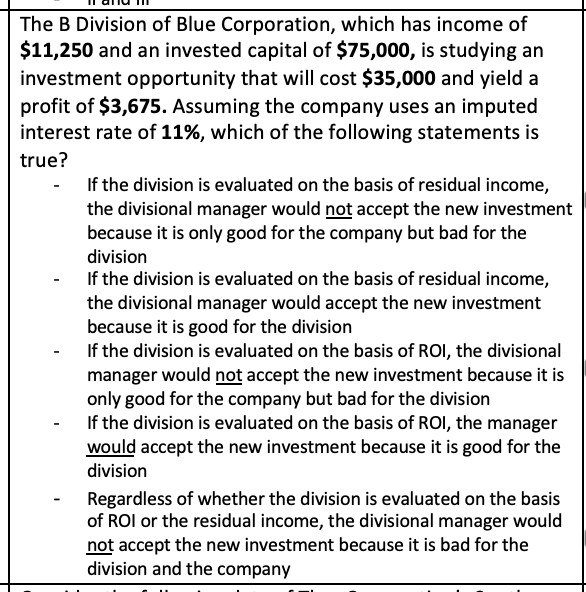

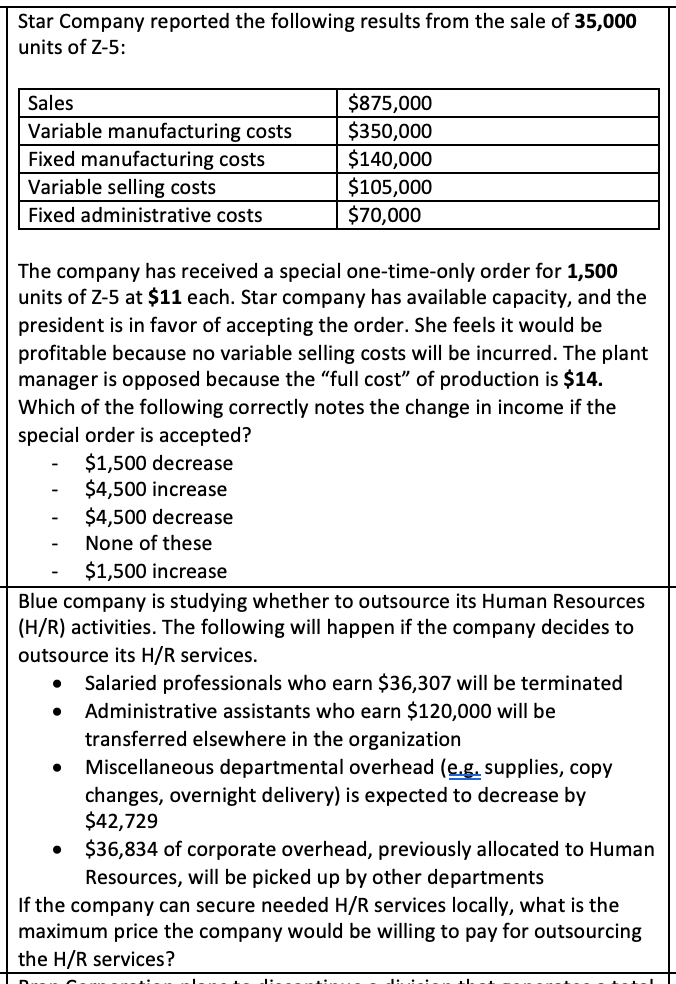

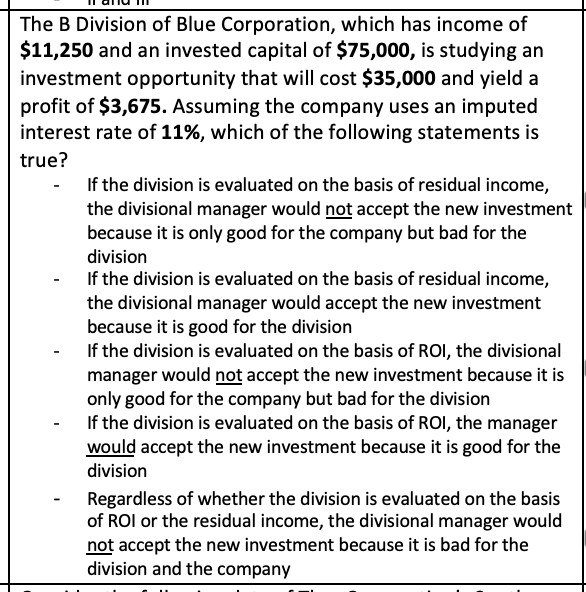

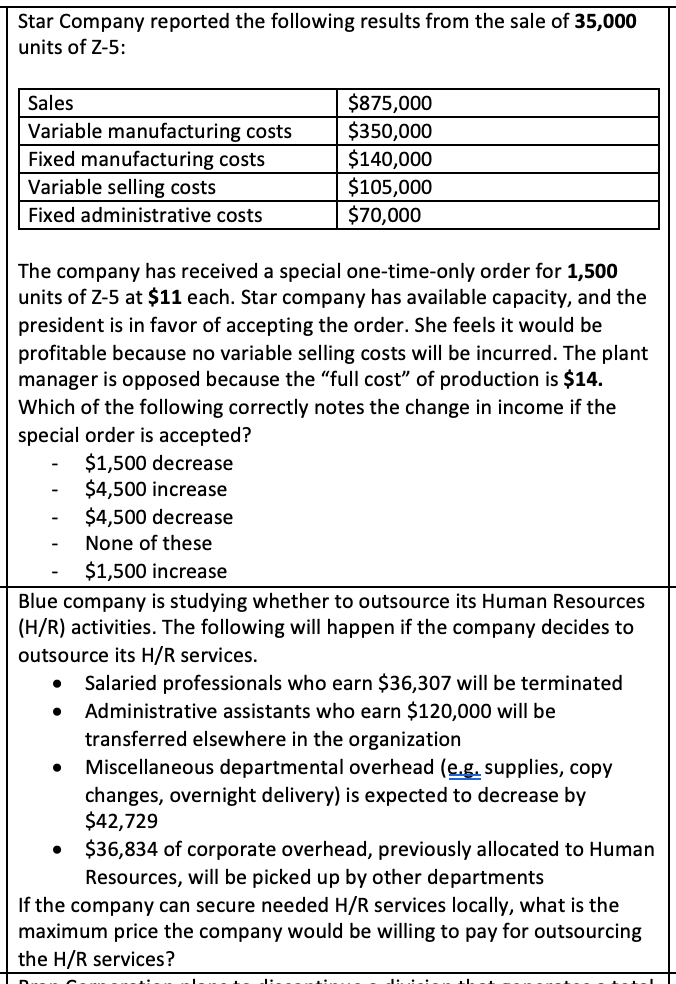

The B Division of Blue Corporation, which has income of $11,250 and an invested capital of $75,000, is studying an investment opportunity that will cost $35,000 and yield a profit of $3,675. Assuming the company uses an imputed interest rate of 11%, which of the following statements is true? If the division is evaluated on the basis of residual income, the divisional manager would not accept the new investment because it is only good for the company but bad for the division If the division is evaluated on the basis of residual income, the divisional manager would accept the new investment because it is good for the division If the division is evaluated on the basis of ROI, the divisional manager would not accept the new investment because it is only good for the company but bad for the division If the division is evaluated on the basis of ROI, the manager would accept the new investment because it is good for the division Regardless of whether the division is evaluated on the basis of ROI or the residual income, the divisional manager would not accept the new investment because it is bad for the division and the company Star Company reported the following results from the sale of 35,000 units of Z-5: Sales Variable manufacturing costs Fixed manufacturing costs Variable selling costs Fixed administrative costs $875,000 $350,000 $140,000 $105,000 $70,000 The company has received a special one-time-only order for 1,500 units of Z-5 at $11 each. Star company has available capacity, and the president is in favor of accepting the order. She feels it would be profitable because no variable selling costs will be incurred. The plant manager is opposed because the "full cost of production is $14. Which of the following correctly notes the change in income if the special order is accepted? $1,500 decrease $4,500 increase $4,500 decrease None of these $1,500 increase Blue company is studying whether to outsource its Human Resources (H/R) activities. The following will happen if the company decides to outsource its H/R services. Salaried professionals who earn $36,307 will be terminated Administrative assistants who earn $120,000 will be transferred elsewhere in the organization Miscellaneous departmental overhead (e.g. supplies, copy changes, overnight delivery) is expected to decrease by $42,729 $36,834 of corporate overhead, previously allocated to Human Resources, will be picked up by other departments If the company can secure needed H/R services locally, what is the