Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The board of Clapton Ltd (Clapton) are considering the following non-cash remuneration-based options for its executive committee members: 1 Issuing 1,000 shares to each

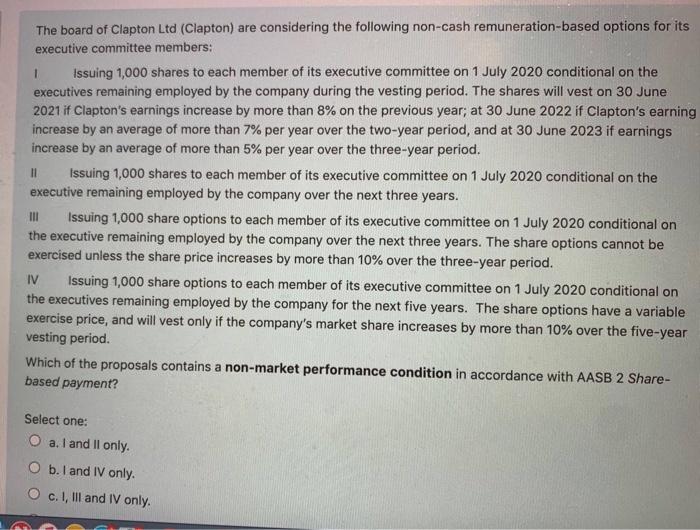

The board of Clapton Ltd (Clapton) are considering the following non-cash remuneration-based options for its executive committee members: 1 Issuing 1,000 shares to each member of its executive committee on 1 July 2020 conditional on the executives remaining employed by the company during the vesting period. The shares will vest on 30 June 2021 if Clapton's earnings increase by more than 8% on the previous year; at 30 June 2022 if Clapton's earning increase by an average of more than 7% per year over the two-year period, and at 30 June 2023 if earnings increase by an average of more than 5% per year over the three-year period. Issuing 1,000 shares to each member of its executive committee on 1 July 2020 conditional on the executive remaining employed by the company over the next three years. 11 III Issuing 1,000 share options to each member of its executive committee on 1 July 2020 conditional on the executive remaining employed by the company over the next three years. The share options cannot be exercised unless the share price increases by more than 10% over the three-year period. IV Issuing 1,000 share options to each member of its executive committee on 1 July 2020 conditional on the executives remaining employed by the company for the next five years. The share options have a variable exercise price, and will vest only if the company's market share increases by more than 10% over the five-year vesting period. Which of the proposals contains a non-market performance condition in accordance with AASB 2 Share- based payment? Select one: O a. I and II only. O b. I and IV only. O c. I, III and IV only.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The proposal that cont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started