Answered step by step

Verified Expert Solution

Question

1 Approved Answer

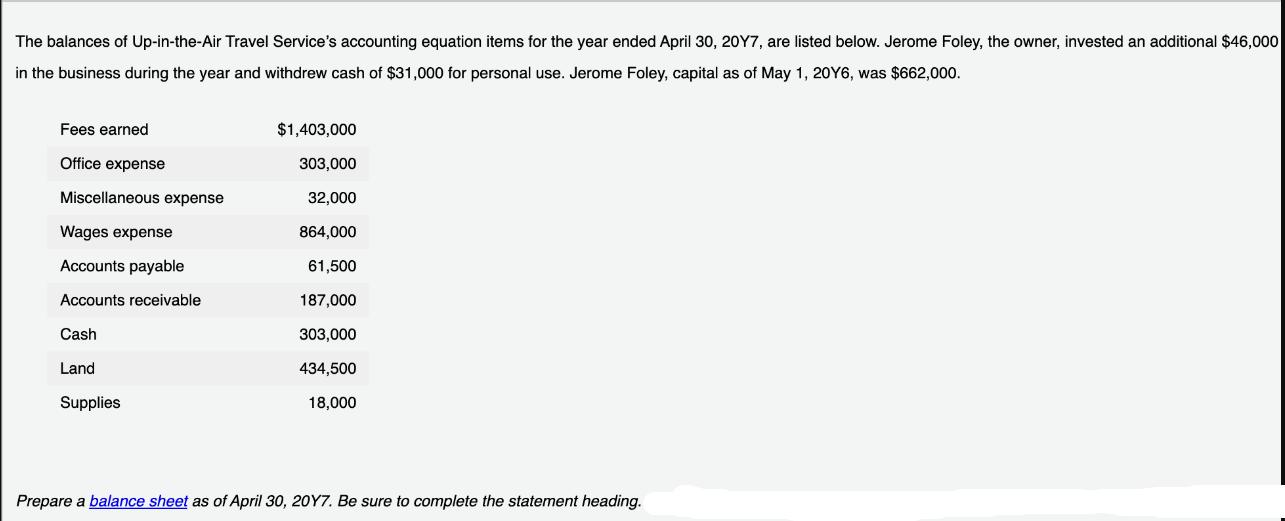

The balances of Up-in-the-Air Travel Service's accounting equation items for the year ended April 30, 20Y7, are listed below. Jerome Foley, the owner, invested

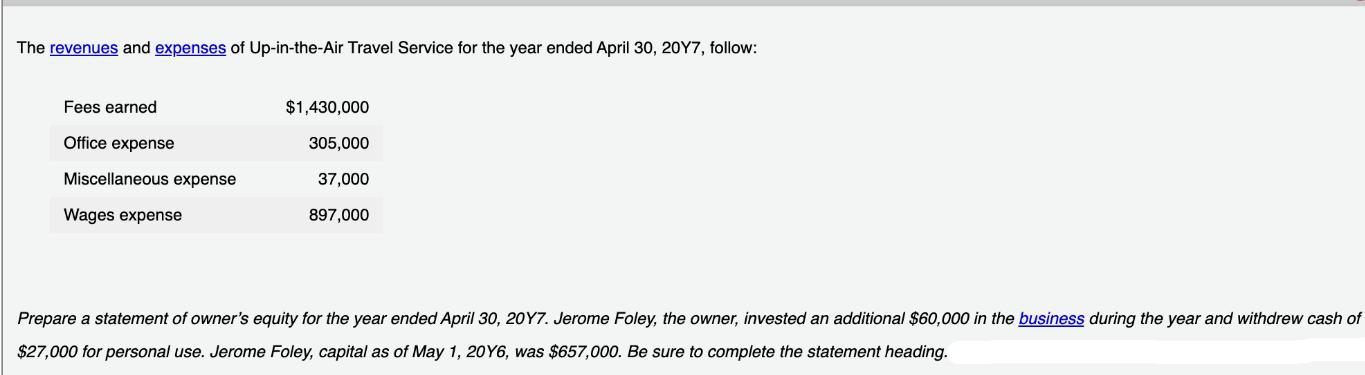

The balances of Up-in-the-Air Travel Service's accounting equation items for the year ended April 30, 20Y7, are listed below. Jerome Foley, the owner, invested an additional $46,000 in the business during the year and withdrew cash of $31,000 for personal use. Jerome Foley, capital as of May 1, 20Y6, was $662,000. Fees earned Office expense Miscellaneous expense Wages expense Accounts payable Accounts receivable Cash Land Supplies $1,403,000 303,000 32,000 864,000 61,500 187,000 303,000 434,500 18,000 Prepare a balance sheet as of April 30, 20Y7. Be sure to complete the statement heading. The revenues and expenses of Up-in-the-Air Travel Service for the year ended April 30, 20Y7, follow: Fees earned Office expense Miscellaneous expense Wages expense $1,430,000 305,000 37,000 897,000 Prepare a statement of owner's equity for the year ended April 30, 20Y7. Jerome Foley, the owner, invested an additional $60,000 in the business during the year and withdrew cash of $27,000 for personal use. Jerome Foley, capital as of May 1, 20Y6, was $657,000. Be sure to complete the statement heading.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Calculations Jerome Foley Capital as of May 1 20Y6 657000 Additional Investment during the Year 6000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started