Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THE ANSWER IS NOT -640 or -360 i have already tried those. I do only want the answer for accural. the second picture is a

THE ANSWER IS NOT -640 or -360 i have already tried those. I do only want the answer for accural. the second picture is a hint. please help and i also do not know how to reply to comments.

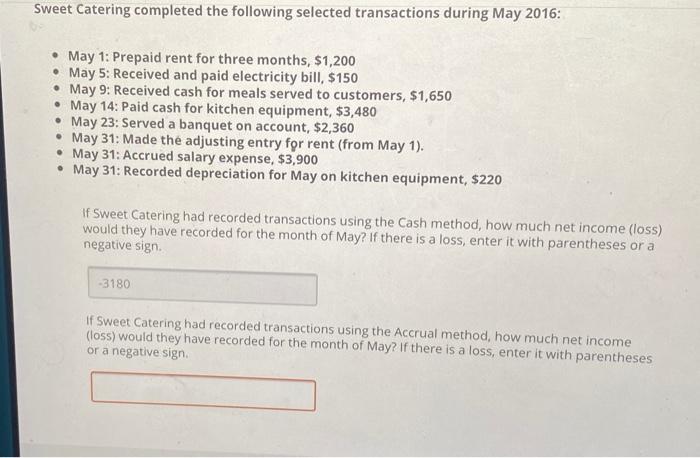

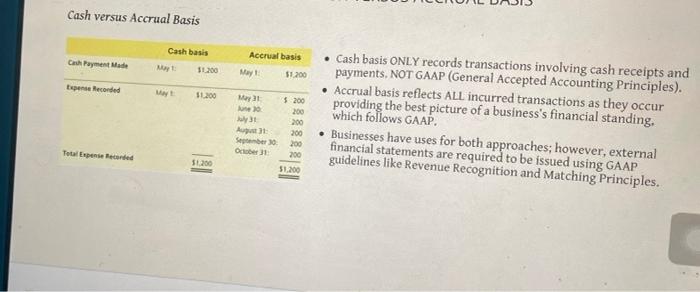

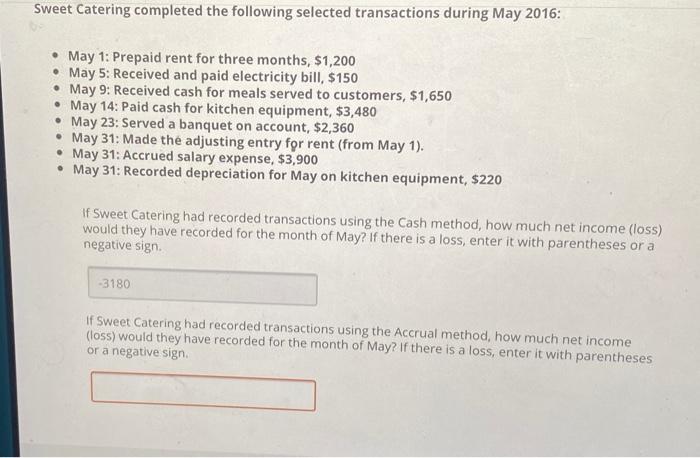

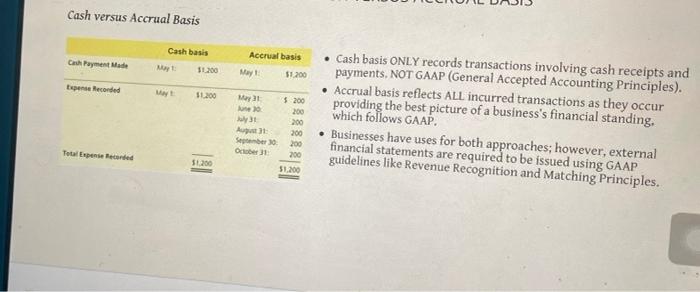

Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, $1,200 May 5: Received and paid electricity bill, $150 May 9: Received cash for meals served to customers, $1,650 May 14: Paid cash for kitchen equipment, $3,480 May 23: Served a banquet on account, $2,360 May 31: Made the adjusting entry for rent (from May 1). May 31: Accrued salary expense, $3,900 May 31: Recorded depreciation for May on kitchen equipment, $220 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign -3180 if Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign Cash versus Accrual Basis Cash basis Cach Payment Mode Accrual basis May $1.200 11.200 Espen Recorded May 51200 May Cash basis ONLY records transactions involving cash receipts and payments, NOT GAAP (General Accepted Accounting Principles). Accrual basis reflects ALL incurred transactions as they occur providing the best picture of a business's financial standing, which follows GAAP. Businesses have uses for both approaches; however, external financial statements are required to be issued using GAAP guidelines like Revenue Recognition and Matching Principles. $ 200 200 200 200 200 200 51.200 A Sember 30 Obert Total Recorded 1300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started