Answered step by step

Verified Expert Solution

Question

1 Approved Answer

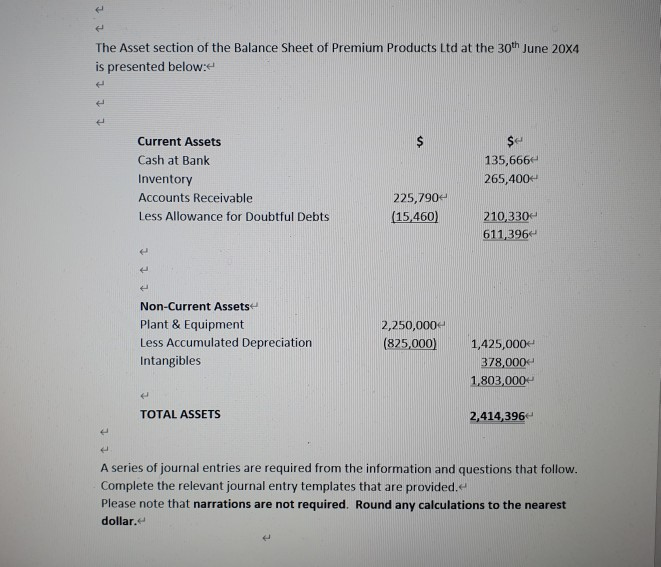

The Asset section of the Balance Sheet of Premium Products Ltd at the 30th June 20x4 is presented below: $ Current Assets Cash at Bank

