Answered step by step

Verified Expert Solution

Question

1 Approved Answer

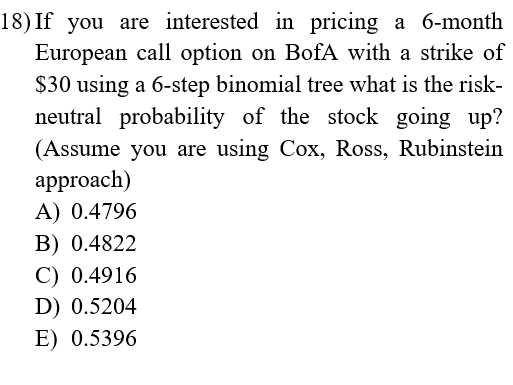

The answer is C but how do you get that answer? please show all work This was all that was given. If its not doable

The answer is C but how do you get that answer? please show all work

This was all that was given. If its not doable due to lack of information in the question then please refund.

18) If you are interested in pricing a 6-month European call option on BofA with a strike of $30 using a 6-step binomial tree what is the risk- neutral probability of the stock going up? (Assume you are using Cox, Ross, Rubinstein approach) A) 0.4796 B) 0.4822 C) 0.4916 D) 0.5204 E) 0.5396 18) If you are interested in pricing a 6-month European call option on BofA with a strike of $30 using a 6-step binomial tree what is the risk- neutral probability of the stock going up? (Assume you are using Cox, Ross, Rubinstein approach) A) 0.4796 B) 0.4822 C) 0.4916 D) 0.5204 E) 0.5396Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started