maximum price the company would be willing to pay for outsourcing the H/R services? . . The B Division of Blue Corporation, which has income of $11,250 and an invested capital of $75,000, is studying an investment opportunity that will cost $35,000 and yield a profit of $3,675. Assuming the company uses an imputed interest rate of 11%, which of the following statements is true? If the division is evaluated on the basis of residual income, the divisional manager would not accept the new investment because it is only good for the company but bad for the division If the division is evaluated on the basis of residual income, the divisional manager would accept the new investment because it is good for the division If the division is evaluated on the basis of ROI, the divisional manager would not accept the new investment because it is only good for the company but bad for the division If the division is evaluated on the basis of ROI, the manager would accept the new investment because it is good for the division Regardless of whether the division is evaluated on the basis of ROI or the residual income, the divisional manager would not accept the new investment because it is bad for the division and the company Star Company reported the following results from the sale of 35,000 units of Z-5: Sales Variable manufacturing costs Fixed manufacturing costs Variable selling costs Fixed administrative costs $875,000 $350,000 $140,000 $105,000 $70,000 The company has received a special one-time-only order for 1,500 units of Z-5 at $11 each. Star company has available capacity, and the president is in favor of accepting the order. She feels it would be profitable because no variable selling costs will be incurred. The plant manager is opposed because the "full cost of production is $14. Which of the following correctly notes the change in income if the special order is accepted? $1,500 decrease $4,500 increase $4,500 decrease None of these $1,500 increase Blue company is studying whether to outsource its Human Resources (H/R) activities. The following will happen if the company decides to outsource its H/R services. Salaried professionals who earn $36,307 will be terminated Administrative assistants who earn $120,000 will be transferred elsewhere in the organization Miscellaneous departmental overhead (e.g. supplies, copy changes, overnight delivery) is expected to decrease by $42,729 $36,834 of corporate overhead, previously allocated to Human Resources, will be picked up by other departments If the company can secure needed H/R services locally, what is the maximum price the company would be willing to pay for outsourcing the H/R services