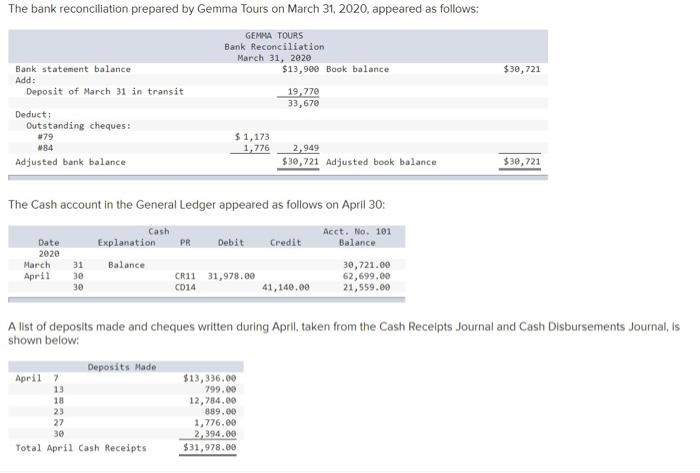

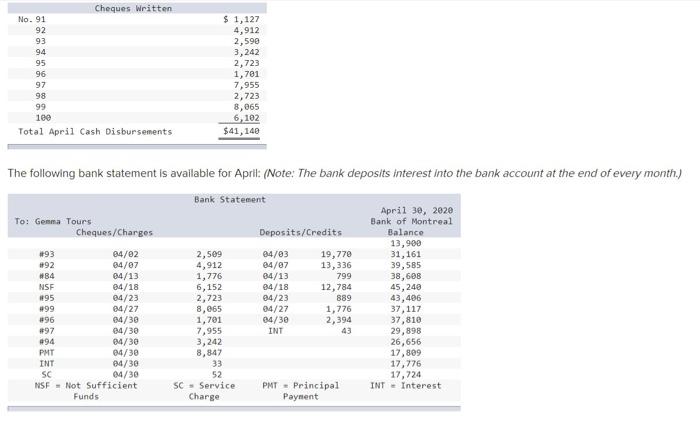

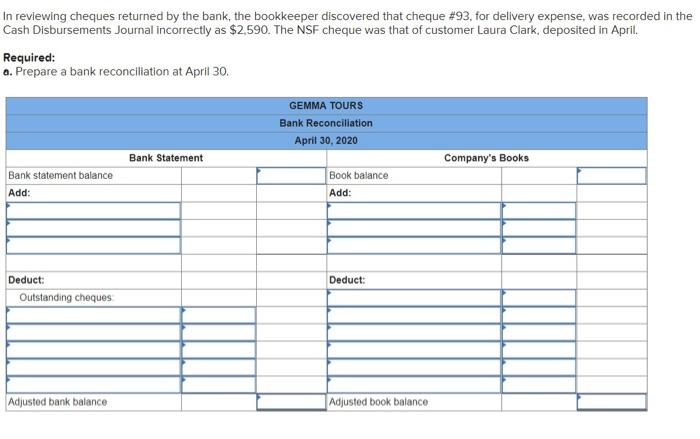

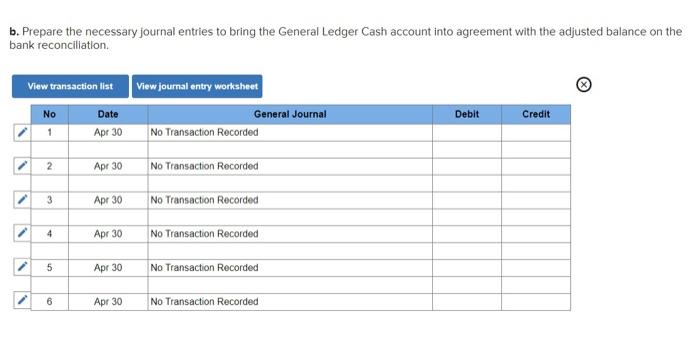

The bank reconciliation prepared by Gemma Tours on March 31, 2020, appeared as follows: GEMMA TOURS Bank Reconciliation March 31, 2020 $13,900 Book balance 19,770 33,670 $38,721 Bank statement balance Add: Deposit of March 31 in transit Deduct: Outstanding cheques : #79 284 Adjusted bank balance $ 1,173 1,776 2,949 $30,721 Adjusted book balance $30, 721 The Cash account in the General Ledger appeared as follows on April 30: Cash Explanation PR Acct. No. 10 Balance Debit Credit Date 2020 March April Balance 31 30 30 CR11 31,978.00 C014 30,721.00 62,699.00 21,559.00 41,140.00 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, Is shown below: Deposits Made April $13,336.00 13 799.00 18 12,784.00 23 889.00 27 1,776.00 30 2,394.00 Total April Cash Receipts $31,978.00 Cheques Written No. 91 92 93 94 95 96 97 98 99 180 Total April Cash Disbursements $ 1,127 4,912 2,590 3,242 2,723 1,701 7,955 2,723 8,065 6,102 $41, 140 The following bank statement is available for April: (Note: The bank deposits interest into the bank account at the end of every month.) Bank Statement April 30, 2020 To: Gemma Tours Bank of Montreal Cheques/Charges Deposits/Credits Balance 13,900 #93 04/02 2,509 04/03 19,770 31,161 #92 24/07 4,912 04/07 13,336 39,585 #84 04/13 1,776 84/13 799 38,608 NSF 84/18 6,152 84/18 12,784 45, 240 #95 04/23 2,723 04/23 889 43,406 #99 04/27 8,865 04/27 1,776 37,117 #96 04/30 1,701 04/30 2,394 37,810 #97 04/30 7,955 INT 43 29,898 294 04/30 3,242 26,656 PMT 04/30 8,847 17,809 INT 04/30 33 17,776 SC 04/30 52 17,724 NSF - Not Sufficient SC Service PMT - Principal INT - Interest Funds Charge Payment In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #93, for delivery expense, was recorded in the Cash Disbursements Journal incorrectly as $2.590. The NSF cheque was that of customer Laura Clark, deposited in April. Required: a. Prepare a bank reconciliation at April 30. GEMMA TOURS Bank Reconciliation April 30, 2020 Bank Statement Company's Books Bank statement balance Add: Book balance Add: Deduct: Deduct: Outstanding cheques Adjusted bank balance Adjusted book balance b. Prepare the necessary journal entries to bring the General Ledger Cash account into agreement with the adjusted balance on the bank reconciliation View transaction list View journal entry worksheet Debit Credit No 1 Date Apr 30 General Journal No Transaction Recorded 2 Apr 30 No Transaction Recorded 3 Apr 30 No Transaction Recorded 4 Apr 30 No Transaction Recorded 5 5 Apr 30 No Transaction Recorded 6 Apr 30 No Transaction Recorded