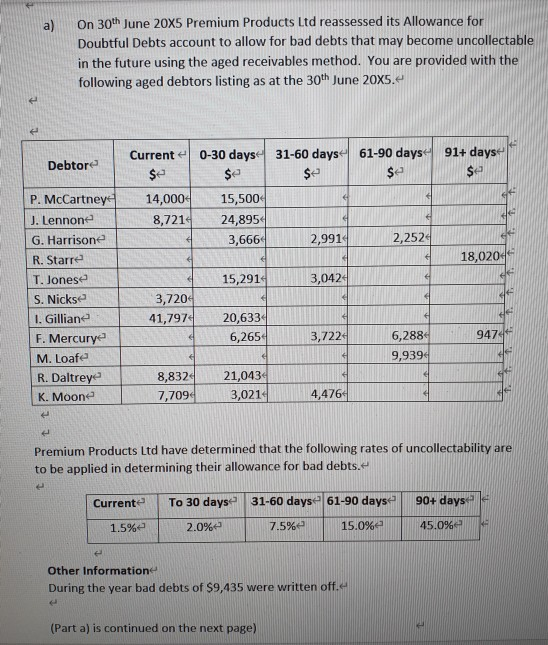

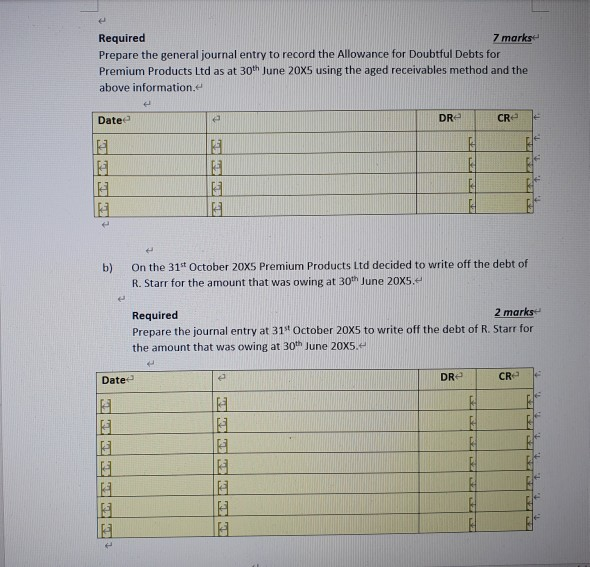

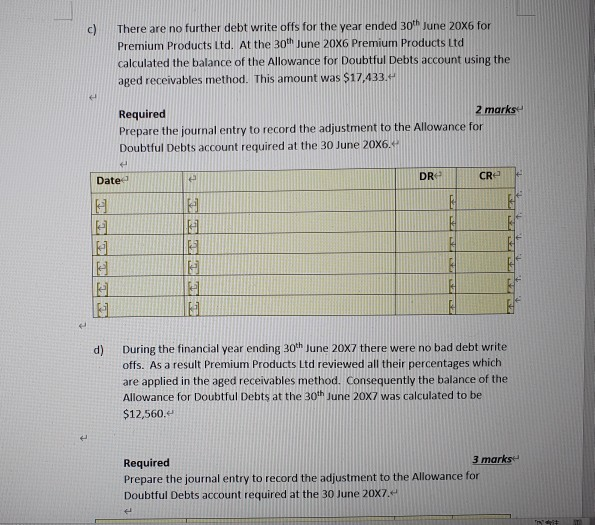

The Asset section of the Balance Sheet of Premium Products Ltd at the 30th June 20x4 is presented below: $ Current Assets Cash at Bank Inventory Accounts Receivable Less Allowance for Doubtful Debts $ 135,666 265,400- 225,790 (15,460) 210,330 611,396 Non-Current Assets Plant & Equipment Less Accumulated Depreciation Intangibles 2,250,000 (825,000) 1,425,000 378,000 1,803,000 TOTAL ASSETS 2,414,396 A series of journal entries are required from the information and questions that follow. Complete the relevant journal entry templates that are provided. Please note that narrations are not required. Round any calculations to the nearest dollar." On 30th June 20x5 Premium Products Ltd reassessed its Allowance for Doubtful Debts account to allow for bad debts that may become uncollectable in the future using the aged receivables method. You are provided with the following aged debtors listing as at the 30th June 20x5. Debtore $ P. McCartney J. Lennone G. Harrisone R. Starre T. Jonese S. Nickse 1. Gillian F. Mercury M. Loafe R. Daltreye K. Moone Current 0-30 days 31-60 days 61-90 days 91+ days $e $e $e $ 14,000 15,500 8,7214 24,8954 3,6664 2,991 2,2524 18,02041 15,2914 3,042 3,7204 41,7974 20,6334 6,2654 3,722 6,288 947 9,9394 8,832 21,0434 7,7094 3,0214 4,4764 Premium Products Ltd have determined that the following rates of uncollectability are to be applied in determining their allowance for bad debts.- Currente To 30 days. 31-60 days 61-90 days 90+ days 1.5% 2.0% 7.5% 15.0%e 45.0% Other Informatione During the year bad debts of $9,435 were written off. (Part a) is continued on the next page) Required 7 marks Prepare the general journal entry to record the Allowance for Doubtful Debts for Premium Products Ltd as at 30th June 20x5 using the aged receivables method and the above information. Date DR CR H H Ei b) On the 31st October 20X5 Premium Products Ltd decided to write off the debt of R. Starr for the amount that was owing at 30th June 20x5. e Required 2 marks Prepare the journal entry at 31 October 20x5 to write off the debt of R. Starr for the amount that was owing at 30th June 20x5. Date DR CR F E 22 LLLL H There are no further debt write offs for the year ended 30th June 20x6 for Premium Products Ltd. At the 30th June 20x6 Premium Products Ltd calculated the balance of the Allowance for Doubtful Debts account using the aged receivables method. This amount was $17,433.4 Required 2 marks Prepare the journal entry to record the adjustment to the Allowance for Doubtful Debts account required at the 30 June 20x6. Date DR CR lal H el IL el d) During the financial year ending 30th June 20x7 there were no bad debt write offs. As a result Premium Products Ltd reviewed all their percentages which are applied in the aged receivables method. Consequently the balance of the Allowance for Doubtful Debts at the 30th June 20X7 was calculated to be $12,560.- Required 3 marks Prepare the journal entry to record the adjustment to the Allowance for Doubtful Debts account required at the 30 June 20x7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started