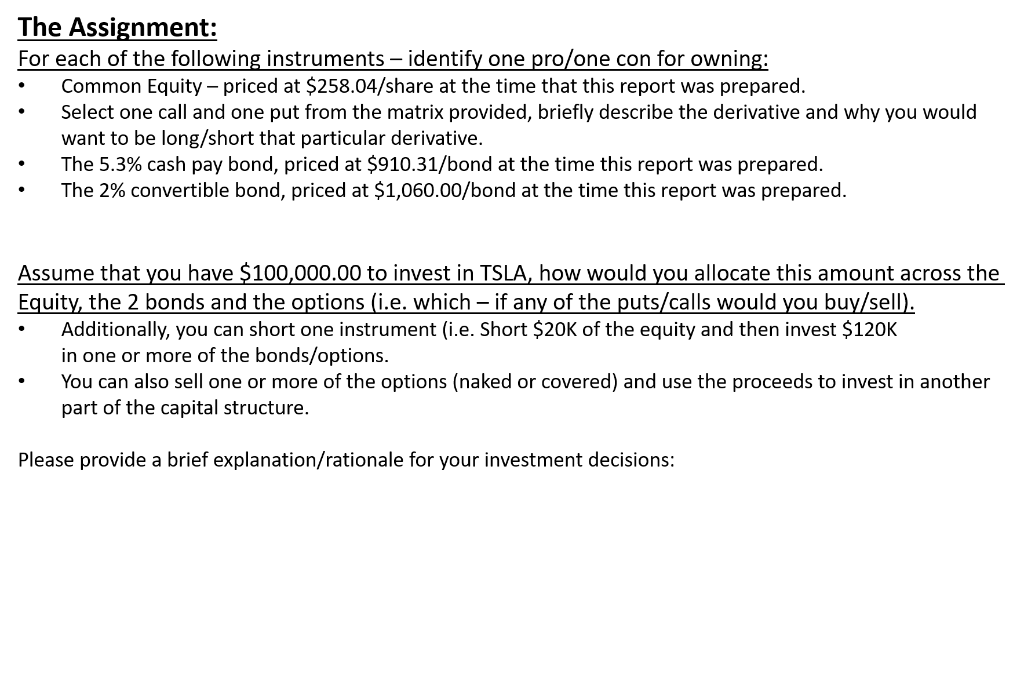

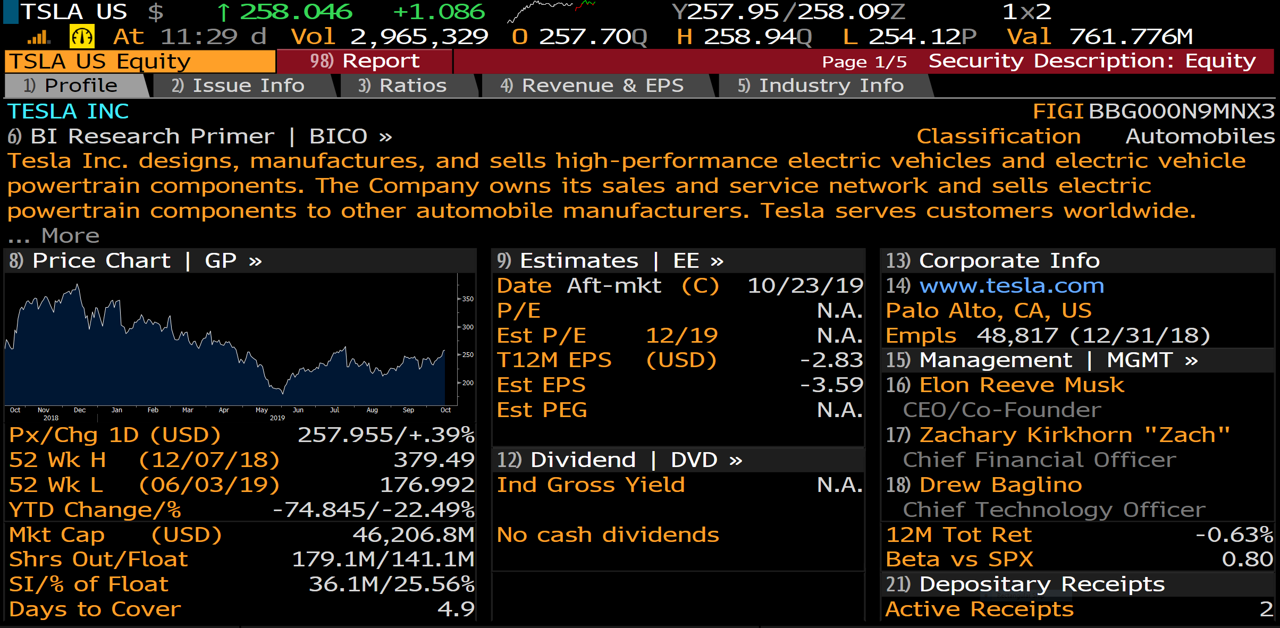

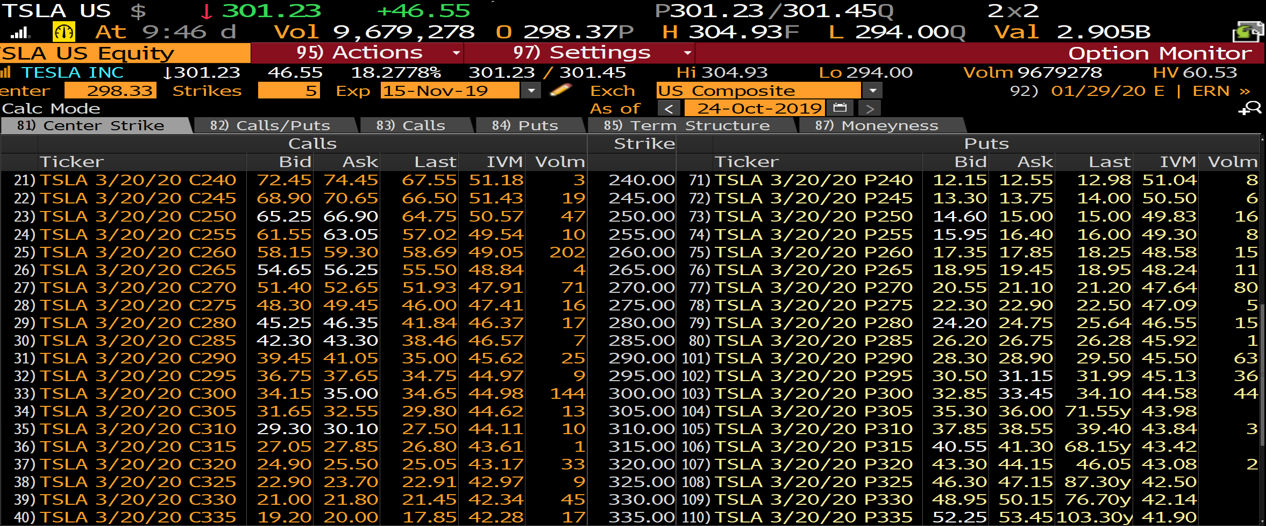

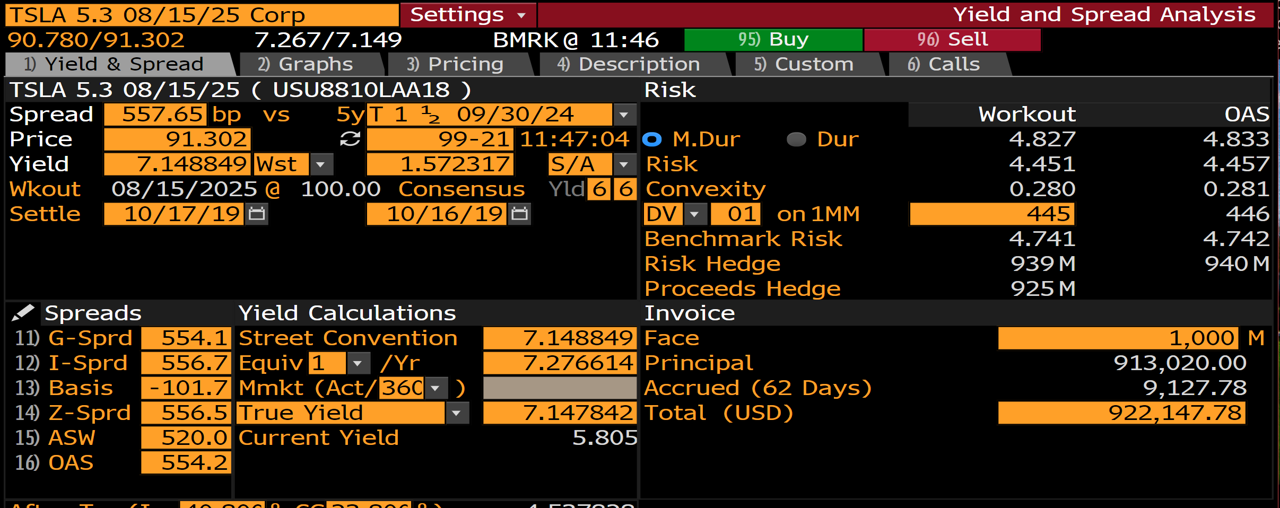

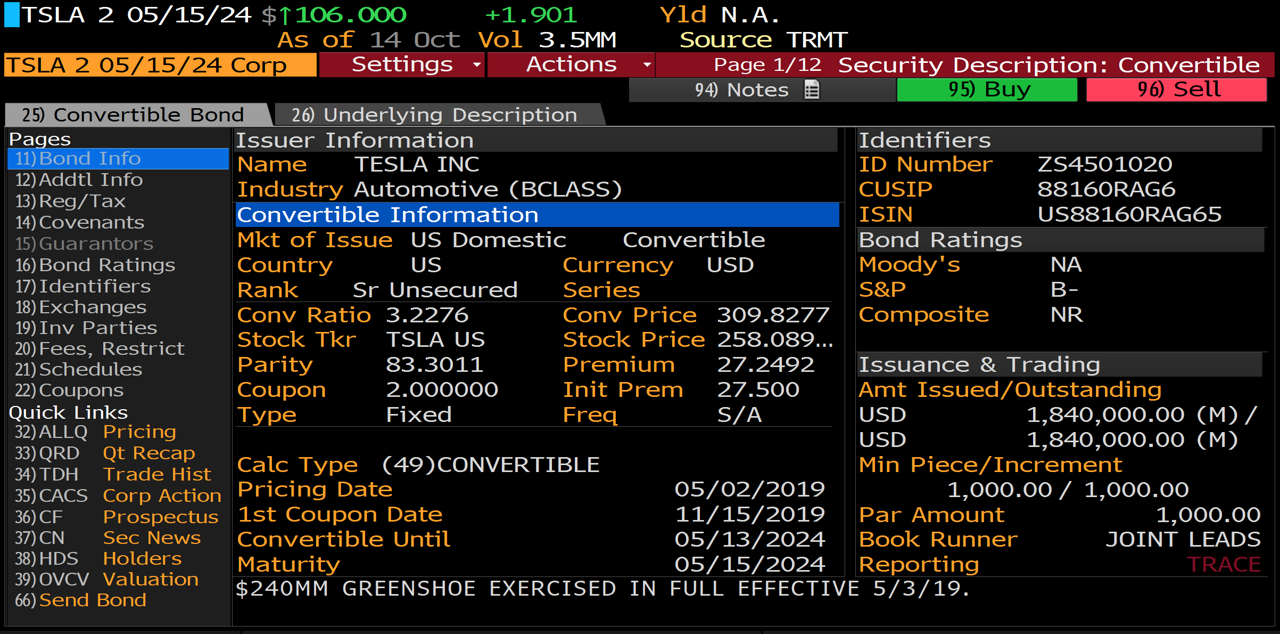

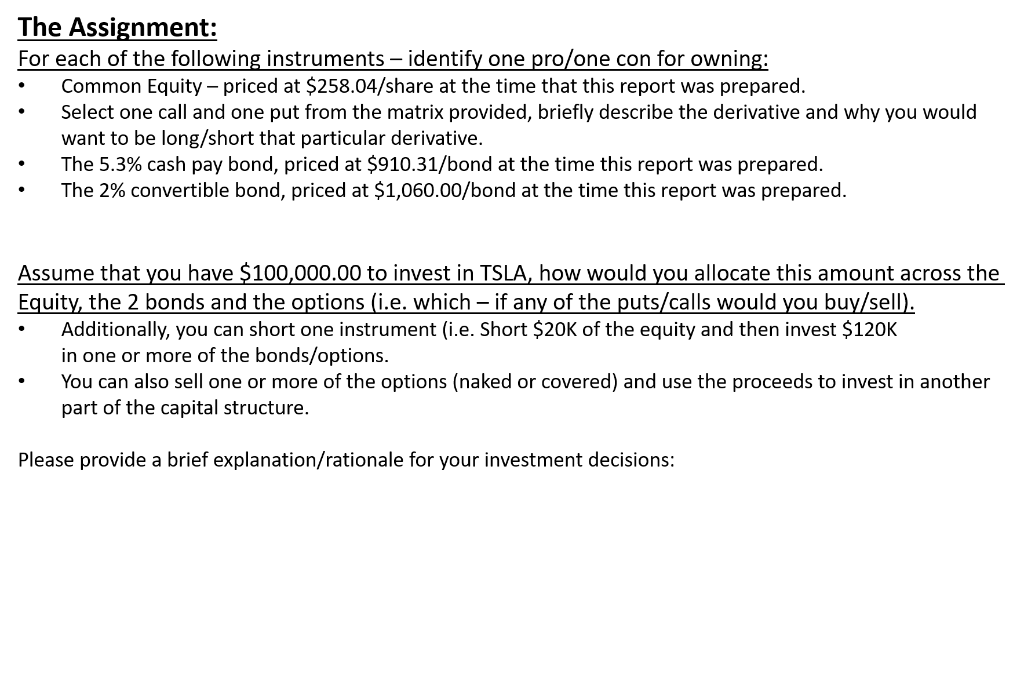

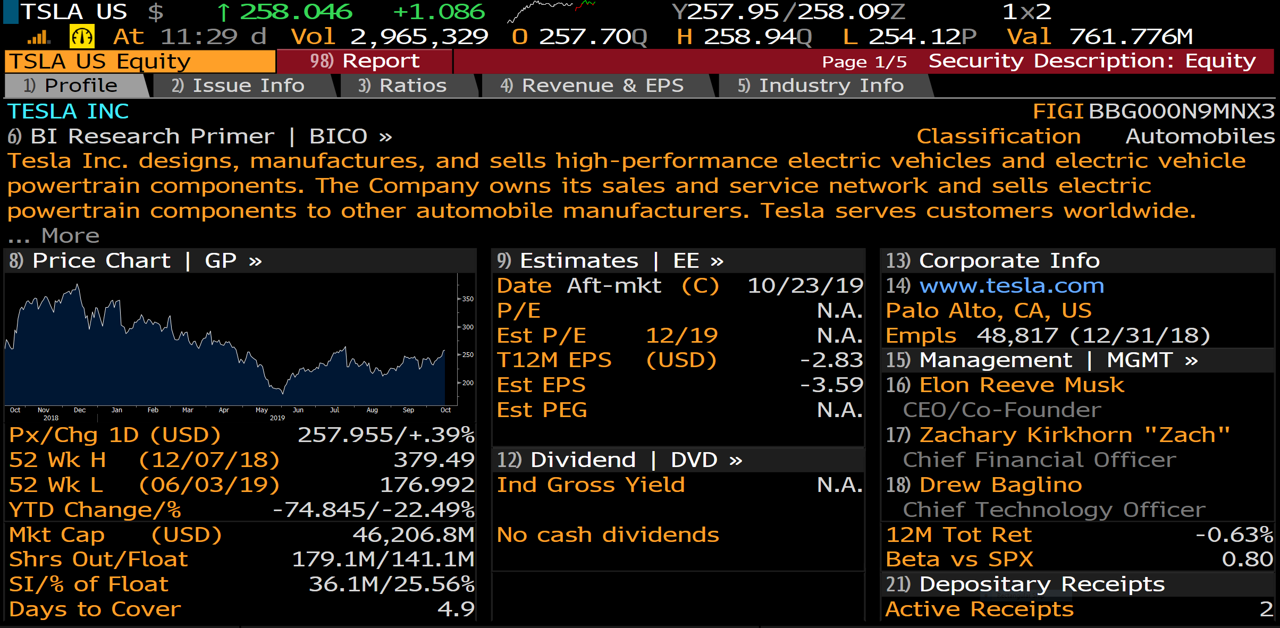

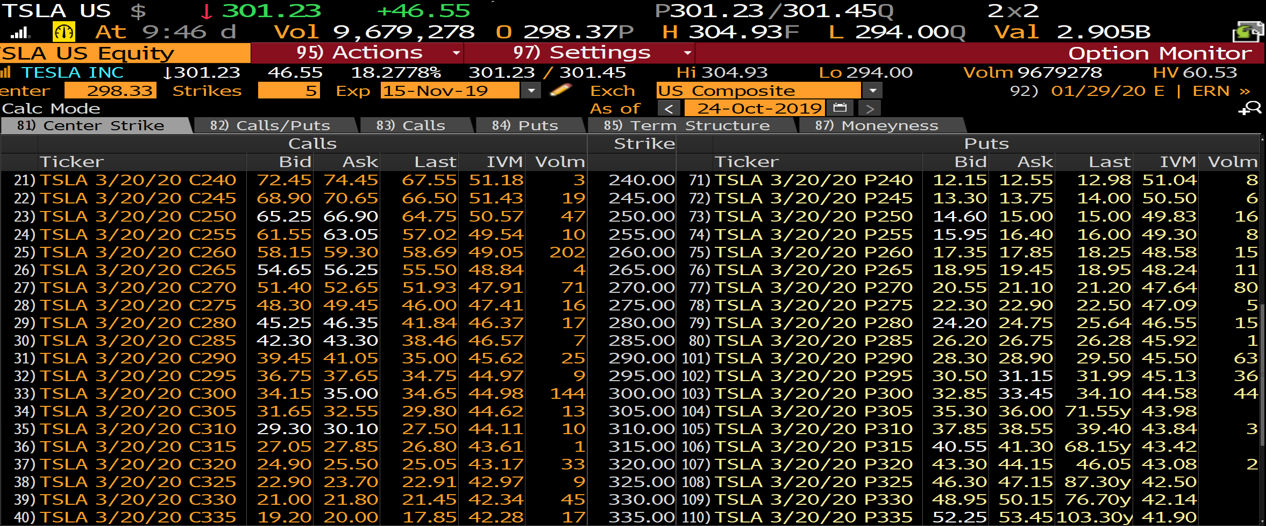

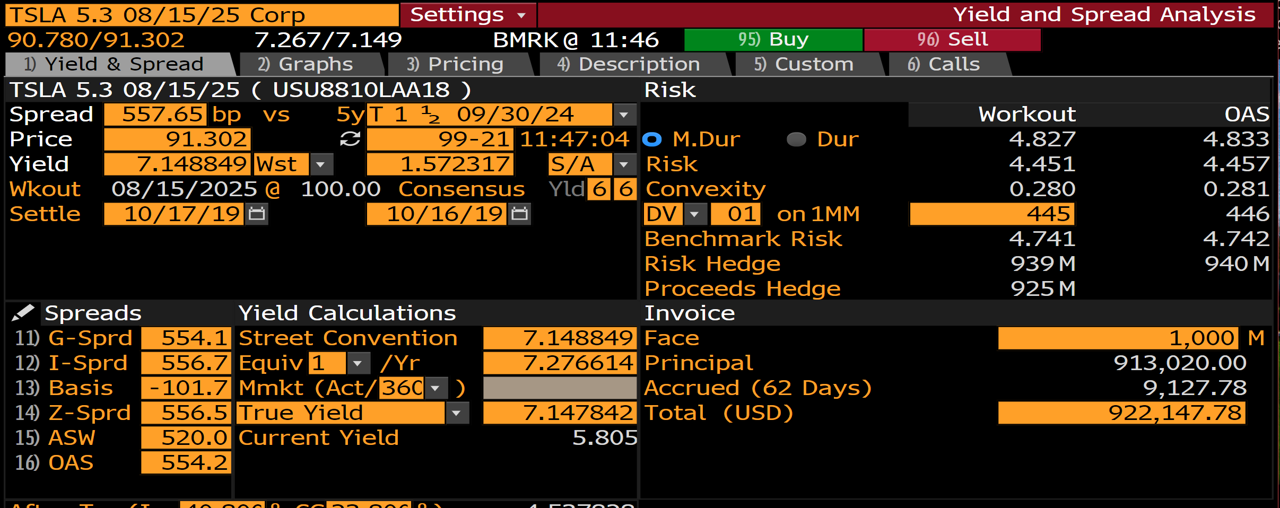

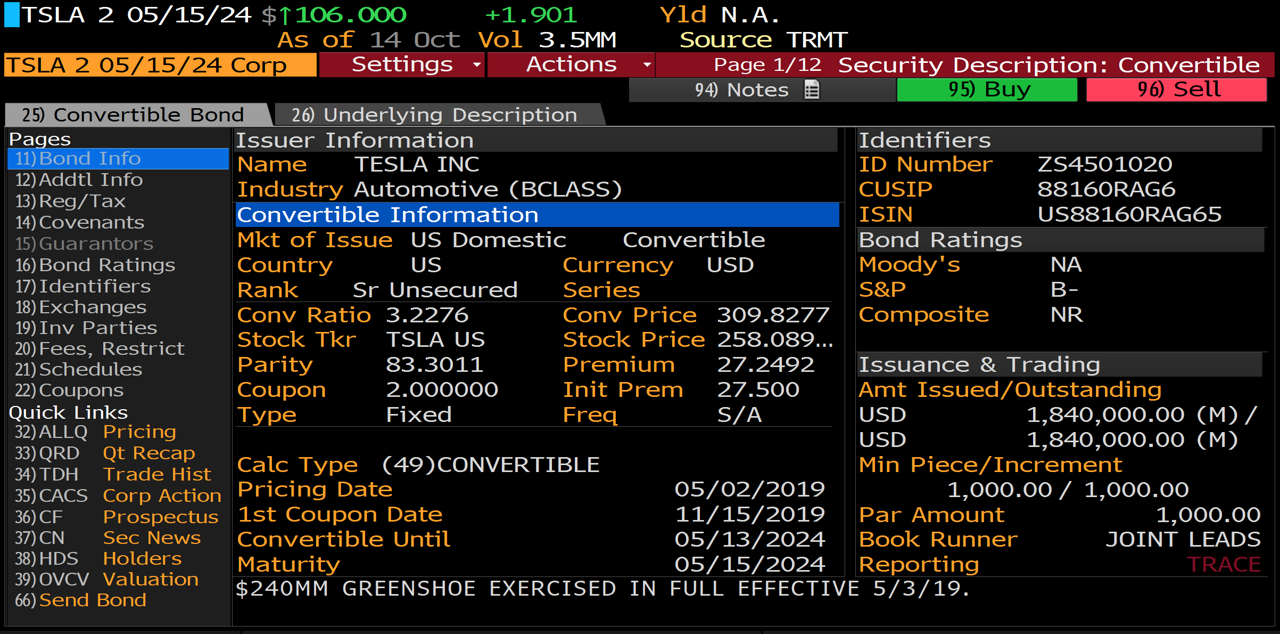

The Assignment: For each of the following instruments - identify one pro/one con for owning: Common Equity - priced at $258.04/share at the time that this report was prepared. . Select one call and one put from the matrix provided, briefly describe the derivative and why you would want to be long/short that particular derivative. The 5.3% cash pay bond, priced at $910.31/bond at the time this report was prepared. The 2% convertible bond, priced at $1,060.00/bond at the time this report was prepared. Assume that you have $100,000.00 to invest in TSLA, how would you allocate this amount across the Equity, the 2 bonds and the options (i.e. which if any of the puts/calls would you buy/sell). Additionally, you can short one instrument (i.e. Short $20K of the equity and then invest $120K in one or more of the bonds/options. You can also sell one or more of the options (naked or covered) and use the proceeds to invest in another part of the capital structure. Please provide a brief explanation/rationale for your investment decisions: TSLA US $ 1 258.046 +1.086 Y257.95/258.09Z 1x2 l. TO At 11:29 d Vol 2.965,329 0 257.700 H 258.940 L 254.12P Val 761.776M TSLA US Equity 98) Report Page 1/5 Security Description: Equity 1) Profile 2) Issue Info 3) Ratios 4) Revenue & EPS 5) Industry Info TESLA INC FIGI BBGOOONOMNX3 6) BI Research Primer | BICO Classification Automobiles Tesla Inc. designs, manufactures, and sells high-performance electric vehicles and electric vehicle powertrain components. The Company owns its sales and service network and sells electric powertrain components to other automobile manufacturers. Tesla serves customers worldwide. ... More 8) Price Chart | GP 9) Estimates | EE 13) Corporate Info Date Aft-mkt (C) 10/23/19 14) www.tesla.com P/E N.A. Palo Alto, CA, US Est P/E 12/19 N.A. Empls 48,817 (12/31/18) T12M EPS (USD) -2.83 15) Management MGMT Est EPS -3.59 16) Elon Reeve Musk Est PEG N.A. CEO/Co-Founder Px/Chg 1D (USD). 