Question

The Balance Sheets, as at 31 December 2019, of three entities, P S and A are produced below. P acquired 80% of the shares in

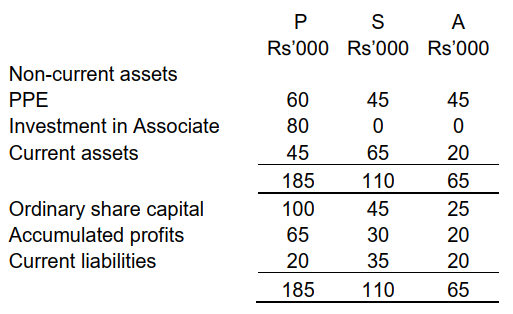

The Balance Sheets, as at 31 December 2019, of three entities, P S and A are produced below.

P acquired 80% of the shares in S on 31 December 2018 at a cost of Rs65,000 and 25% of the share capital of company A on the same date at a cost of Rs15,000. P controls S and exercises significant influence over A.

P acquired 80% of the shares in S on 31 December 2018 at a cost of Rs65,000 and 25% of the share capital of company A on the same date at a cost of Rs15,000. P controls S and exercises significant influence over A.

At the time of acquisition, Ss profits stood at Rs15,000 and an item of PPE in the books of S was undervalued by Rs10,000. This item of PPE had a remaining useful life of 5 years at date of acquisition. At the time of acquisition, As profits stood at Rs15,000 and the net assets of A at that date were deemed to reflect fair values. Goodwill in S is deemed to have been impaired by 20% since date of acquisition. The fair value of non-controlling interest at 31 December 2018 was Rs20,000. There was no impairment in the investment in the associate.

During the year ended 2019, S sold goods to P for Rs20,000 and P still has 50% of the goods in stock at balance sheet date. S applies a margin of 25% on all sales.

Required:

| (a) | Prepare Consolidated Statement of financial position at 31 December 2019. (25 marks) |

| (b) | Discuss the recognition criteria under the purchase method of consolidation. (10 marks) |

| (c) | Explain the circumstances where control still exists even when the parent |

| company owns half or less than one half of the voting power. | (5 marks) |

P SA Rs'000 Rs'000 Rs'000 Non-current assets PPE Investment in Associate Current assets 60 80 45 185 100 65 20 185 45 0 65 110 45 30 35 110 45 0 20 65 25 20 20 65 Ordinary share capital Accumulated profits Current liabilities P SA Rs'000 Rs'000 Rs'000 Non-current assets PPE Investment in Associate Current assets 60 80 45 185 100 65 20 185 45 0 65 110 45 30 35 110 45 0 20 65 25 20 20 65 Ordinary share capital Accumulated profits Current liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started