Question

The board of directors of Southeast Co. is considering seven large capital investments. Each investment can be made only once. These investments differ in the

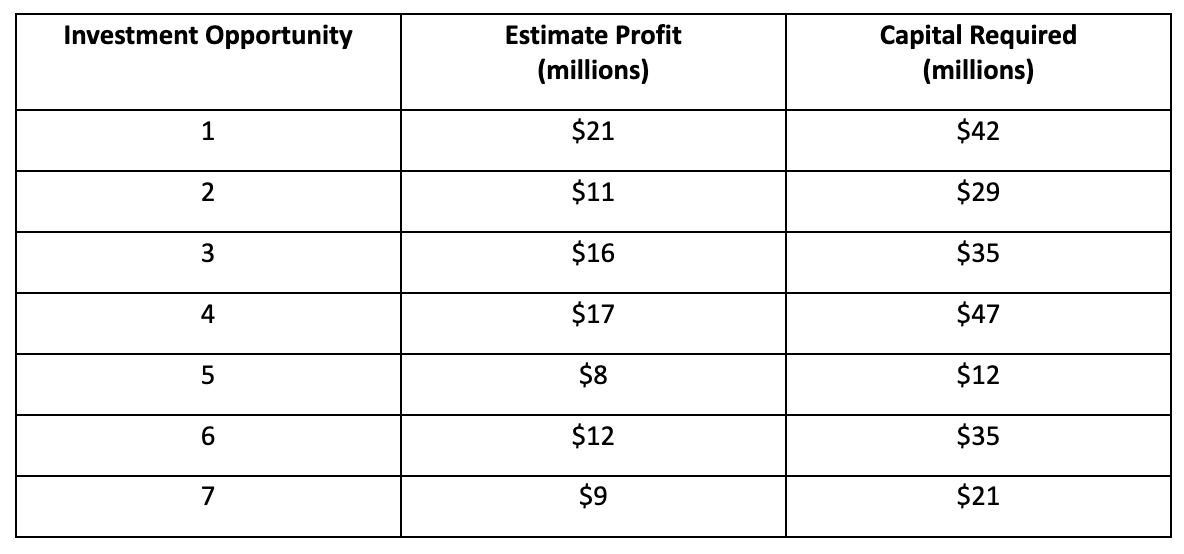

The board of directors of Southeast Co. is considering seven large capital investments. Each investment can be made only once. These investments differ in the estimated long-run profit (net present value) that they will generate as well as in the amount of capital required, as shown by the following table.

The total amount of capital available for these investments is $120 million. Investment opportunities 1 and 2 are mutually exclusive, and so are 5 and 6. Furthermore, neither 5 nor 6 can be undertaken unless at least one of the first three opportunities is undertaken. The objective is to select the combination of capital investments that will maximize the total estimated long-run profit (net present value).

Formulate and solve the binary programming model that will provide the optimal solution. Describe the optimal solution (i.e., which opportunities should be invested in and what is the total estimated long-run profit?). What are the binding constraints?

\begin{tabular}{|c|c|c|} \hline Investment Opportunity & EstimateProfit(millions) & CapitalRequired(millions) \\ \hline 1 & $21 & $42 \\ \hline 2 & $11 & $29 \\ \hline 3 & $16 & $35 \\ \hline 4 & $17 & $12 \\ \hline 5 & $8 & $35 \\ \hline 6 & $12 & $21 \\ \hline 7 & $9 & $47 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started