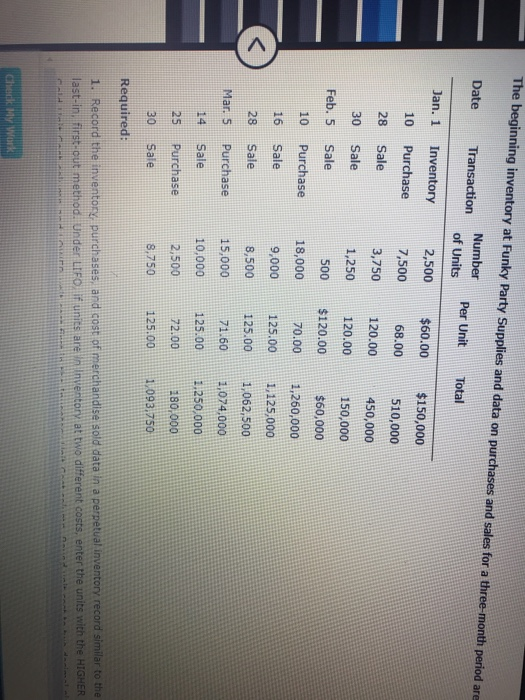

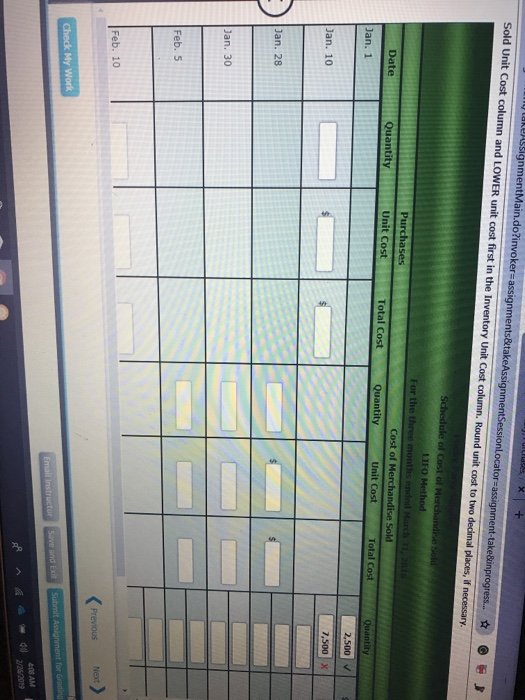

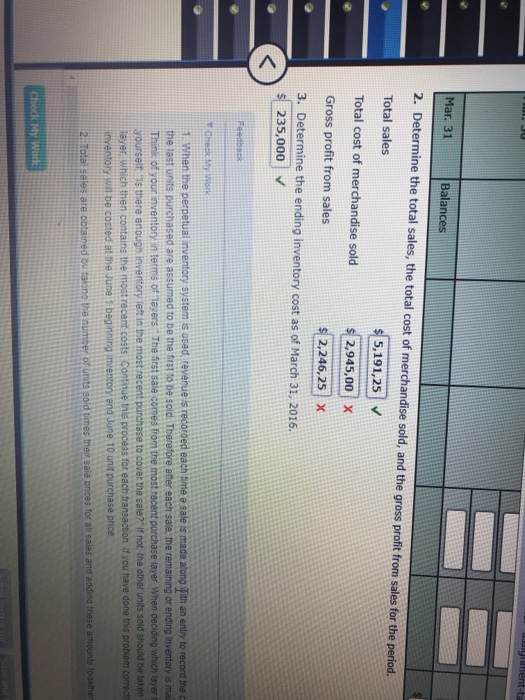

The beginning inventory at Funky Party Supplies and data on purchases and sales for a three month period Number of Units Date Transaction Per Unit Total Jan. 1 Inventory 2,500$60.00 $150,000 7,500 68.00510,000 3,750 120.00 4s0,ood 150,000 $60,000 70.00 1,260,000 9,000125.00 1,125,000 8,500 125.001,062,500 71.601,074.000 10,000 125.00.250,000 80,000 8,750 125.001093.750 10 Purchase 28 Sale 30 Sale 1,250 120.00 Feb. 5 Sale 500 $120.00 10 Purchase 16 Sale 28 Sale 18,000 Mar. 5 Purchase 15,000 14 Sale 25 Purchase 30 Sale 2,500 72.00 Required: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar last-in. firs t method. Under LIFO if units are in Inventory at two different costs, enter the units with the gnmentMain.do?invoker-assignments&itak Sold Unit Cost in the Invent Unit Cost Cost of Merchandise Sold Unit Cost Date Unit Cost Total Cost Quantity an. 1 Jan. 10 an. 28 an. 30 Feb. 5 Next Feb. 10 408 AM Mar. 31 2. Determine the total sales, the total cost of merchandise sold, and the gross profit from sales for the period. Total sales Balances 5,191,25 V Total cost of merchandise sold2945,00x Gross profit from sales 2,246,25x 3. Determine the ending inventory cost as of March 31, 2016. 235,000V t Check ty k 1 When the perpetual inventory system is used, revenue is recorded each tme a sale is made atong ith an entry to record the c the last units purchased are assumed to pe the first to be sold. Therefore atter each sale, the remaining or ending inventory is ma n. if you have done this problem correct 2i Tota sales are o The beginning inventory at Funky Party Supplies and data on purchases and sales for a three month period Number of Units Date Transaction Per Unit Total Jan. 1 Inventory 2,500$60.00 $150,000 7,500 68.00510,000 3,750 120.00 4s0,ood 150,000 $60,000 70.00 1,260,000 9,000125.00 1,125,000 8,500 125.001,062,500 71.601,074.000 10,000 125.00.250,000 80,000 8,750 125.001093.750 10 Purchase 28 Sale 30 Sale 1,250 120.00 Feb. 5 Sale 500 $120.00 10 Purchase 16 Sale 28 Sale 18,000 Mar. 5 Purchase 15,000 14 Sale 25 Purchase 30 Sale 2,500 72.00 Required: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar last-in. firs t method. Under LIFO if units are in Inventory at two different costs, enter the units with the gnmentMain.do?invoker-assignments&itak Sold Unit Cost in the Invent Unit Cost Cost of Merchandise Sold Unit Cost Date Unit Cost Total Cost Quantity an. 1 Jan. 10 an. 28 an. 30 Feb. 5 Next Feb. 10 408 AM Mar. 31 2. Determine the total sales, the total cost of merchandise sold, and the gross profit from sales for the period. Total sales Balances 5,191,25 V Total cost of merchandise sold2945,00x Gross profit from sales 2,246,25x 3. Determine the ending inventory cost as of March 31, 2016. 235,000V t Check ty k 1 When the perpetual inventory system is used, revenue is recorded each tme a sale is made atong ith an entry to record the c the last units purchased are assumed to pe the first to be sold. Therefore atter each sale, the remaining or ending inventory is ma n. if you have done this problem correct 2i Tota sales are o