257.955/+.39% 17) Zachary Kirkhorn "Zach", 52 WK H (12/07/18) 379.49 12) Dividend | DVD Chief Financial Officer 52 Wk L (06/03/19) 176.992 Ind Gross Yield N.A. 18) Drew Baglino YTD Change/% -74.845/-22.49% Chief Technology Officer Mkt Cp (USD) 46,206.8M No cash dividends 12M Tot Ret -0.63% Shrs Out/Float 179.1M/141.1M Beta vs SPX 0.80 SI/% of Float 36.1M/25.56% 21) Depositary Receipts Days to Cover 4.9 Active Receipts Oct Nov Dec ' Jan Feb Mar Apr May TSLA US $ 1 257.91 +0.95 _ K257.91/257.96K 1x1 ul. At 11:27 d Vol 2.930,058 0 257.70Q H 258.940 L 254.12P Val 751.215M TSLA US Equity 95) Actions - 97) Settings Option Monitor ... TESLA INC 1257.9099 .9499 .3697% 257.8999/257.96 Hi 258.94 Lo 254.12 Volm 2930058 HV 42.65 Center 257.85 Strikes 5 Exp 18-Oct-19 Exch US Composite 92) 10/23/19 C | ERN Calc Mode As of 81) Center Strike 82) Calls/Puts 83) Calls 8 4) Puts 85) Term Structure 87) Moneyness Calls Strike Puts Ticker Bid AskLast IVM Volm Ticker Bid Ask Last IVM Volm 21) TSLA 3/20/20 C240 72.45 74.45 67.55 51.18 240.00 71) TSLA 3/20/20 P240 12.15 12.55 12.98 51.04 22) TSLA 3/20/20 C245 68.90 70.65 66.50 51.43 19 245.00 72) TSLA 3/20/20 P245 13.30 13.75 14.00 50.50 23) TSLA 3/20/20 C250 65.25 66.90 64.75 50.57 250.00 73) TSLA 3/20/20 P250 14.60 15.00 15.00 49.83 24) TSLA 3/20/20 C255 61.55 63.05 57.02 49.54 255.00 74) TSLA 3/20/20 P255 15.95 16.40 16.00 49.30 25) TSLA 3/20/20 C260 58.15 59.30 58.69 49.05 260.00 75) TSLA 3/20/20 P260 17.35 17.85 18.25 48.58 26) TSLA 3/20/20 C265 54.65 56.25 55.50 48.84 265.00 76) TSLA 3/20/20 P265 18.95 19.45 18.95 48.24 27) TSLA 3/20/20 C270 51.40 52.65 51.93 47.91 270.00 77) TSLA 3/20/20 P270 20.55 21.10 21.20 47.64 28) TSLA 3/20/20 C275 48.30 49.45 46.00 47.41 275.00 78) TSLA 3/20/20 P275 22.30 22.90 22.50 47.09 29) TSLA 3/20/20 C280 45.25 46.35 41.84 46.37 280.00 79) TSLA 3/20/20 P280 24.20 24.75 25.64 46.55 30) TSLA 3/20/20 C285 42.30 43.30 38.46 46.57 285.00 80) TSLA 3/20/20 P285 26.20 26.75 26.28 45.92 31) TSLA 3/20/20 C290 39.45 