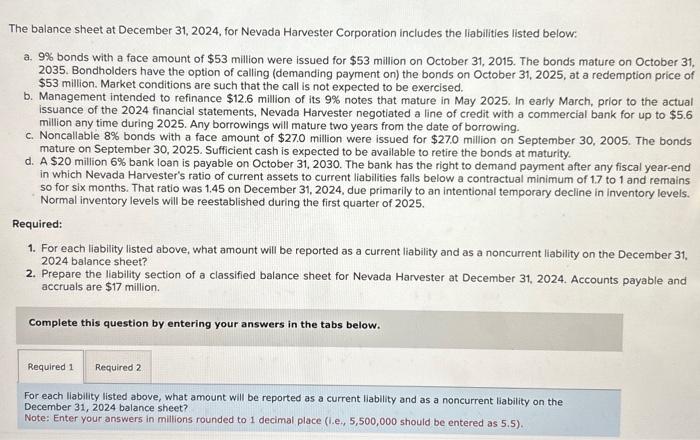

The balance sheet at December 31, 2024, for Nevada Harvester Corporation includes the liabilities listed below: a. 9% bonds with a face amount of $53 million were issued for $53 million on October 31,2015 . The bonds mature on October 31 , 2035. Bondholders have the option of calling (demanding payment on) the bonds on October 31, 2025, at a redemption price of $53 million. Market conditions are such that the call is not expected to be exercised. b. Management intended to refinance $12.6 million of its 9% notes that mature in May 2025 . In early March, prior to the actual issuance of the 2024 financial statements, Nevada Harvester negotiated a line of credit with a commercial bank for up to $5.6 million any time during 2025. Any borrowings will mature two years from the date of borrowing. c. Noncallable 8% bonds with a face amount of $27.0 million were issued for $27.0 million on September 30,2005 . The bonds mature on September 30,2025 . Sufficient cash is expected to be available to retire the bonds at maturity. d. A $20 million 6% bank loan is payable on October 31, 2030. The bank has the right to demand payment after any fiscal year-end in which Nevada Harvester's ratio of current assets to current liabilities falls below a contractual minimum of 1.7 to 1 and remains so for six months. That ratio was 1.45 on December 31,2024 , due primarily to an intentional temporary decline in inventory levels. Normal inventory levels will be reestablished during the first quarter of 2025. Required: 1. For each liability listed above, what amount will be reported as a current liability and as a noncurrent liability on the December 31. 2024 balance sheet? 2. Prepare the liability section of a classified balance sheet for Nevada Harvester at December 31, 2024. Accounts payable and accruals are $17 million. Complete this question by entering your answers in the tabs below. For each liability listed above, what amount will be reported as a current liability and as a noncurrent liability on the December 31,2024 balance sheet? Note: Enter your answers in millions rounded to 1 decimal place (1.e, 5,500,000 should be entered as 5.5 )