Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The balance in the accounts of W Beavan at the end of April 2022 were: bank $3215, motor vehicle $13200, machinery $2400, accounts receivable

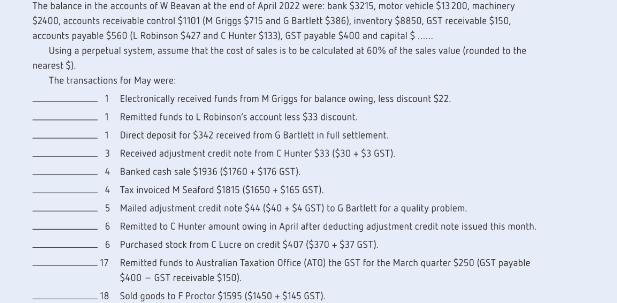

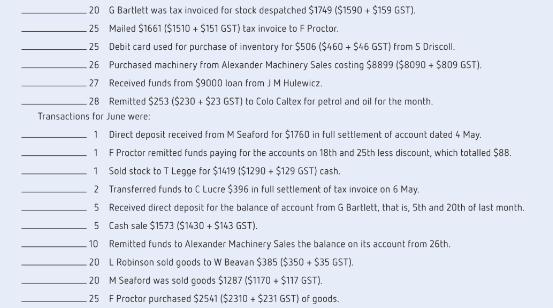

The balance in the accounts of W Beavan at the end of April 2022 were: bank $3215, motor vehicle $13200, machinery $2400, accounts receivable control $1101 (M Griggs $715 and G Bartlett $386), inventory $8850, GST receivable $150, accounts payable $560 (L Robinson $427 and C Hunter $133), GST payable $400 and capital $. Using a perpetual system, assume that the cost of sales is to be calculated at 60% of the sales value (rounded to the nearest $). The transactions for May were: 1 1 1 3 Electronically received funds from M Griggs for balance owing, less discount $22 Remitted funds to L Robinson's account less $33 discount. Direct deposit for $342 received from G Bartlett in full settlement. Received adjustment credit note from C Hunter $33 ($30 + $3 GST). 4 Banked cash sale $1936 ($1760 + $176 GST). 4 Tax invoiced M Seaford $1815 ($1650 + $165 GST). 5 Mailed adjustment credit note $44 ($40+ $4 GST) to G Bartlett for a quality problem. 6 Remitted to C Hunter amount owing in April after deducting adjustment credit note issued this month. 6 Purchased stock from C Lucre on credit $407 ($370 + $37 GST). 17 Remitted funds to Australian Taxation Office (ATO) the GST for the March quarter $250 (GST payable $400-GST receivable $150). 18 Sold goods to F Proctor $1595 ($1450 + $145 GST). 20 G Bartlett was tax invoiced for stock despatched $1749 ($1590 + $159 GST), 25 Mailed $1661 ($1510+ $151 GST) tax invoice to F Proctor. 25 Debit card used for purchase of inventory for $506 ($460+ $46 GST) from S Driscoll. 26 Purchased machinery from Alexander Machinery Sales costing $8899 ($8090 + $809 GST). Received funds from $9000 loan from JM Hulewicz. 27 28 Remitted $253 ($230 + $23 GST) to Colo Caltex for petrol and oil for the month. Transactions for June were: 1 Direct deposit received from M Seaford for $1760 in full settlement of account dated 4 May. 1 F Proctor remitted funds paying for the accounts on 18th and 25th less discount, which totalled $88. 1 Sold stock to T Legge for $1419 ($1290+ $129 GST) cash. 2 Transferred funds to C Lucre $396 in full settlement of tax invoice on 6 May. 5 Received direct deposit for the balance of account from G Bartlett, that is, 5th and 20th of last month. Cash sale $1573 ($1430 +$143 GST). 5 10 Remitted funds to Alexander Machinery Sales the balance on its account from 26th. 20 L Robinson sold goods to W Beavan $385 ($350 + $35 GST). 20 M Seaford was sold goods $1287 ($1170+ $117 GST). 25 F Proctor purchased $2541 ($2310+ $231 GST) of goods. 26 Electronically transferred $1280 to Northern Rivers Council for rates. 28 Remitted $297 ($270+$27 GST) to Colo Caltex for petrol and oil for the month. b c You are required to: a enter the appropriate journal abbreviation next to each of the above transactions and prepare all relevant journals (or prepare the general journal) for May and then for June post to a structured general ledger and balance the accounts at the end of each month prepare a trial balance at the end of each month. The Workbook that accompanies this text will allow you to complete this question using a periodic inventory system.

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below A Enter the Appropriate Journal Abbreviations May 1 M Griggs CR Bank22 2 L Robinson DR Ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started