Answered step by step

Verified Expert Solution

Question

1 Approved Answer

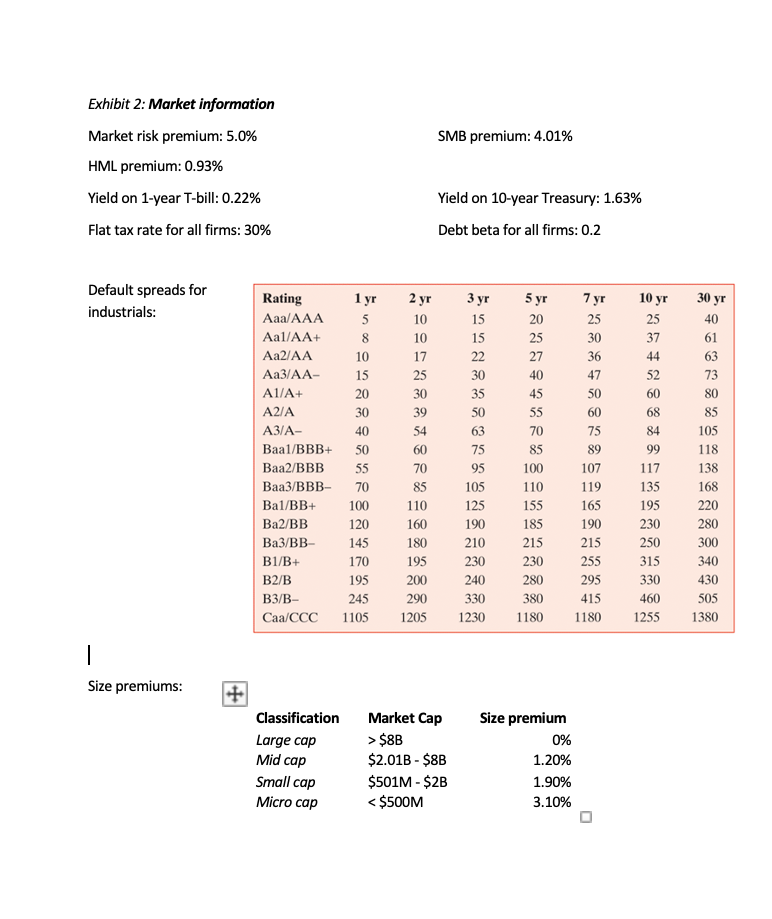

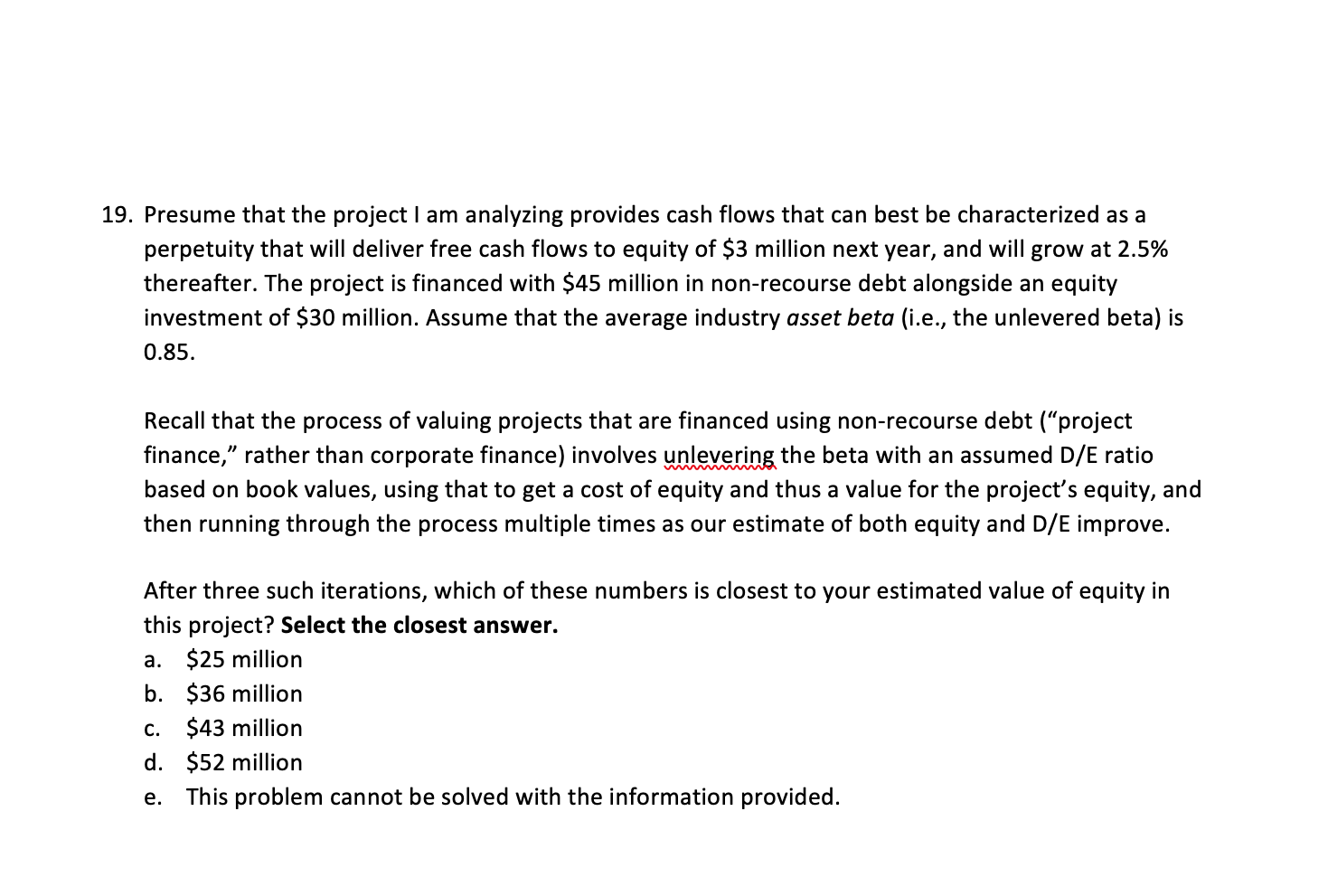

The answer is 43 million SMB premium: 4.01% Exhibit 2: Market information Market risk premium: 5.0% HML premium: 0.93% Yield on 1-year T-bill: 0.22% Flat

The answer is 43 million

SMB premium: 4.01% Exhibit 2: Market information Market risk premium: 5.0% HML premium: 0.93% Yield on 1-year T-bill: 0.22% Flat tax rate for all firms: 30% Yield on 10-year Treasury: 1.63% Debt beta for all firms: 0.2 Default spreads for industrials: 3 yr 5 yr 10 yr 30 yr 20 25 27 40 45 55 70 85 Rating Aaa/AAA Aal/AA+ Aa2/AA Aa3/AA- A1/A+ A2/A A3/A- Baal/BBB+ Baa2/BBB Baa3/BBB- Ba1/BB+ Ba2/BB Ba3/BB- B1/B+ B2/B B3/B- Caa/CCC 1 yr 5 8 10 15 20 30 40 50 55 70 100 120 145 170 195 245 1105 2 yr 10 10 17 25 30 39 54 60 70 85 110 160 180 195 200 290 1205 15 15 22 30 35 50 63 75 95 105 125 190 210 230 240 330 1230 7 yr 25 30 36 47 50 60 75 89 107 119 165 190 215 255 295 415 1180 100 25 37 44 52 60 68 84 99 117 135 195 230 250 315 330 460 1255 40 61 63 73 80 85 105 118 138 168 220 280 300 340 430 505 1380 110 155 185 215 230 280 380 1180 1 Size premiums: + Classification Large cap Mid cap Small cap Micro cap Market Cap >$8B $2.01B - $8B $501M - $2B $8B $2.01B - $8B $501M - $2BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started