %age equity in sources Sponsor IRR Sponsor Cash-on-Cash 173.03 70.0% 30% 21.6% 2.7x See attached Transaction Assumptions. What would the Sponsor IRR be if the exit multiple was 10.5x instead of 10.0x? Format answer 12.34% as 12.3 Answer: 33.4 x (23.4)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started