Answered step by step

Verified Expert Solution

Question

1 Approved Answer

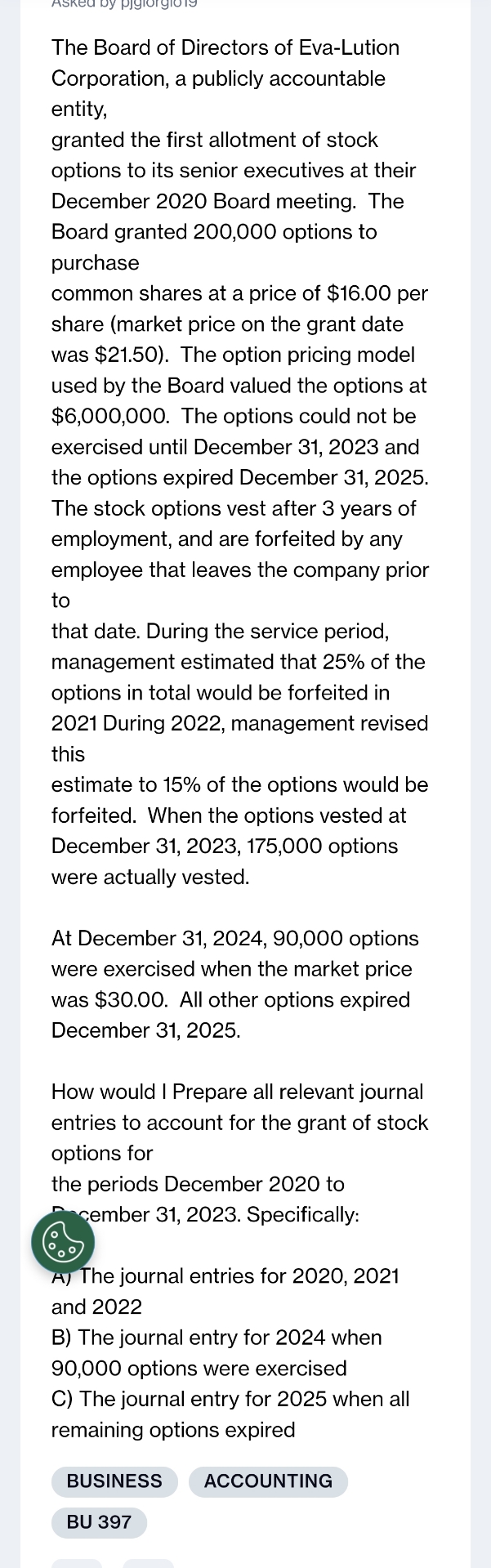

The Board of Directors of Eva - Lution Corporation, a publicly accountable entity, granted the first allotment of stock options to its senior executives at

The Board of Directors of EvaLution Corporation, a publicly accountable entity, granted the first allotment of stock options to its senior executives at their December Board meeting. The Board granted options to purchase common shares at a price of $ per share market price on the grant date was $ The option pricing model used by the Board valued the options at $ The options could not be exercised until December and the options expired December The stock options vest after years of employment, and are forfeited by any employee that leaves the company prior to

that date. During the service period, management estimated that of the options in total would be forfeited in During management revised this estimate to of the options would be forfeited. When the options vested at December options were actually vested.

At December options were exercised when the market price was $ All other options expired December

How would I Prepare all relevant journal entries to account for the grant of stock options for the periods December to

A The journal entries for and

B The journal entry for when options were exercised

C The journal entry for when all remaining options expired

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started