The Board of Directors (BOD) of Mayu Sdn Bhd are concerned of their profits during this pandemic and the Finance Manager, Michael Lee has assigned you to prepare a detail working for supporting document to the BOD. There are a few options and he wanted you to prepare the workings for these proposals. No recommendation and analysis are to be made. The forecast of 31 October 2021 is as follows:

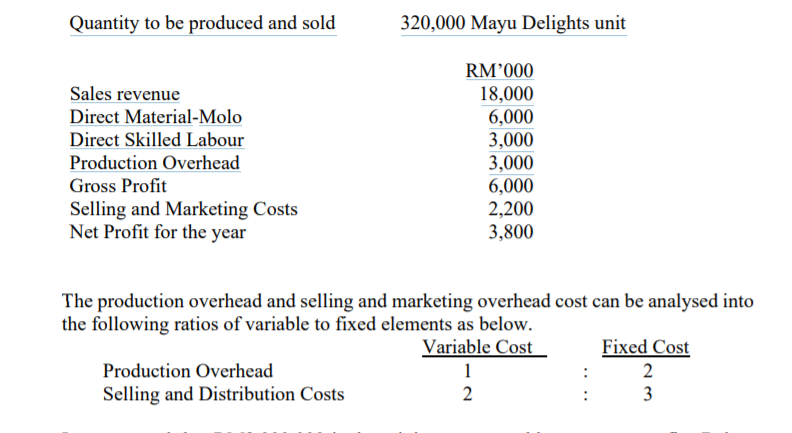

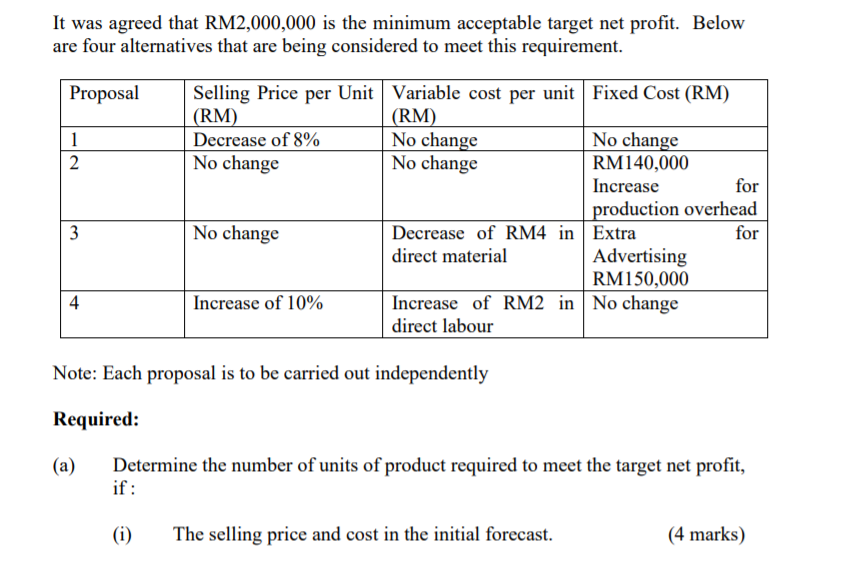

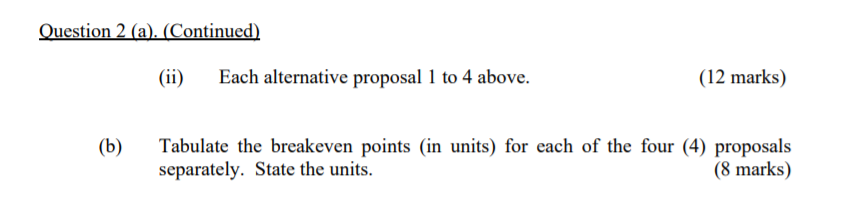

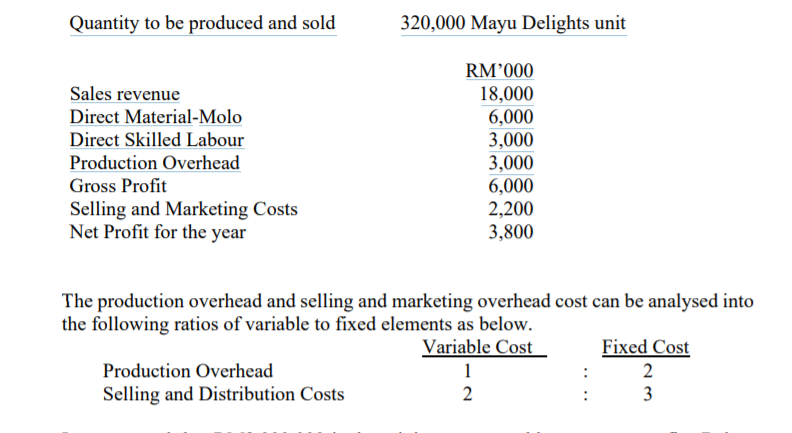

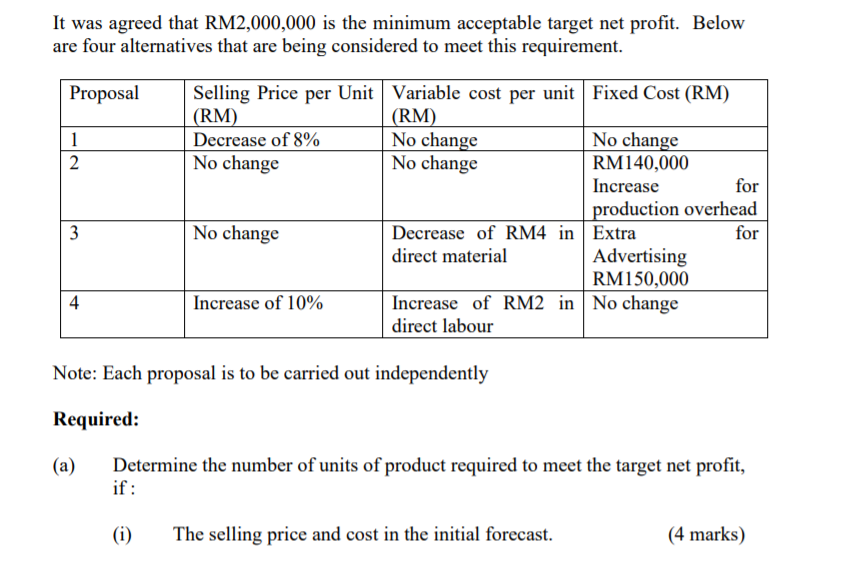

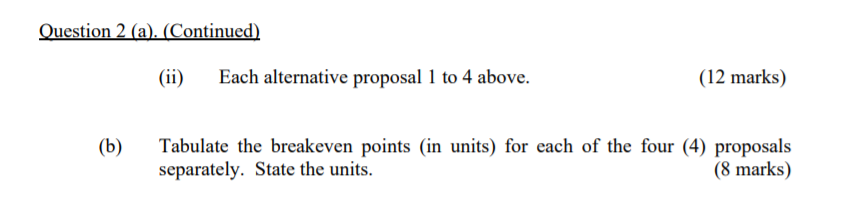

Quantity to be produced and sold 320,000 Mayu Delights unit Sales revenue Direct Material-Molo Direct Skilled Labour Production Overhead Gross Profit Selling and Marketing Costs Net Profit for the year RM000 18,000 6,000 3,000 3,000 6,000 2,200 3,800 The production overhead and selling and marketing overhead cost can be analysed into the following ratios of variable to fixed elements as below. Variable Cost Fixed Cost Production Overhead 1 2 Selling and Distribution Costs 2 3 It was agreed that RM2,000,000 is the minimum acceptable target net profit. Below are four alternatives that are being considered to meet this requirement. Proposal 1 2 Selling Price per Unit Variable cost per unit Fixed Cost (RM) (RM) (RM) Decrease of 8% No change No change No change No change RM140,000 Increase for production overhead No change Decrease of RM4 in Extra direct material Advertising RM150,000 Increase of 10% Increase of RM2 in No change direct labour 3 for 4 Note: Each proposal is to be carried out independently Required: (a) Determine the number of units