Answered step by step

Verified Expert Solution

Question

1 Approved Answer

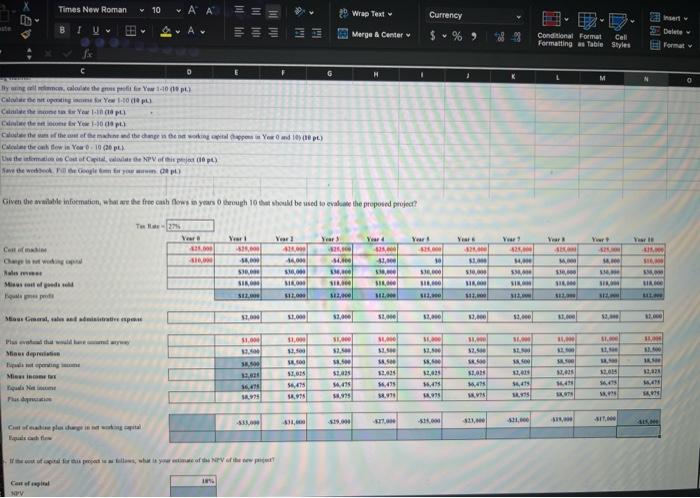

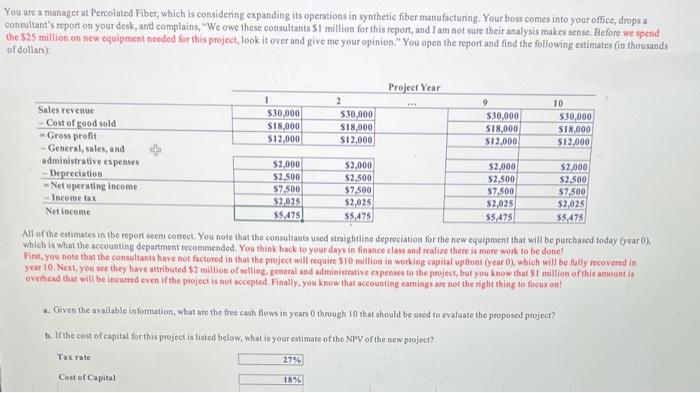

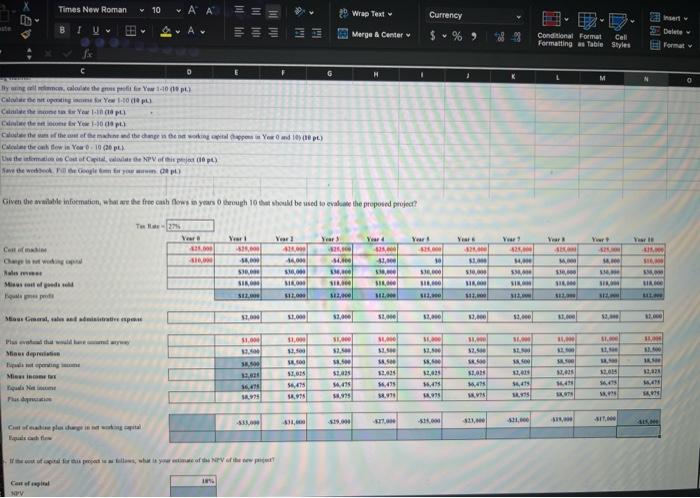

the blank cells I could not figure out, and I wanted to know if what I filled is correct. please help (1st image is info

the blank cells I could not figure out, and I wanted to know if what I filled is correct. please help (1st image is info made to solve the second image)

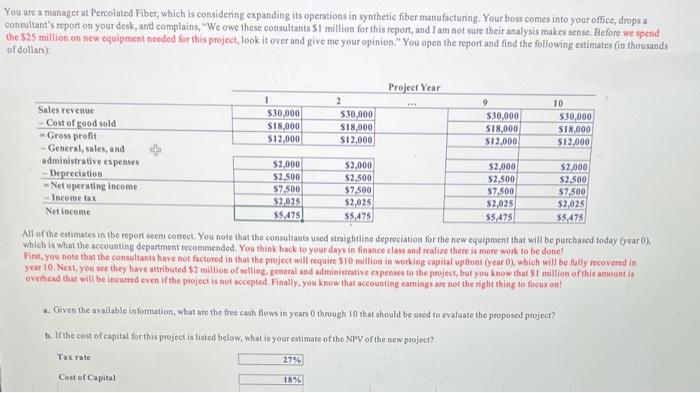

You are a manager at Percolated Fiber, which is considering expanding its openations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $ million for this report, and I am not sure their analysis makes sense. Before we ipend the 525 miltion on new equipment needed for this projeet, look it over and give me your opinion." You open the report and find the following estimates (in thousands of dolfani): All of the evimates in the report ieem correct. You note that the consultants used straightline depreciation for the new equipment that will be purehased today (year 0 . Which is what the accounting depastment recommended. You think hack to your days in finance elass and realize theee is more work to be done! Fins, you note that the consultants bave not factored in that the project will requiee $10 million in workieg capital upfront (year o), which will be fully recovered in yeat 10, Next, you see they have attributed $2 million of welling, general abd attrinistrative expenses to the peoject, but you know that $1 millioe of this amount is overtiead that will be incurred even if the project is not accepted. Finally, you know that accounting earningt are not the right thing to focus on! a. Given the available information, what ate the free cash flow in years 0 through 10 that should be used to evafuate the groposed ptoject? b. If the cost of eapital for this preject is liated thelow, what is your ettimate of the NPV of the new projeet? Tax rate Cost of Capital Calcelet the cowb thew in Year 0 i 19(20pL)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started