Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The answers highlighted/shown are all wrong. Question 29 0/1 point Lauderdale Consultants Partnership enters into a multi-year termination agreement with, Tina, a departing partner. Which

The answers highlighted/shown are all wrong.

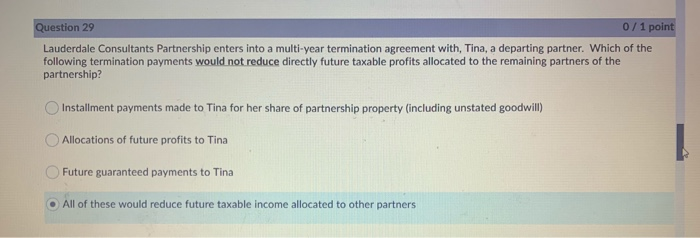

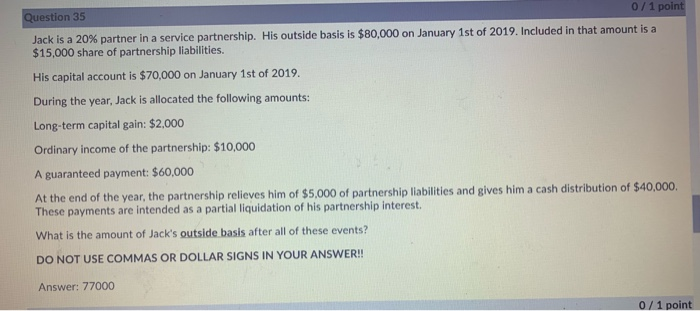

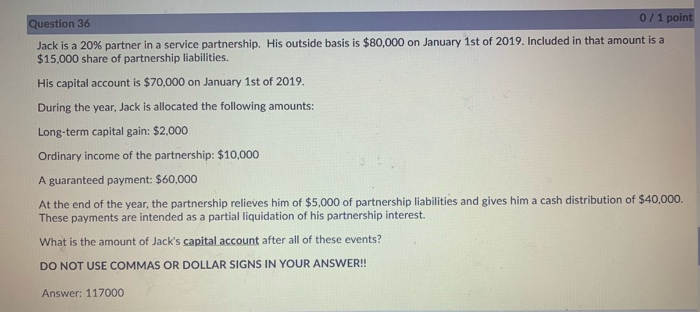

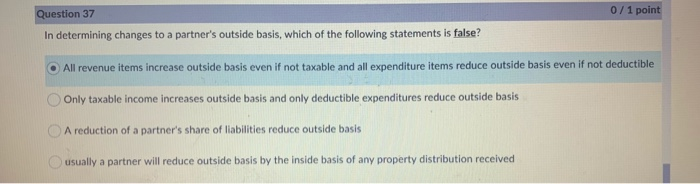

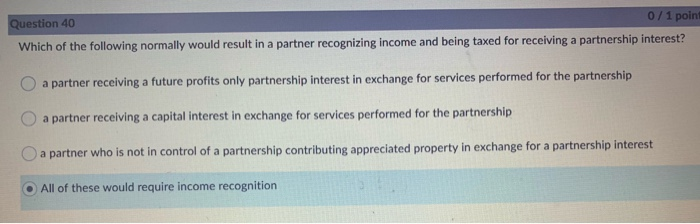

Question 29 0/1 point Lauderdale Consultants Partnership enters into a multi-year termination agreement with, Tina, a departing partner. Which of the following termination payments would not reduce directly future taxable profits allocated to the remaining partners of the partnership? Installment payments made to Tina for her share of partnership property (including unstated goodwill) Allocations of future profits to Tina Future guaranteed payments to Tina All of these would reduce future taxable income allocated to other partners Question 35 0/1 point Jack is a 20% partner in a service partnership. His outside basis is $80,000 on January 1st of 2019. Included in that amount is a $15,000 share of partnership liabilities. His capital account is $70,000 on January 1st of 2019. During the year, Jack is allocated the following amounts: Long-term capital gain: $2,000 Ordinary income of the partnership: $10,000 A guaranteed payment: $60,000 At the end of the year, the partnership relieves him of $5,000 of partnership liabilities and gives him a cash distribution of $40,000 These payments are intended as a partial liquidation of his partnership interest. What is the amount of Jack's outside basis after all of these events? DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!! Answer: 77000 1 point Question 36 0/1 point Jack is a 20% partner in a service partnership. His outside basis is $80,000 on January 1st of 2019. Included in that amount is a $15,000 share of partnership liabilities. His capital account is $70,000 on January 1st of 2019. During the year, Jack is allocated the following amounts: Long-term capital gain: $2,000 Ordinary income of the partnership: $10,000 A guaranteed payment: $60,000 At the end of the year, the partnership relieves him of $5,000 of partnership liabilities and gives him a cash distribution of $40,000. These payments are intended as a partial liquidation of his partnership interest. What is the amount of Jack's capital account after all of these events? DO NOT USE COMMAS OR DOLLAR SIGNS IN YOUR ANSWER!! Answer: 117000 0/1 point Question 37 In determining changes to a partner's outside basis, which of the following statements is false? All revenue items increase outside basis even if not taxable and all expenditure items reduce outside basis even if not deductible Only taxable income increases outside basis and only deductible expenditures reduce outside basis A reduction of a partner's share of liabilities reduce outside basis usually a partner will reduce outside basis by the inside basis of any property distribution received Question 40 0/1 poin Which of the following normally would result in a partner recognizing income and being taxed for receiving a partnership interest? a partner receiving a future profits only partnership interest in exchange for services performed for the partnership O a partner receiving a capital interest in exchange for services performed for the partnership a partner who is not in control of a partnership contributing appreciated property in exchange for a partnership interest O All of these would require income recognition Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started