of product required to meet the target net profit, if : (i) The selling price and cost in the initial forecast. (4 marks) Question 2 (a). (Continued) (ii) Each alternative proposal 1 to 4 above. (12 marks) (b) Tabulate the breakeven points (in units) for each of the four (4) proposals separately. State the units. (8 marks) Quantity to be produced and sold 320,000 Mayu Delights unit Sales revenue Direct Material-Molo Direct Skilled Labour Production Overhead Gross Profit Selling and Marketing Costs Net Profit for the year RM000 18,000 6,000 3,000 3,000 6,000 2,200 3,800 The production overhead and selling and marketing overhead cost can be analysed into the following ratios of variable to fixed elements as below. Variable Cost Fixed Cost Production Overhead 1 2 Selling and Distribution Costs 2 3 It was agreed that RM2,000,000 is the minimum acceptable target net profit. Below are four alternatives that are being considered to meet this requirement. Proposal 1 2 Selling Price per Unit Variable cost per unit Fixed Cost (RM) (RM) (RM) Decrease of 8% No change No change No change No change RM140,000 Increase for production overhead No change Decrease of RM4 in Extra direct material Advertising RM150,000 Increase of 10% Increase of RM2 in No change direct labour 3 for 4 Note: Each proposal is to be carried out independently Required: (a) Determine the number of units of product required to meet the target net profit, if : (i) The selling price and cost in the initial forecast. (4 marks) Question 2 (a). (Continued) (ii) Each alternative proposal 1 to 4 above. (12 marks) (b) Tabulate the breakeven points (in units) for each of the four (4) proposals separately. State the units. (8 marks)