41.05 35.00 45.62 25 290.00 101) TSLA 3/20/20 P290 28.30 28.90 29.50 45.50 32) TSLA 3/20/20 C295 36.75 37.65 34.75 44.97 295.00 102) TSLA 3/20/20 P295 30.50 31.15 31.99 45.13 33) TSLA 3/20/20 C300 34.15 35.00 34.65 44.98 144 300.00 103) TSLA 3/20/20 P300 32.85 33.45 34.10 44.58 34) TSLA 3/20/20 C305 31.65 32.55 29.80 44.62 305.00 104) TSLA 3/20/20 P305 35.30 36.00 71.559 43.98 35) TSLA 3/20/20 C310 29.30 30.10 27.50 44.11 310.00 105) TSLA 3/20/20 P310 37.85 38.55 39.40 43.84 36) TSLA 3/20/20 C315 27.05 27.85 26.80 43.61 315.00 106) TSLA 3/20/20 P315 40.55 41.30 68.15y 43.42 37) TSLA 3/20/20 C320 24.90 25.50 25.05 43.17 320.00 107) TSLA 3/20/20 P320 43.30 44.15 46.05 43.08 38) TSLA 3/20/20 C325 22.90 23.70 22.91 42.97 325.00 108) TSLA 3/20/20 P325 46.30 47.15 87.30 42.50 39) TSLA 3/20/20 C330 21.00 21.80 21.45 42.34 45 330.00 109) TSLA 3/20/20 P330 48.95 50.15 76.70 42.14 40) TSLA 3/20/20 C335 19.20 20.00 17.85 42.28 17 335.00 110) TSLA 3/20/20 P335 52.25 53.45 103.30y 41.90 TSLA 5.3 08/15/25 $191.031 +.117 Yld 7.210 At 11:46 Source BMRK TSLA 5.3 08/15/25 Corp Settings - Actions Page 1/12 Security Description: Bond 94) Notes 95) Buy 96) Sell 25) Bond Description 26) Issuer Description Pages Issuer Information Identifiers 11) Bond Info Name TESLA INC ID Number A07577130 12) Addtl Info Industry Automotive (BCLASS) ISIN USU8810LAA18 13) Reg/Tax 14) Covenants Security Information FIGI BBGOOHEMRCN6 15) Guarantors Mkt Iss Euro-Dollar Bond Ratings 16) Bond Ratings Country US Currency USD Moody's Caa1 17) Identifiers Rank Sr Unsecured Series REGS S&P B- 18) Exchanges Coupon 5.300000 Type Fixed Composite CCC+ 19) Inv Parties 20) Fees, Restrict Cpn Freq S/A 21) Schedules Day Cnt 30/360 Iss Price 100.00000 Issuance & Trading 22) Coupons Maturity 08/15/2025 Aggregated Amount Issued out Quick Links MAKE WHOLE @50.000000 until 08/15/20/ CALL... USD 1,800,000.00 (M)/ 32) ALLQ Pricing Iss Sprd +320.00bp vs T 2 08/15/25 USD 1,800,000.00 (M) 33) QRD Qt Recap 34) TDH Trade Hist Calc Type (1)STREET CONVENTION Min Piece/Increment 35) CACS Corp Action Pricing Date 08/11/2017 2,000.00 / 1,000.00 36) CF Prospectus Interest Accrual Date 08/18/2017 Par Amount 1,000.00 37) CN Sec