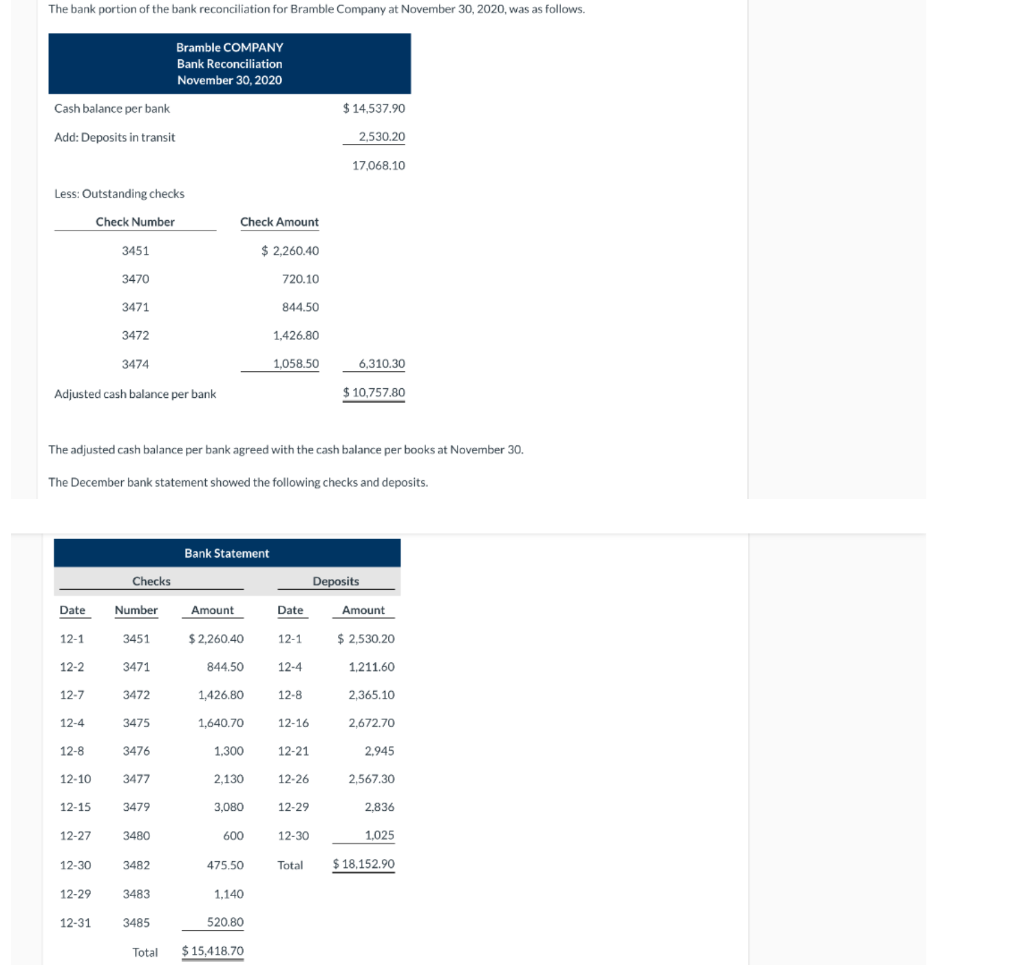

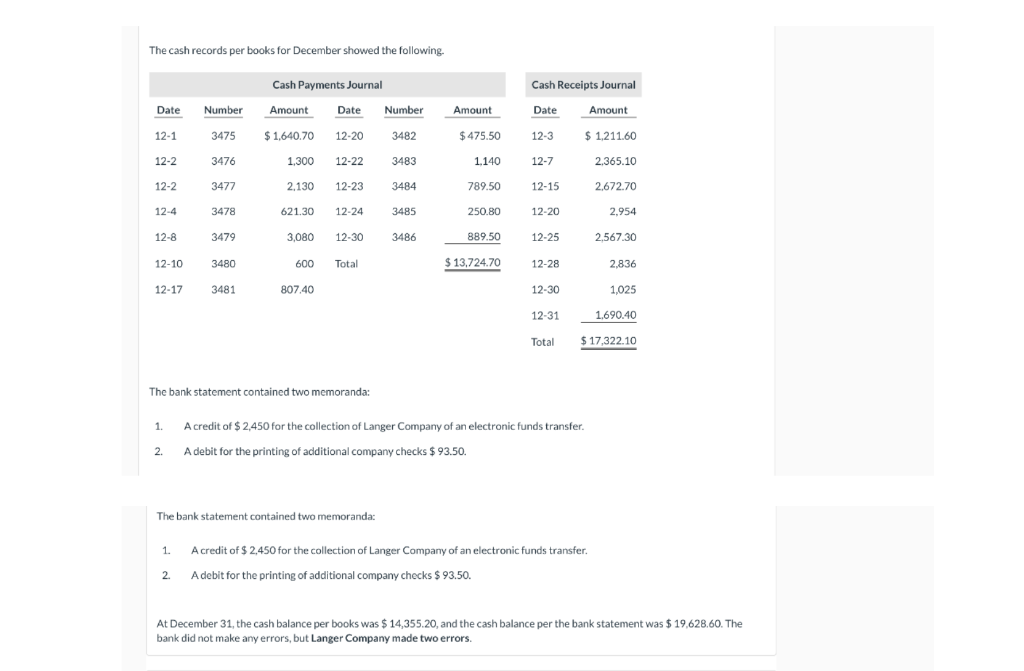

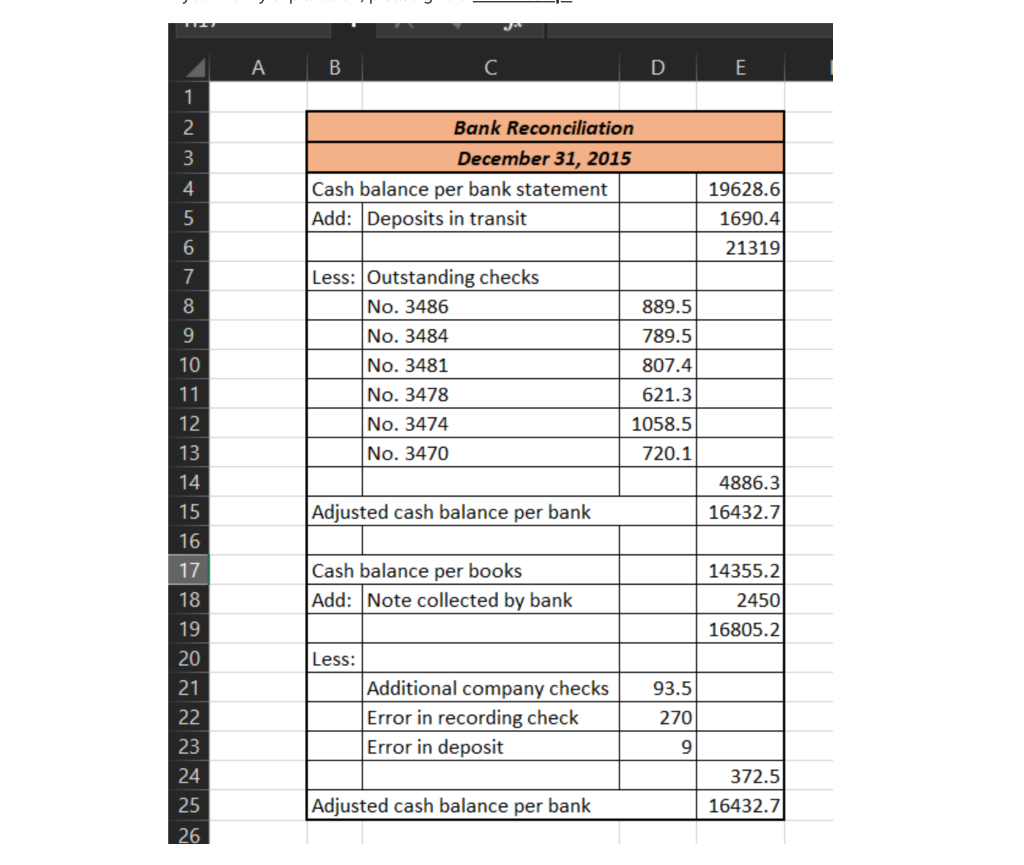

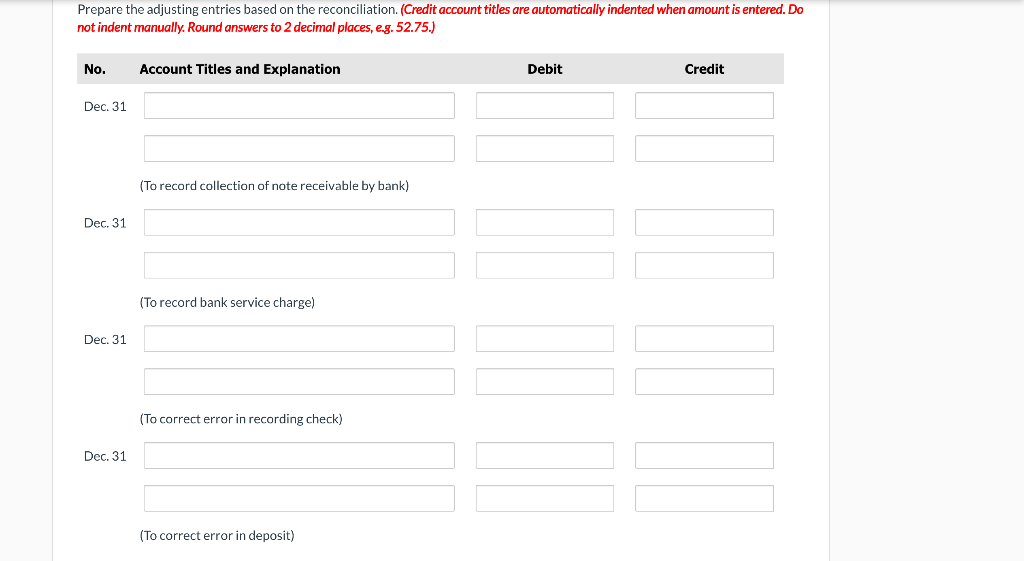

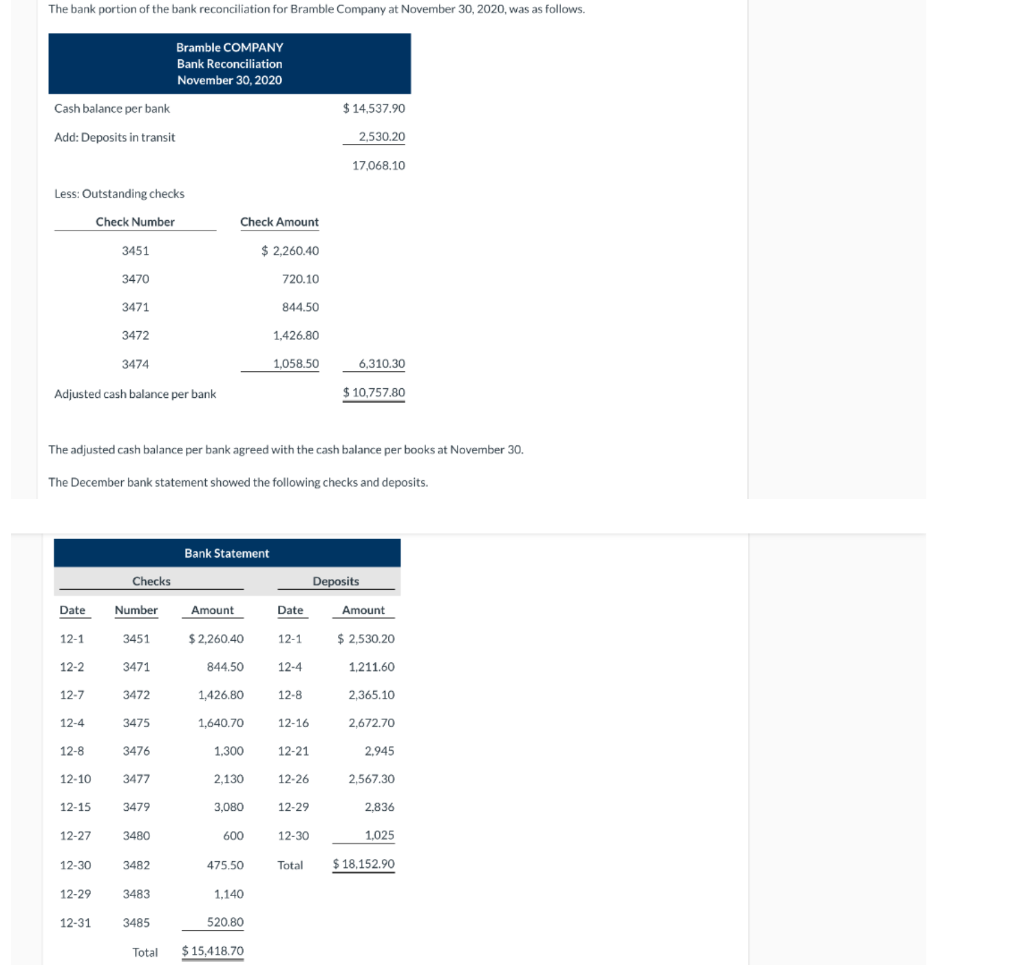

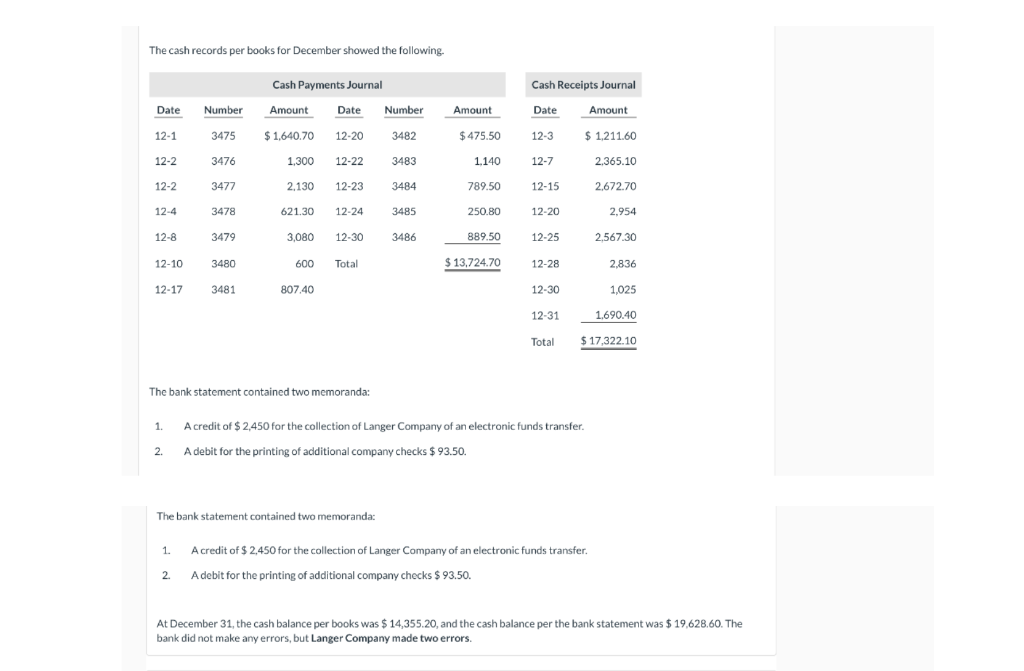

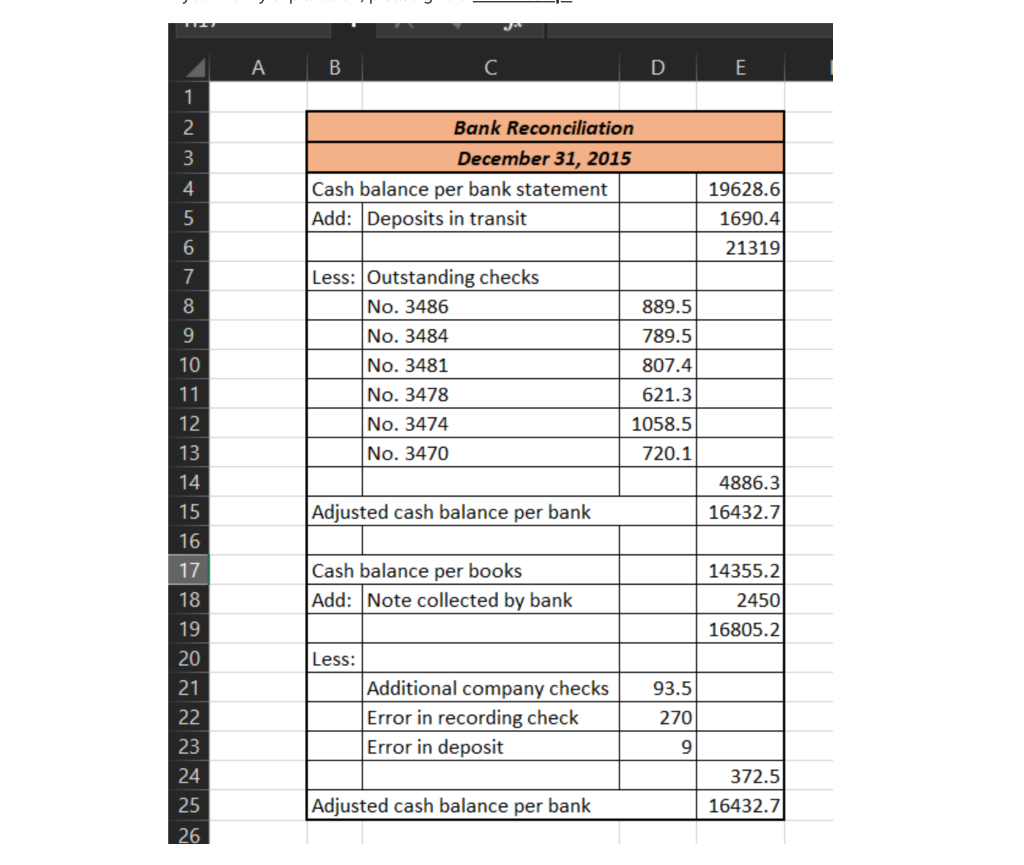

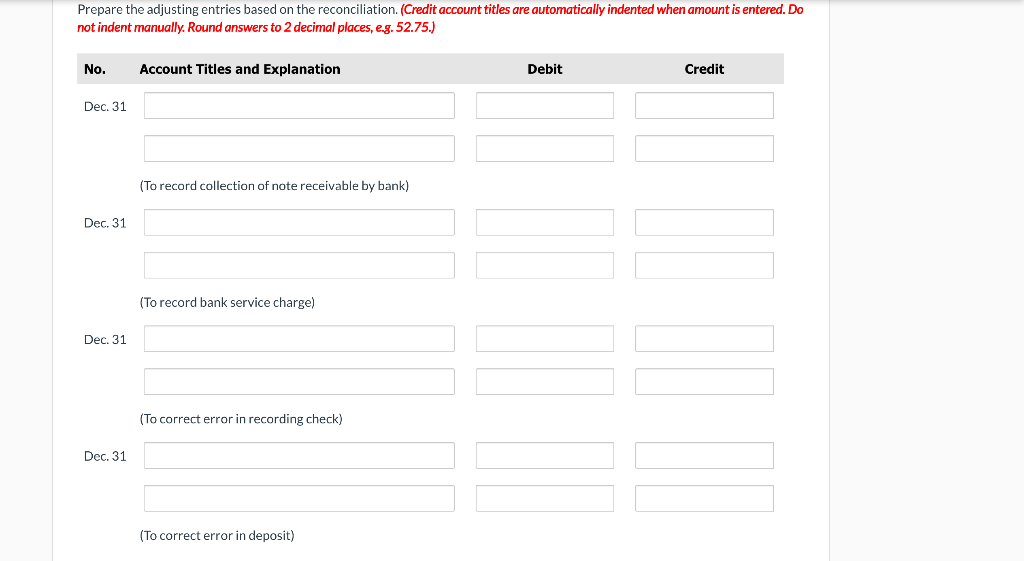

The bank portion of the bank reconciliation for Bramble Company at November 30, 2020, was as follows. Bramble COMPANY Bank Reconciliation November 30, 2020 Cash balance per bank $ 14,537.90 Add: Deposits in transit 