What amount did Apple report as Other comprehensive earnings in its consolidated statement of comprehensive income ending September 30, 2017? By what percentage did Apples Comprehensive income differ from its Net income? (Round difference percentage to 1 decimal place, e.g. 15.2%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter amount in millions.)

| Other comprehensive earnings | | ? | millions |

| Difference | | ? | % |

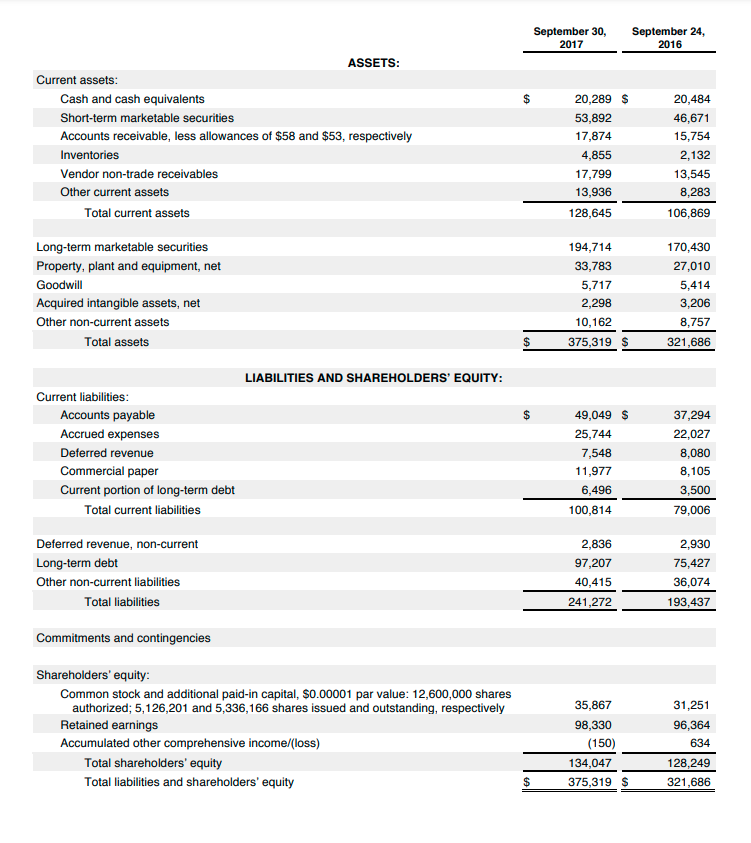

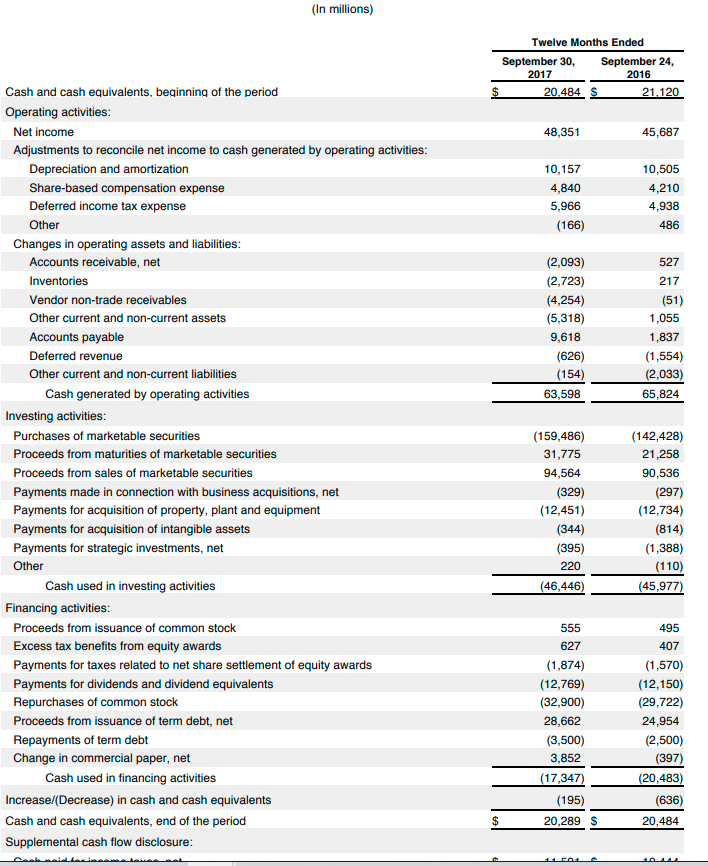

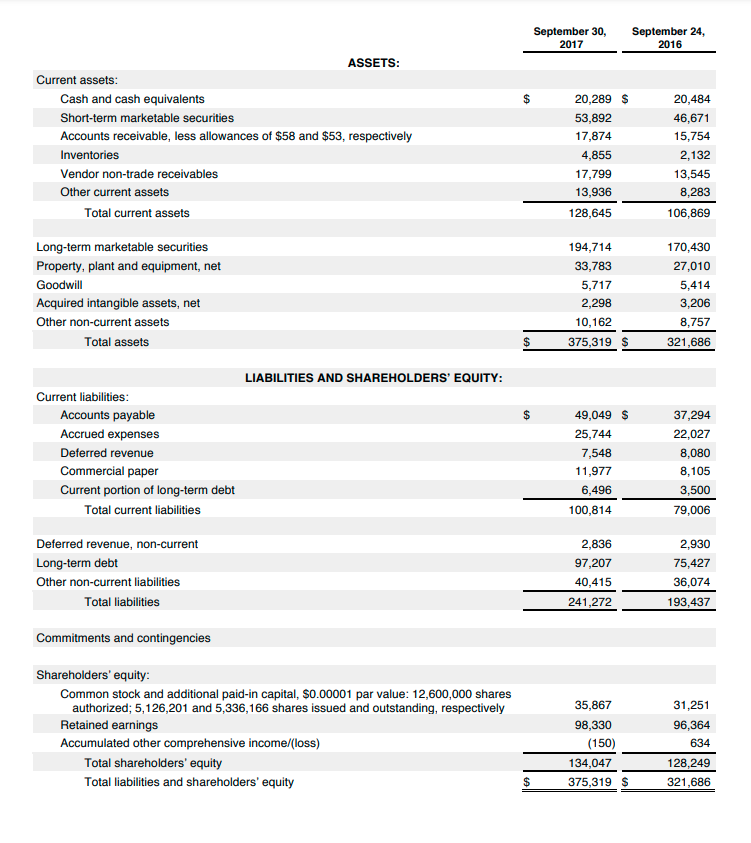

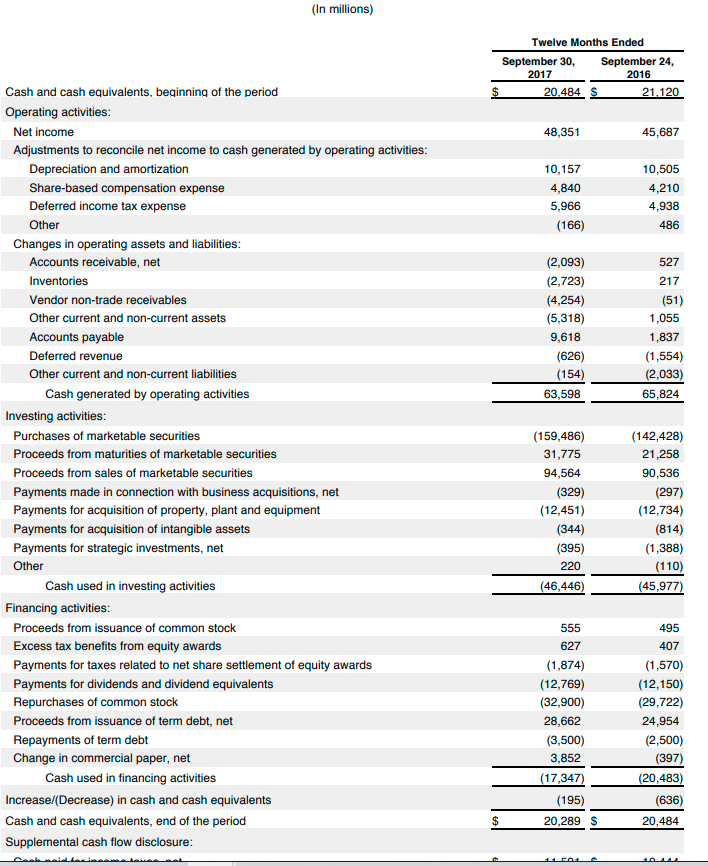

September 30, 2017 September 24, 2016 ASSETS: Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances of $58 and $53, respectively Inventories Vendor non-trade receivables Other current assets Total current assets 20,289 $ 53,892 17,874 4,855 17,799 13,936 128,645 20,484 46,671 15,754 2,132 13,545 8,283 106,869 Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other non-current assets Total assets 194,714 33,783 5,717 2,298 10,162 375,319 $ 170,430 27,010 5,414 3,206 8,757 321,686 $ LIABILITIES AND SHAREHOLDERS' EQUITY: $ Current liabilities: Accounts payable Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabilities 49,049 $ 25,744 7,548 11,977 6,496 100,814 37,294 22,027 8,080 8,105 3,500 79,006 Deferred revenue, non-current Long-term debt Other non-current liabilities Total liabilities 