News 1st Settle Date 08/18/2017 Book Runner JOINT LEADS 38) HDS Holders 1st Coupon Date 02/15/2018 Reporting TRACE Yield and Spread Analysis 96) Sell 6) Calls TSLA 5.3 08/15/25 Corp Settings 90.780/91.302 7.267/7.149 BMRK @ 11:46 1 95) Buy 1) Yield & Spread 2) Graphs 3) Pricing 4) Description 5) Custom TSLA 5.3 08/15/25 ( USU8810LAA18 ) Risk Spread 557.65 bp VS 5yT 1 1 09/30/24 Price 91.302 3 9 9-21 11:47:04 O M.Dur Dur Yield 7.148849Wst - 1.572317 S/A , Risk, Wkout 08/15/2025 @ 100.00 Consensus Yld 66 Convexity Settle 10/17/190 10/16/190 DV - 01 on 1MM Benchmark Risk Risk Hedge Proceeds Hedge Spreads Yield Calculations Invoice | 11) G-Sprd 554.1 Street Convention 7.148849 Face 12) I-Sprd 556.7 Equiv 1 /Yr 7.276614 Principal 13) Basis - 101.7 Mmkt (Act/360 ) Accrued (62 Days) 14) Z-Sprd 556.5 True Yield 7.147842 Total (USD) 15) ASW 520.0 Current Yield 5.805 16) OAS 554.2 Workout 4.827 4.451 0.280 445 4.741 939M 925M OAS 4.833 4.457 0.281 446 4.742 940M 1,000 M 913,020.00 9,127.78 922,147.78 B- TSLA 2 05/15/24 $1106.000 +1.901 Yld N.A. As of 14 Oct Vol 3.5MM Source TRMT TSLA 2 05/15/24 Corp Settings - Actions - Page 1/12 Security Description: Convertible 94) Notes 95) Buy 96) Sell 25) Convertible Bond 26) Underlying Description Pages Issuer Information Identifiers 11) Bond Info Name TESLA INC ID Number ZS4501020 12) Addtl Info Industry Automotive (BCLASS) CUSIP 88160RAGO 13) Reg/Tax 14) Covenants Convertible Information ISIN US88160RAG65 15) Guarantors Mkt of Issue US Domestic Convertible Bond Ratings 16) Bond Ratings Country Currency USD Moody's NA 17) Identifiers Rank Sr Unsecured Series S&P 18) Exchanges Conv Ratio 3.2276 Conv Price 309.8277 Composite NR 19) Inv Parties Stock Tkr TSLA US Stock Price 258.089... 20) Fees, Restrict 21) Schedules Parity 83.3011 Premium 27.2492 Issuance & Trading 22) Coupons Coupon 2.000000 Init Prem 27.500 Amt Issued/Outstanding Quick Links Type Fixed Freq. S/A USD 1,840,000.00 (M)/ 32) ALLQ Pricing USD 1,840,000.00 (M) 33) QRD Qt Recap 34) TDH Min Piece/Increment Trade Hist Calc Type (49)CONVERTIBLE 35) CACS Corp Action Pricing Date 05/02/2019 1,000.00 / 1,000.00 36 CF Prospectus Is Coupon Date 11/15/2019 Par Amount 1,000.00 37) CN Sec News Convertible Until 05/13/2024 Book Runner JOINT LEADS 38) HDS Holders Maturity 05/15/2024 Reporting TRACE 39) OVCV Valuation $240MM GREENSHOE EXERCISED IN FULL EFFECTIVE 5/3/19. 