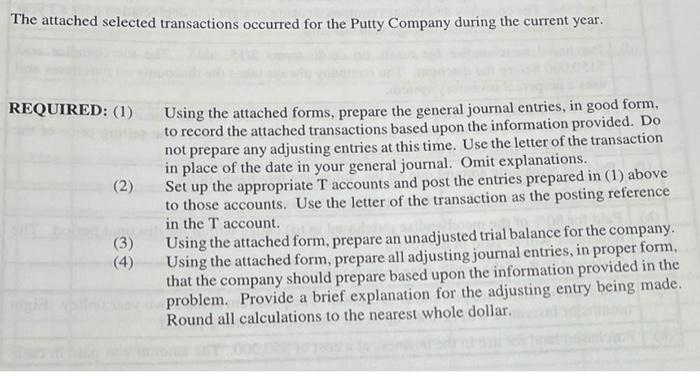

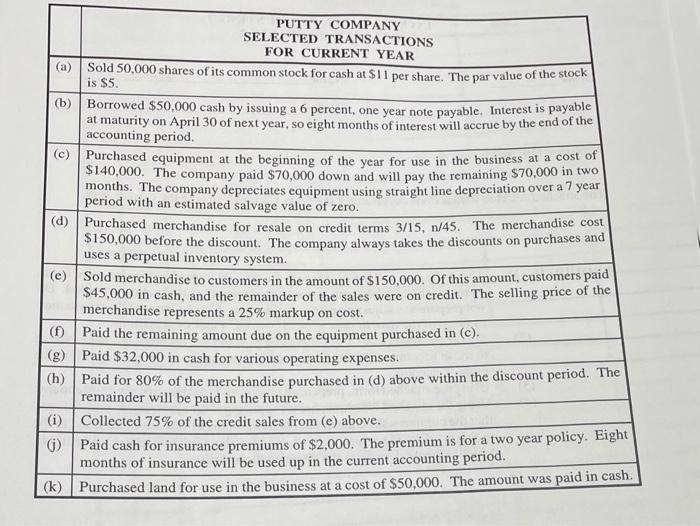

The attached selected transactions occurred for the Putty Company during the current year. REQUIRED: (1) (2) Using the attached forms, prepare the general journal entries, in good form, to record the attached transactions based upon the information provided. Do not prepare any adjusting entries at this time. Use the letter of the transaction in place of the date in your general journal. Omit explanations. Set up the appropriate T accounts and post the entries prepared in (1) above to those accounts. Use the letter of the transaction as the posting reference in the T account. Using the attached form, prepare an unadjusted trial balance for the company. Using the attached form, prepare all adjusting journal entries, in proper form, that the company should prepare based upon the information provided in the problem. Provide a brief explanation for the adjusting entry being made. Round all calculations to the nearest whole dollar. (3) (4) PUTTY COMPANY SELECTED TRANSACTIONS FOR CURRENT YEAR (a) Sold 50,000 shares of its common stock for cash at $11 per share. The par value of the stock is $5. (6) Borrowed $50,000 cash by issuing a 6 percent, one year note payable. Interest is payable at maturity on April 30 of next year, so eight months of interest will accrue by the end of the accounting period. (c) Purchased equipment at the beginning of the year for use in the business at a cost of $140,000. The company paid $70,000 down and will pay the remaining $70,000 in two months. The company depreciates equipment using straight line depreciation over a 7 year period with an estimated salvage value of zero. () Purchased merchandise for resale on credit terms 3/15, 1/45. The merchandise cost $150,000 before the discount. The company always takes the discounts on purchases and uses a perpetual inventory system. (e) Sold merchandise to customers in the amount of $150,000. Of this amount, customers paid $45,000 in cash, and the remainder of the sales were on credit. The selling price of the merchandise represents a 25% markup on cost. (1) Paid the remaining amount due on the equipment purchased in C). (g) Paid $32,000 in cash for various operating expenses. ch) Paid for 80% of the merchandise purchased in (d) above within the discount period. The remainder will be paid in the future. i Collected 75% of the credit sales from (e) above. ( Paid cash for insurance premiums of $2,000. The premium is for a two year policy. Eight months of insurance will be used up in the current accounting period. (k) Purchased land for use in the business at a cost of $50,000. The amount was paid in cash