Answered step by step

Verified Expert Solution

Question

1 Approved Answer

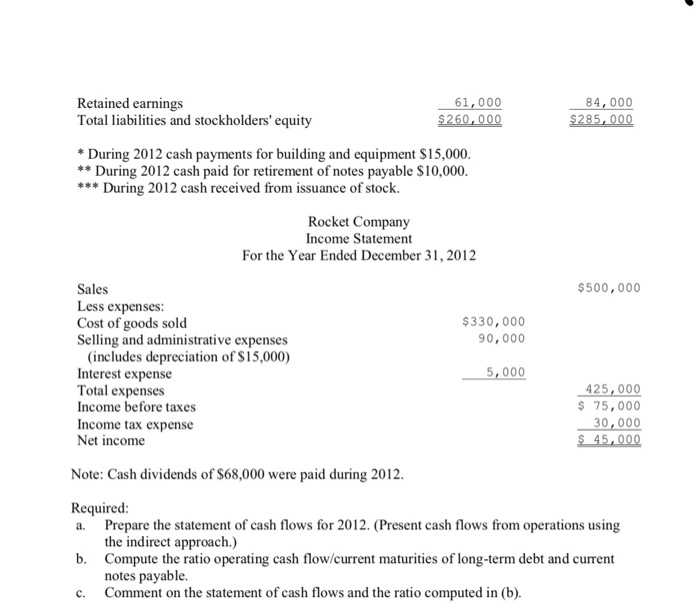

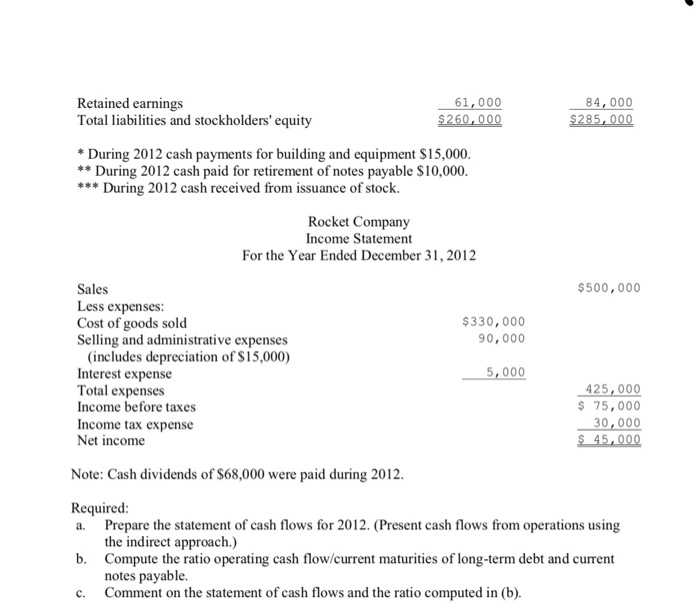

The balance sheet for sheet Retained earnings Total liabilities and stockholders' equity 61,000 84,000 During 2012 cash payments for building and equipment S15,000 **During 2012

The balance sheet for sheet

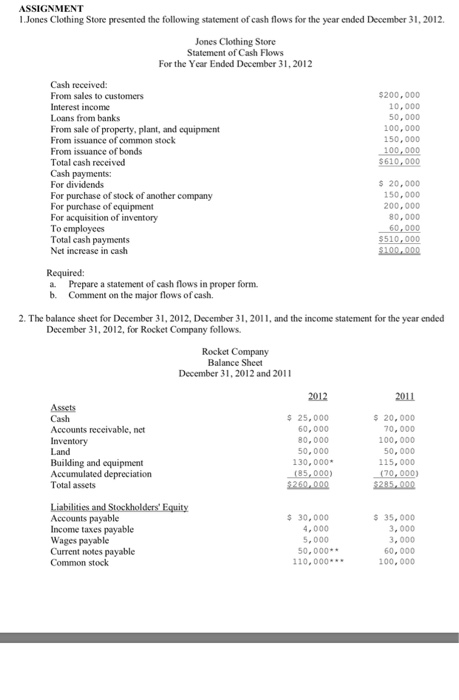

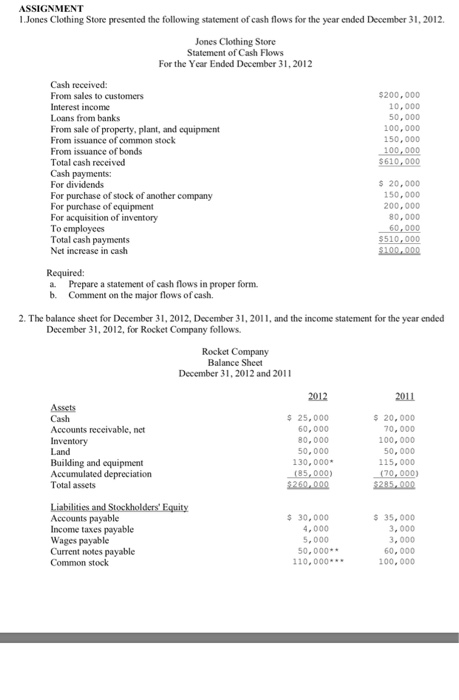

Retained earnings Total liabilities and stockholders' equity 61,000 84,000 During 2012 cash payments for building and equipment S15,000 **During 2012 cash paid for retirement of notes payable $10,000 *During 2012 cash received from issuance of stock Rocket Company Income Statement For the Year Ended December 31, 2012 Sales Less expenses: Cost of goods sold Selling and administrative expenses $500,000 $330,000 90,000 (includes depreciation of $15,000) Interest expense Total expenses Income before taxes Income tax expense Net income 5,000 425,000 75, 000 30,000 Note: Cash dividends of $68,000 were paid during 2012 Required a. Prepare the statement of cash flows for 2012. (Present cash flows from operations using the indirect approach.) b. Compute the ratio operating cash flow/current maturities of long-term debt and current notes payable. Comment on the statement of cash flows and the ratio computed in (b) c. ASSIGNMENT 1 Jones Clothing Store presented the following statement of cash flows for the year ended December 31, 2012 Jones Clothing Store Statement of Cash Flows For the Year Ended December 31, 2012 Cash received: From sales to customers Interest income Loans from banks From sale of property, plant, and equipment From issuance of common stock From issuance of bonds Total cash received Cash payments: For dividends For purchase of stock of another company For purchase of equipment For acquisition of inventory To employees Total cash payments Net increase in cash $200,000 10,000 50,000 100,000 150,000 20,000 150,000 200,000 80,000 a. Prepare a statement of cash flows in proper form. b. Comment on the major flows of cash. 2. The balance sheet for December 31, 2012, December 31, 2011, and the income statement for the year ended December 31, 2012, for Rocket Company follows. Rocket Company December 3,2012 and 2011 s 20, 000 70, 000 100, 000 50, 000 115, 000 (70,000) Cash Accounts receivable, net 25,000 60,000 80, 000 50, 000 130, 000 (85,000 Building and equipment Accumulated depreciation Total assets 30, 000 Accounts payable Income taxes payable Wages payable Current notes payable Common stock 4, 000 5, 000 50,000 110,000. $ 35, 000 3, 000 3, 000 60, 000 100, 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started