66) Send Bond The Assignment: For each of the following instruments - identify one pro/one con for owning: Common Equity - priced at $258.04/share at the time that this report was prepared. . Select one call and one put from the matrix provided, briefly describe the derivative and why you would want to be long/short that particular derivative. The 5.3% cash pay bond, priced at $910.31/bond at the time this report was prepared. The 2% convertible bond, priced at $1,060.00/bond at the time this report was prepared. Assume that you have $100,000.00 to invest in TSLA, how would you allocate this amount across the Equity, the 2 bonds and the options (i.e. which if any of the puts/calls would you buy/sell). Additionally, you can short one instrument (i.e. Short $20K of the equity and then invest $120K in one or more of the bonds/options. You can also sell one or more of the options (naked or covered) and use the proceeds to invest in another part of the capital structure. Please provide a brief explanation/rationale for your investment decisions: TSLA US $ 1 258.046 +1.086 Y257.95/258.09Z 1x2 l. TO At 11:29 d Vol 2.965,329 0 257.700 H 258.940 L 254.12P Val 761.776M TSLA US Equity 98) Report Page 1/5 Security Description: Equity 1) Profile 2) Issue Info 3) Ratios 4) Revenue & EPS 5) Industry Info TESLA INC FIGI BBGOOONOMNX3 6) BI Research Primer | BICO Classification Automobiles Tesla Inc. designs, manufactures, and sells high-performance electric vehicles and electric vehicle powertrain components. The Company owns its sales and service network and sells electric powertrain components to other automobile manufacturers. Tesla serves customers worldwide. ... More 8) Price Chart | GP 9) Estimates | EE 13) Corporate Info Date Aft-mkt (C) 10/23/19 14) www.tesla.com P/E N.A. Palo Alto, CA, US Est P/E 12/19 N.A. Empls 48,817 (12/31/18) T12M EPS (USD) -2.83 15) Management MGMT Est EPS -3.59 16) Elon Reeve Musk Est PEG N.A. CEO/Co-Founder Px/Chg 1D (USD). 