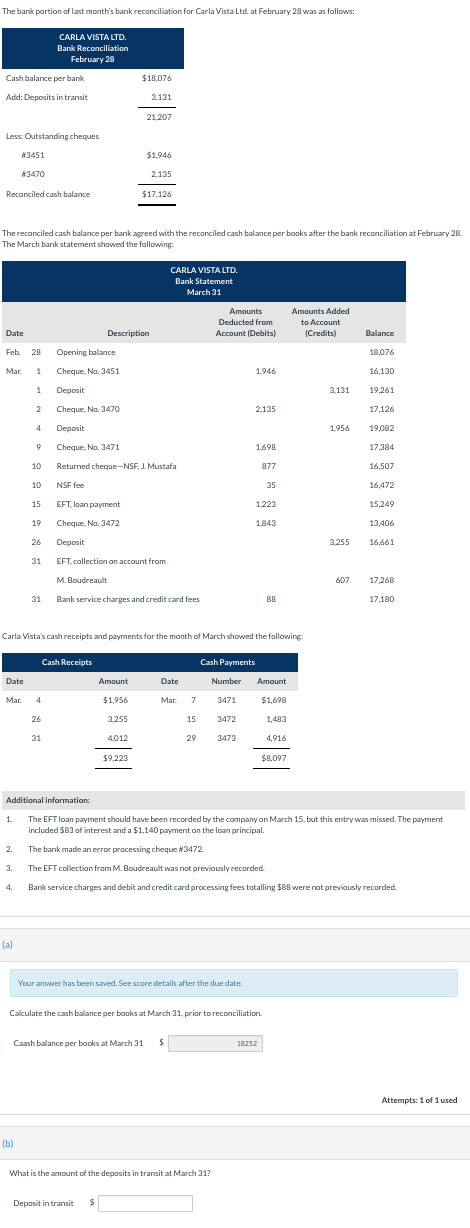

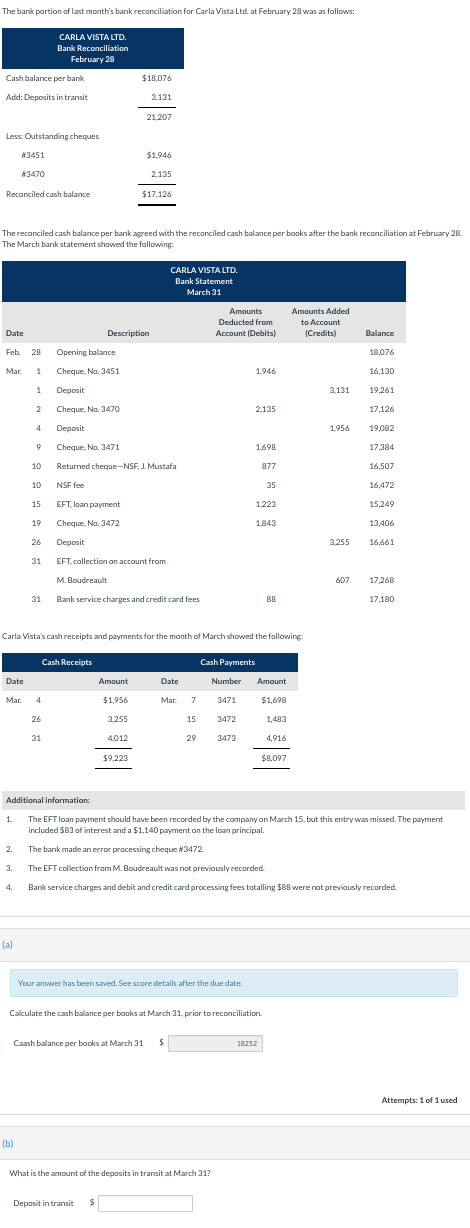

The bank portion of last month's bank reconciliation for Carla Vista Ltd. at February 28 was as follows: The reconciled cash balance per bank agreed with the reconciled cash balance per boaks after the bank reconciliation at February 2B. The March bank statement shawed the following: Carla Vista's cash receipts and payments for the month of March showed the fallowing: Additional information: 1. The EFT loan payment shauld have been recorded by the company on March 15 , but this entry was missed. The payment. included $B3 af interest and a $1,140 payment on the loan principal. 2. The bank made an error pracessing cheque #3472 3. The EFT collection fram M. Boudreault was nat previously recarded. 4. Bank service charges and debit and credit card processing fees tatalling $BB were not previously recarded. [a] Your answer has been saved. See score details after the due date. Calculate the cash balance per boaks at March 31, priar to reconciliation. Caash balance per bocks at March 31$ Attempts: 1 of 1 used (b) What is the amount of the deposits in transit at March 31 ? The bank portion of last month's bank reconciliation for Carla Vista Ltd. at February 28 was as follows: The reconciled cash balance per bank agreed with the reconciled cash balance per boaks after the bank reconciliation at February 2B. The March bank statement shawed the following: Carla Vista's cash receipts and payments for the month of March showed the fallowing: Additional information: 1. The EFT loan payment shauld have been recorded by the company on March 15 , but this entry was missed. The payment. included $B3 af interest and a $1,140 payment on the loan principal. 2. The bank made an error pracessing cheque #3472 3. The EFT collection fram M. Boudreault was nat previously recarded. 4. Bank service charges and debit and credit card processing fees tatalling $BB were not previously recarded. [a] Your answer has been saved. See score details after the due date. Calculate the cash balance per boaks at March 31, priar to reconciliation. Caash balance per bocks at March 31$ Attempts: 1 of 1 used (b) What is the amount of the deposits in transit at March 31