2,530.20 17,068.10 Less: Outstanding checks Check Number Check Amount 3451 $ 2,260.40 720.10 3470 3471 844.50 3472 1,426.80 3474 1,058.50 6,310.30 Adjusted cash balance per bank $ 10,757.80 The adjusted cash balance per bank agreed with the cash balance per books at November 30. The December bank statement showed the following checks and deposits. Bank Statement Checks Deposits Date Number Amount Date Amount 12-1 3451 $ 2,260.40 12-1 $ 2,530.20 $ 12-2 3471 12-4 1,211.60 12-7 3472 844.50 1,426.80 1,640.70 12-8 12-4 3475 12-16 2,365.10 2,672.70 2.945 2,567.30 12-8 3476 1.300 12-21 12-10 3477 12-26 2,130 3,080 12-15 3479 12-29 2.836 12-27 3480 600 12-30 1,025 12-30 3482 475.50 Total $ 18,152.90 12-29 3483 1.140 12-31 3485 520.80 Total $ 15,418.70 The cash records per books for December showed the following. Cash Payments Journal Date Date Number Amount Number 3475 Cash Receipts Journal Date Amount 12-3 $ 1,211.60 Amount $ 1,640.70 1.300 12-1 12-20 3482 $475.50 12-2 3476 12-22 3483 1.140 12-7 2.365.10 12-2 3477 2.130 12-23 3484 789.50 12-15 2,672.70 12-4 3478 621.30 12-24 3485 250.80 12-20 2.954 