2,836 97,207 40,415 241,272 2,930 75,427 36,074 193,437 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 35,867 98,330 (150) 134,047 375,319 $ 31,251 96,364 634 128,249 321,686 $ (In millions) Twelve Months Ended September 30, September 24, 2017 2016 20.484 $ 21,120 48,351 45,687 10,157 4,840 5,966 (166) 10,505 4,210 4,938 486 (2,093) (2,723) (4,254) (5,318) 9,618 (626) (154) 63,598 527 217 (51) 1,055 1,837 (1,554) (2,033) 65,824 Cash and cash equivalents, beginning of the period Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments made in connection with business acquisitions, net Payments for acquisition of property, plant and equipment Payments for acquisition of intangible assets Payments for strategic investments, net Other Cash used in investing activities Financing activities: Proceeds from issuance of common stock Excess tax benefits from equity awards Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Change in commercial paper, net Cash used in financing activities Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents, end of the period Supplemental cash flow disclosure: (159,486) 31,775 94,564 (329) (12,451) (344) (395) 220 (46,446) (142,428) 21,258 90,536 (297) (12,734) (814) (1,388) (110) (45,977) 555 627 (1,874) (12,769) (32,900) 28,662 (3,500) 3,852 (17,347) 495 407 (1,570) (12,150) (29,722) 24,954 (2,500) (397) (20,483) (636) 20,484 (195) 20,289 $ $