Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Craig Alves passed away on 30 June 2021 at the age of 62 years. He was survived by his spouse, Marissa Alves, to whom

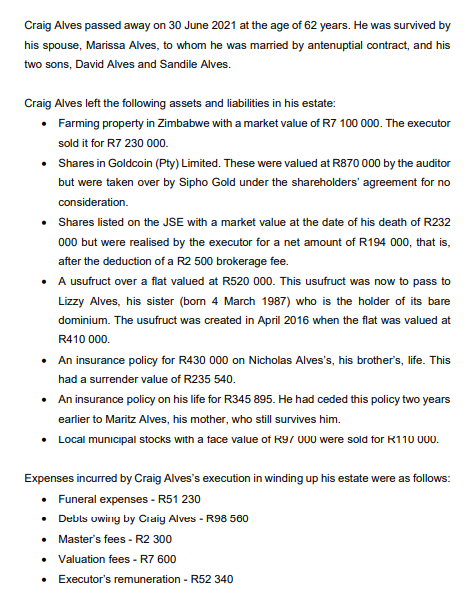

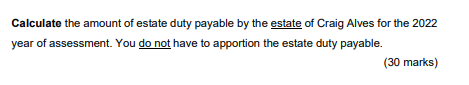

Craig Alves passed away on 30 June 2021 at the age of 62 years. He was survived by his spouse, Marissa Alves, to whom he was married by antenuptial contract, and his two sons, David Alves and Sandile Alves. Craig Alves left the following assets and liabilities in his estate: Farming property in Zimbabwe with a market value of R7 100 000. The executor sold it for R7 230 000. Shares in Goldcoin (Pty) Limited. These were valued at R870 000 by the auditor but were taken over by Sipho Gold under the shareholders' agreement for no consideration. Shares listed on the JSE with a market value at the date of his death of R232 000 but were realised by the executor for a net amount of R194 000, that is, after the deduction of a R2 500 brokerage fee. A usufruct over a flat valued at R520 000. This usufruct was now to pass to Lizzy Alves, his sister (born 4 March 1987) who is the holder of its bare dominium. The usufruct was created in April 2016 when the flat was valued at R410 000. An insurance policy for R430 000 on Nicholas Alves's, his brother's, life. This had a surrender value of R235 540. An insurance policy on his life for R345 895. He had ceded this policy two years earlier to Maritz Alves, his mother, who still survives him. Local municipal stocks with a face value of R9/ 000 were sold for R110 000. Expenses incurred by Craig Alves's execution in winding up his estate were as follows: Funeral expenses - R51 230 Debts owing by Craig Alves - R98 560 Master's fees - R2 300 Valuation fees - R7 600 Executor's remuneration - R52 340 . Calculate the amount of estate duty payable by the estate of Craig Alves for the 2022 year of assessment. You do not have to apportion the estate duty payable. (30 marks)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Estate duty payable by estate of Craig Alves R7 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started