12-8 3479 3,080 12-30 3486 889.50 12-25 2.567.30 12-10 3480 600 Total $ 13,724.70 12-28 2,836 12-17 3481 807.40 12-30 1.025 12-31 1.690.40 Total $17,322.10 The bank statement contained two memoranda: 1. A credit of $ 2,450 for the collection of Langer Company of an electronic funds transfer. 2. A debit for the printing of additional company checks $ 93.50. The bank statement contained two memoranda: 1. A credit of $ 2,450 for the collection of Langer Company of an electronic funds transfer. . 2 Adebit for the printing of additional company checks $ 93.50. A At December 31, the cash balance per books was $14,355.20, and the cash balance per the bank statement was $ 19,628.60. The $$ bank did not make any errors, but Langer Company made two errors. A B D E 1 2 3 Bank Reconciliation December 31, 2015 Cash balance per bank statement Add: Deposits in transit 4 19628.6 5 6 1690.4 21319 7 8 9 Less: Outstanding checks No. 3486 No. 3484 No. 3481 No. 3478 No. 3474 No. 3470 889.5 789.5 807.4 10 11 12 13 621.3 1058.5 720.1 14 4886.3 16432.7 Adjusted cash balance per bank Cash balance per books Add: Note collected by bank 14355.2 2450 16805.2 15 16 17 18 19 20 21 22 23 24 25 26 93.5 Less: Additional company checks Error in recording check Error in deposit 270 9 372.5 Adjusted cash balance per bank 16432.7 Prepare the adjusting entries based on the reconciliation. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.75.) No. Account Titles and Explanation Debit Credit Dec. 31 (To record collection of note receivable by bank) Dec. 31 (To record bank service charge) Dec. 31 (To correct error in recording check) Dec. 31 (To correct error in deposit)