257.955/+.39% 17) Zachary Kirkhorn "Zach", 52 WK H (12/07/18) 379.49 12) Dividend | DVD Chief Financial Officer 52 Wk L (06/03/19) 176.992 Ind Gross Yield N.A. 18) Drew Baglino YTD Change/% -74.845/-22.49% Chief Technology Officer Mkt Cp (USD) 46,206.8M No cash dividends 12M Tot Ret -0.63% Shrs Out/Float 179.1M/141.1M Beta vs SPX 0.80 SI/% of Float 36.1M/25.56% 21) Depositary Receipts Days to Cover 4.9 Active Receipts Oct Nov Dec ' Jan Feb Mar Apr May TSLA US $ 1 257.91 +0.95 _ K257.91/257.96K 1x1 ul. At 11:27 d Vol 2.930,058 0 257.70Q H 258.940 L 254.12P Val 751.215M TSLA US Equity 95) Actions - 97) Settings Option Monitor ... TESLA INC 1257.9099 .9499 .3697% 257.8999/257.96 Hi 258.94 Lo 254.12 Volm 2930058 HV 42.65 Center 257.85 Strikes 5 Exp 18-Oct-19 Exch US Composite 92) 10/23/19 C | ERN Calc Mode As of 81) Center Strike 82) Calls/Puts 83) Calls 8 4) Puts 85) Term Structure 87) Moneyness Calls Strike Puts Ticker Bid AskLast IVM Volm Ticker Bid Ask Last IVM Volm 21) TSLA 3/20/20 C240 72.45 74.45 67.55 51.18 240.00 71) TSLA 3/20/20 P240 12.15 12.55 12.98 51.04 22) TSLA 3/20/20 C245 68.90 70.65 66.50 51.43 19 245.00 72) TSLA 3/20/20 P245 13.30 13.75 14.00 50.50 23) TSLA 3/20/20 C250 65.25 66.90 64.75 50.57 250.00 73) TSLA 3/20/20 P250 14.60 15.00 15.00 49.83 24) TSLA 3/20/20 C255 61.55 63.05 57.02 49.54 255.00 74) TSLA 3/20/20 P255 15.95 16.40 16.00 49.30 25) TSLA 3/20/20 C260 58.15 59.30 58.69 49.05 260.00 75) TSLA 3/20/20 P260 17.35 17.85 18.25 48.58 26) TSLA 3/20/20 C265 54.65 56.25 55.50 48.84 265.00 76) TSLA 3/20/20 P265 18.95 19.45 18.95 48.24 27) TSLA 3/20/20 C270 51.40 52.65 51.93 47.91 270.00 77) TSLA 3/20/20 P270 20.55 21.10 21.20 47.64 28) TSLA 3/20/20 C275 48.30 49.45 46.00 47.41 275.00 78) TSLA 3/20/20 P275 22.30 22.90 22.50 47.09 29) TSLA 3/20/20 C280 45.25 46.35 41.84 46.37 280.00 79) TSLA 3/20/20 P280 24.20 24.75 25.64 46.55 30) TSLA 3/20/20 C285 42.30 43.30 38.46 46.57 285.00 80) TSLA 3/20/20 P285 26.20 26.75 26.28 45.92 31) TSLA 3/20/20 C290 39.45 41.05 35.00 45.62 25 290.00 101) TSLA 3/20/20 P290 28.30 28.90 29.50 45.50 32) TSLA 3/20/20 C295 36.75 37.65 34.75 44.97 295.00 102) TSLA 3/20/20 P295 30.50 31.15 31.99 45.13 33) TSLA 3/20/20 C300 34.15 35.00 