Answered step by step

Verified Expert Solution

Question

1 Approved Answer

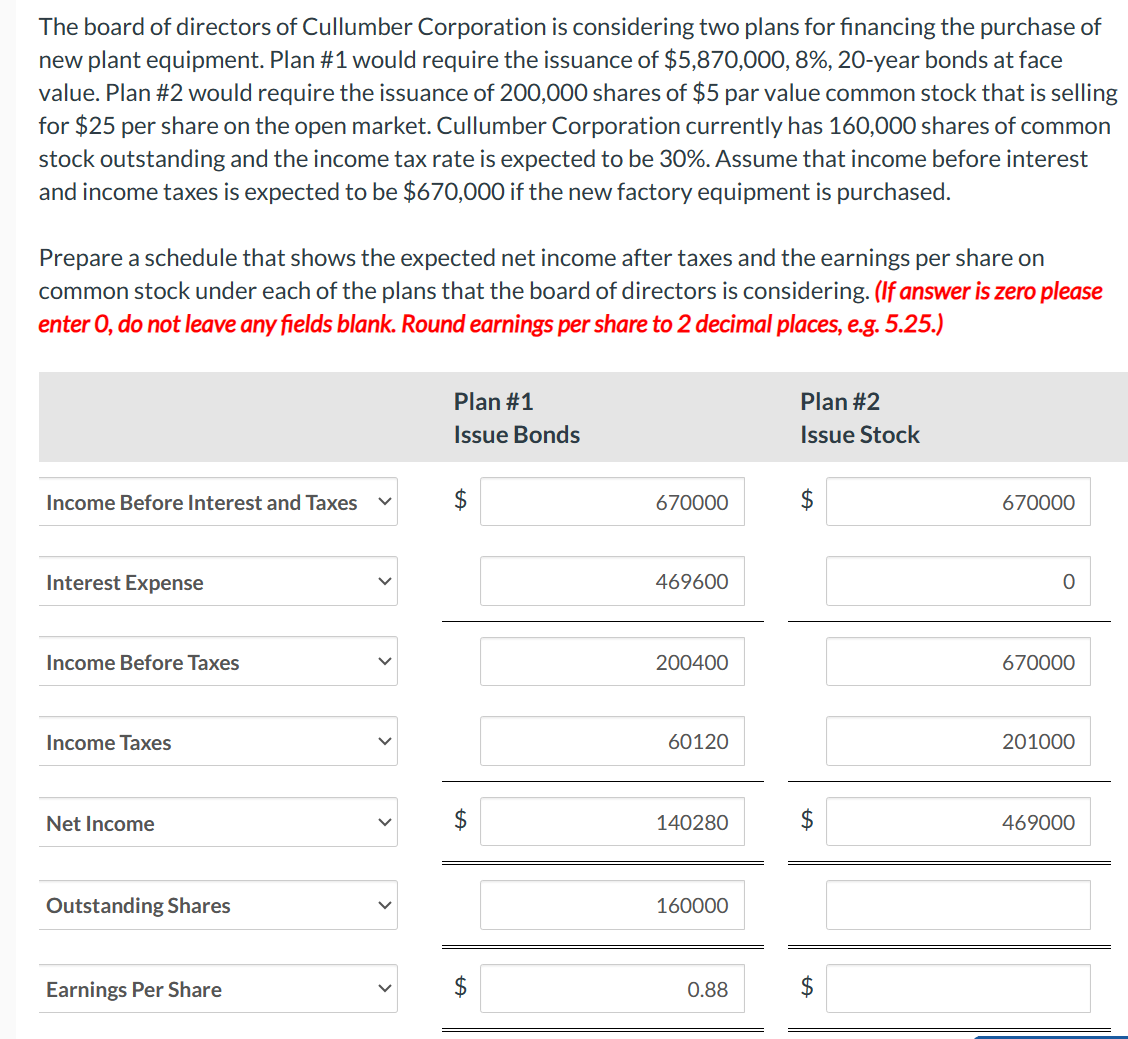

The board of directors of Cullumber Corporation is considering two plans for financing the purchase of new plant equipment. Plan # 1 would require the

The board of directors of Cullumber Corporation is considering two plans for financing the purchase of

new plant equipment. Plan # would require the issuance of $year bonds at face

value. Plan # would require the issuance of shares of $ par value common stock that is selling

for $ per share on the open market. Cullumber Corporation currently has shares of common

stock outstanding and the income tax rate is expected to be Assume that income before interest

and income taxes is expected to be $ if the new factory equipment is purchased.

Prepare a schedule that shows the expected net income after taxes and the earnings per share on

common stock under each of the plans that the board of directors is considering. If answer is zero please

enter do not leave any fields blank. Round earnings per share to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started