Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The authors report total lifetime costs of $4,917 for those who received targeted screening at age 35 ($4,551 without screening), $3,820 at age 45

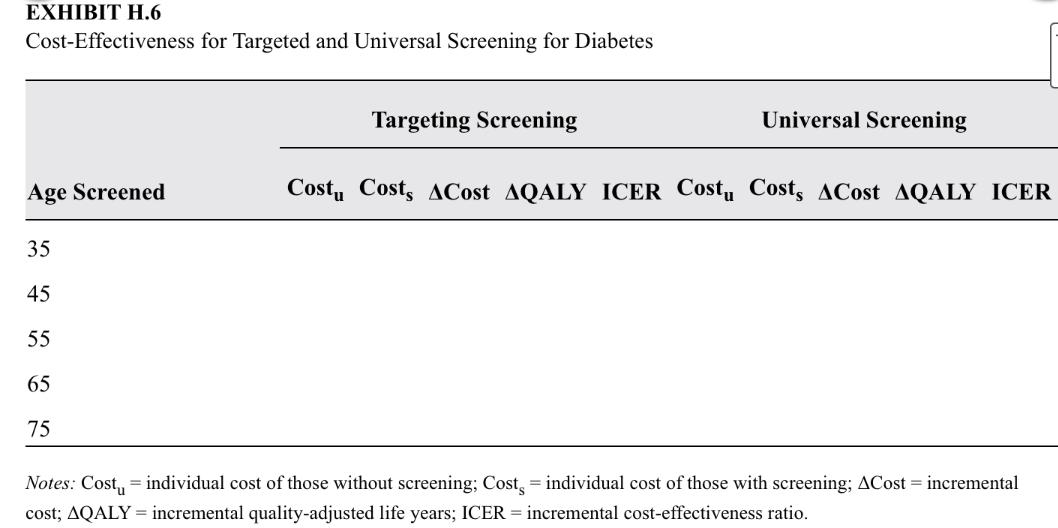

The authors report total lifetime costs of $4,917 for those who received targeted screening at age 35 ($4,551 without screening), $3,820 at age 45 ($3,415 without screening), $4,292 at age 55 ($3,682 without screening), $1,242 at age 65 ($998 without screening), and $952 at age 75 ($720 without screening). Incremental QALYS are reported to be 0.004, 0.008, 0.018, 0.008, and 0.007, respectively, for the five age groups. The authors report total lifetime costs of $4,700 for those with universal screening at age 35 ($4,369 without screening), $3,627 at age 45 ($3,263 without screening), $3,351 at age 55 ($2,872 without screening), $1,007 at age 65 ($805 without screening), and $374 at age 75 ($282 without screening). Incremental QALYS for universal screening are reported to be 0.003, 0.003, 0.008, 0.003, and 0.002, respectively, for the five age groups. Questions For each screening strategy, use exhibit H.6 to calculate the incremental cost associated and the ICER for each age group. How do the ICERs of targeted and universal screening compare across screening ages? EXHIBIT H.6 Cost-Effectiveness for Targeted and Universal Screening for Diabetes Age Screened 35 45 55 65 75 Targeting Screening Universal Screening Cost Cost, ACost AQALY ICER Costu Cost, ACost AQALY ICER Notes: Cost = individual cost of those without screening; Cost = individual cost of those with screening; ACost = incremental cost; AQALY = incremental quality-adjusted life years; ICER = incremental cost-effectiveness ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the incremental cost associated and the incremental costeffectiveness ratio ICER for ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started