34.65 44.98 144 300.00 103) TSLA 3/20/20 P300 32.85 33.45 34.10 44.58 34) TSLA 3/20/20 C305 31.65 32.55 29.80 44.62 305.00 104) TSLA 3/20/20 P305 35.30 36.00 71.559 43.98 35) TSLA 3/20/20 C310 29.30 30.10 27.50 44.11 310.00 105) TSLA 3/20/20 P310 37.85 38.55 39.40 43.84 36) TSLA 3/20/20 C315 27.05 27.85 26.80 43.61 315.00 106) TSLA 3/20/20 P315 40.55 41.30 68.15y 43.42 37) TSLA 3/20/20 C320 24.90 25.50 25.05 43.17 320.00 107) TSLA 3/20/20 P320 43.30 44.15 46.05 43.08 38) TSLA 3/20/20 C325 22.90 23.70 22.91 42.97 325.00 108) TSLA 3/20/20 P325 46.30 47.15 87.30 42.50 39) TSLA 3/20/20 C330 21.00 21.80 21.45 42.34 45 330.00 109) TSLA 3/20/20 P330 48.95 50.15 76.70 42.14 40) TSLA 3/20/20 C335 19.20 20.00 17.85 42.28 17 335.00 110) TSLA 3/20/20 P335 52.25 53.45 103.30y 41.90 TSLA 5.3 08/15/25 $191.031 +.117 Yld 7.210 At 11:46 Source BMRK TSLA 5.3 08/15/25 Corp Settings - Actions Page 1/12 Security Description: Bond 94) Notes 95) Buy 96) Sell 25) Bond Description 26) Issuer Description Pages Issuer Information Identifiers 11) Bond Info Name TESLA INC ID Number A07577130 12) Addtl Info Industry Automotive (BCLASS) ISIN USU8810LAA18 13) Reg/Tax 14) Covenants Security Information FIGI BBGOOHEMRCN6 15) Guarantors Mkt Iss Euro-Dollar Bond Ratings 16) Bond Ratings Country US Currency USD Moody's Caa1 17) Identifiers Rank Sr Unsecured Series REGS S&P B- 18) Exchanges Coupon 5.300000 Type Fixed Composite CCC+ 19) Inv Parties 20) Fees, Restrict Cpn Freq S/A 21) Schedules Day Cnt 30/360 Iss Price 100.00000 Issuance & Trading 22) Coupons Maturity 08/15/2025 Aggregated Amount Issued out Quick Links MAKE WHOLE @50.000000 until 08/15/20/ CALL... USD 1,800,000.00 (M)/ 32) ALLQ Pricing Iss Sprd +320.00bp vs T 2 08/15/25 USD 1,800,000.00 (M) 33) QRD Qt Recap 34) TDH Trade Hist Calc Type (1)STREET CONVENTION Min Piece/Increment 35) CACS Corp Action Pricing Date 08/11/2017 2,000.00 / 1,000.00 36) CF Prospectus Interest Accrual Date 08/18/2017 Par Amount 1,000.00 37) CN Sec News 1st Settle Date 08/18/2017 Book Runner JOINT LEADS 38) HDS Holders 1st Coupon Date 02/15/2018 Reporting TRACE Yield and Spread Analysis 96) Sell 6) Calls TSLA 5.3 08/15/25 Corp Settings 90.780/91.302 