The answer needs the text answer !!!!!!!!!!!!!

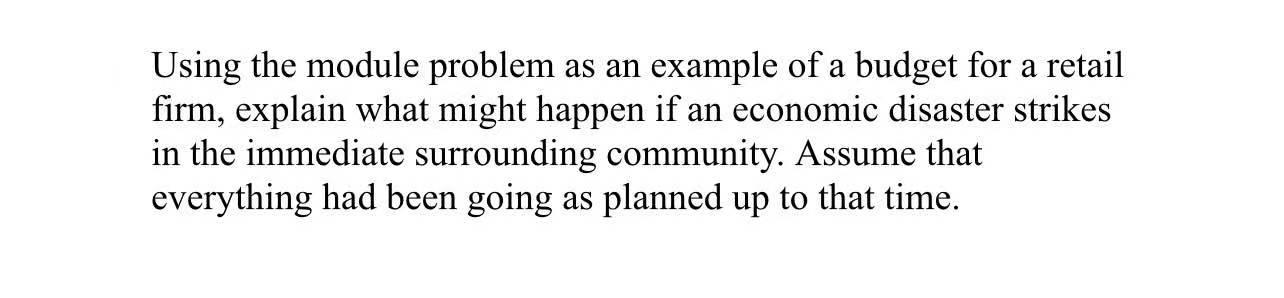

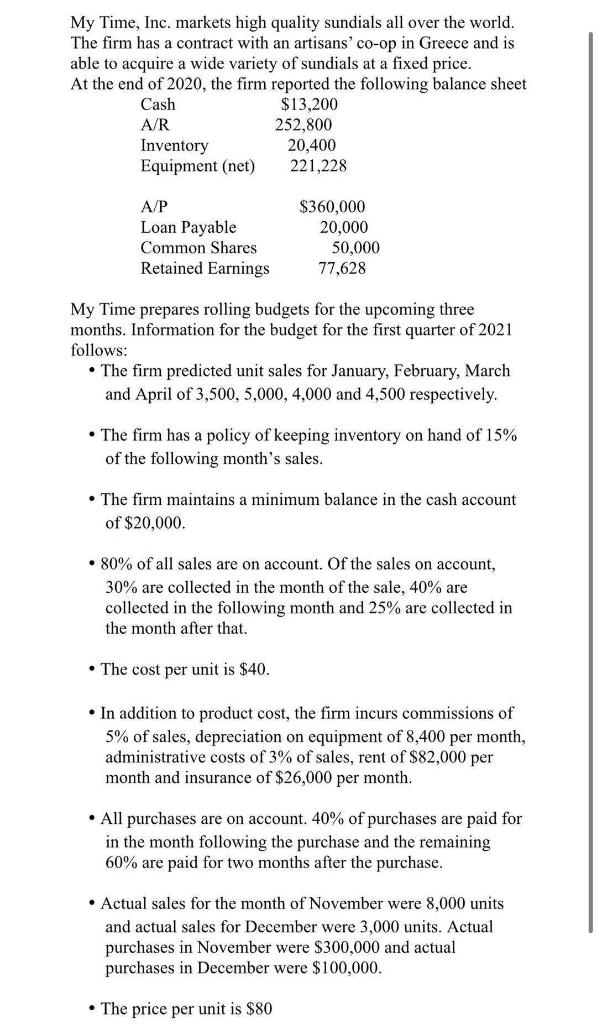

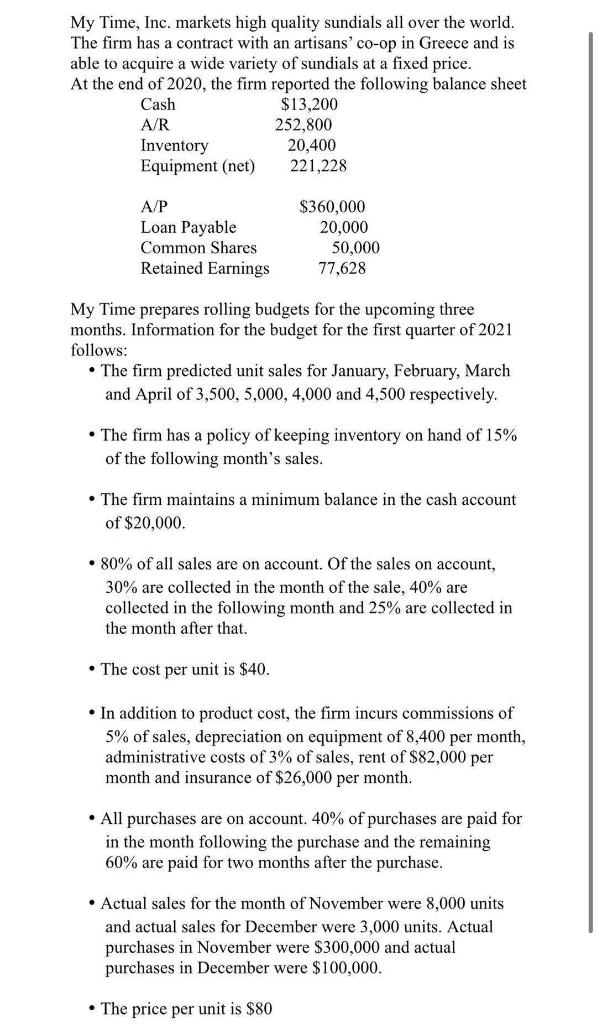

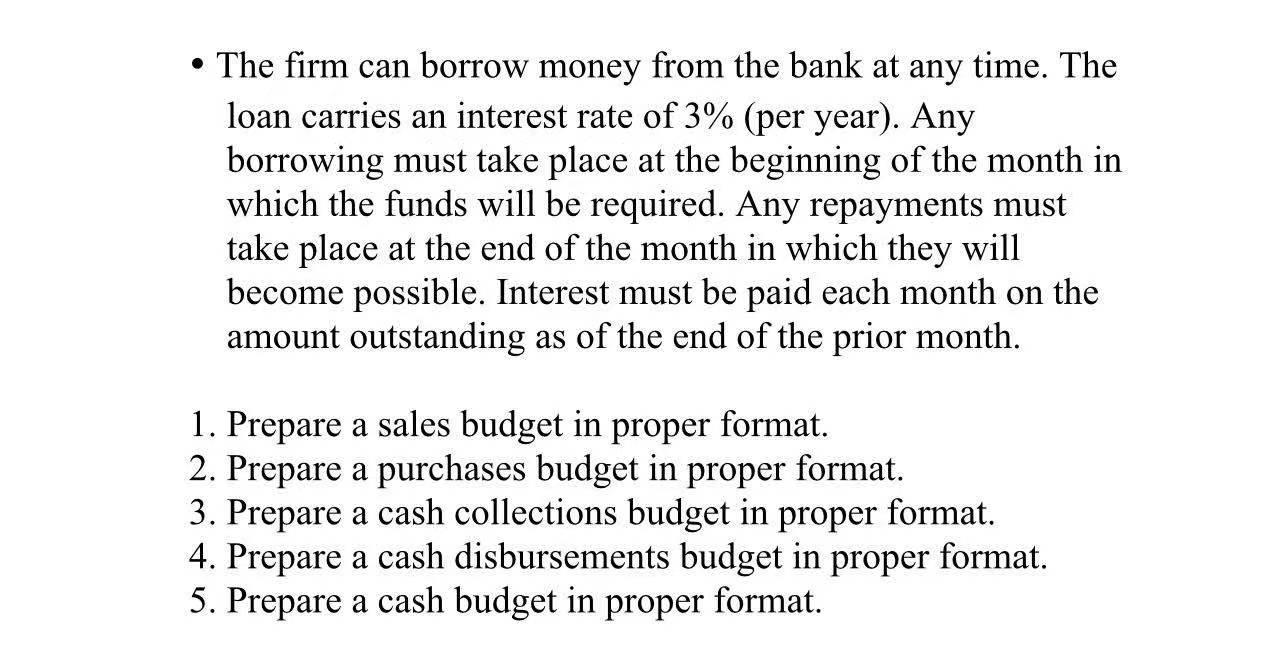

Using the module problem as an example of a budget for a retail firm, explain what might happen if an economic disaster strikes in the immediate surrounding community. Assume that everything had been going as planned up to that time. My Time, Inc. markets high quality sundials all over the world. The firm has a contract with an artisans' co-op in Greece and is able to acquire a wide variety of sundials at a fixed price. At the end of 2020, the firm reported the following balance sheet Cash $13,200 A/R 252,800 Inventory 20,400 Equipment (net) 221,228 A/P Loan Payable Common Shares Retained Earnings $360,000 20,000 50,000 77,628 My Time prepares rolling budgets for the upcoming three months. Information for the budget for the first quarter of 2021 follows: The firm predicted unit sales for January, February, March and April of 3,500, 5,000, 4,000 and 4,500 respectively. The firm has a policy of keeping inventory on hand of 15% of the following month's sales. The firm maintains a minimum balance in the cash account of $20,000. 80% of all sales are on account. Of the sales on account, 30% are collected in the month of the sale, 40% are collected in the following month and 25% are collected in the month after that. The cost per unit is $40. In addition to product cost, the firm incurs commissions of 5% of sales, depreciation on equipment of 8,400 per month, administrative costs of 3% of sales, rent of $82,000 per month and insurance of $26,000 per month. All purchases are on account. 40% of purchases are paid for in the month following the purchase and the remaining 60% are paid for two months after the purchase. Actual sales for the month of November were 8,000 units and actual sales for December were 3,000 units. Actual purchases in November were $300,000 and actual purchases in December were $100,000. The price per unit is $80 The firm can borrow money from the bank at any time. The loan carries an interest rate of 3% (per year). Any borrowing must take place at the beginning of the month in which the funds will be required. Any repayments must take place at the end of the month in which they will become possible. Interest must be paid each month on the amount outstanding as of the end of the prior month. 1. Prepare a sales budget in proper format. 2. Prepare a purchases budget in proper format. 3. Prepare a cash collections budget in proper format. 4. Prepare a cash disbursements budget in proper format. 5. Prepare a cash budget in proper format