7.267/7.149 BMRK @ 11:46 1 95) Buy 1) Yield & Spread 2) Graphs 3) Pricing 4) Description 5) Custom TSLA 5.3 08/15/25 ( USU8810LAA18 ) Risk Spread 557.65 bp VS 5yT 1 1 09/30/24 Price 91.302 3 9 9-21 11:47:04 O M.Dur Dur Yield 7.148849Wst - 1.572317 S/A , Risk, Wkout 08/15/2025 @ 100.00 Consensus Yld 66 Convexity Settle 10/17/190 10/16/190 DV - 01 on 1MM Benchmark Risk Risk Hedge Proceeds Hedge Spreads Yield Calculations Invoice | 11) G-Sprd 554.1 Street Convention 7.148849 Face 12) I-Sprd 556.7 Equiv 1 /Yr 7.276614 Principal 13) Basis - 101.7 Mmkt (Act/360 ) Accrued (62 Days) 14) Z-Sprd 556.5 True Yield 7.147842 Total (USD) 15) ASW 520.0 Current Yield 5.805 16) OAS 554.2 Workout 4.827 4.451 0.280 445 4.741 939M 925M OAS 4.833 4.457 0.281 446 4.742 940M 1,000 M 913,020.00 9,127.78 922,147.78 B- TSLA 2 05/15/24 $1106.000 +1.901 Yld N.A. As of 14 Oct Vol 3.5MM Source TRMT TSLA 2 05/15/24 Corp Settings - Actions - Page 1/12 Security Description: Convertible 94) Notes 95) Buy 96) Sell 25) Convertible Bond 26) Underlying Description Pages Issuer Information Identifiers 11) Bond Info Name TESLA INC ID Number ZS4501020 12) Addtl Info Industry Automotive (BCLASS) CUSIP 88160RAGO 13) Reg/Tax 14) Covenants Convertible Information ISIN US88160RAG65 15) Guarantors Mkt of Issue US Domestic Convertible Bond Ratings 16) Bond Ratings Country Currency USD Moody's NA 17) Identifiers Rank Sr Unsecured Series S&P 18) Exchanges Conv Ratio 3.2276 Conv Price 309.8277 Composite NR 19) Inv Parties Stock Tkr TSLA US Stock Price 258.089... 20) Fees, Restrict 21) Schedules Parity 83.3011 Premium 27.2492 Issuance & Trading 22) Coupons Coupon 2.000000 Init Prem 27.500 Amt Issued/Outstanding Quick Links Type Fixed Freq. S/A USD 1,840,000.00 (M)/ 32) ALLQ Pricing USD 1,840,000.00 (M) 33) QRD Qt Recap 34) TDH Min Piece/Increment Trade Hist Calc Type (49)CONVERTIBLE 35) CACS Corp Action Pricing Date 05/02/2019 1,000.00 / 1,000.00 36 CF Prospectus Is Coupon Date 11/15/2019 Par Amount 1,000.00 37) CN Sec News Convertible Until 05/13/2024 Book Runner JOINT LEADS 38) HDS Holders Maturity 05/15/2024 Reporting TRACE 39) OVCV Valuation $240MM GREENSHOE EXERCISED IN FULL EFFECTIVE 5/3/19. 66) Send Bond