Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Brokerage House is designing an investment fund for people who wish to exclusively invest their resources in securities issued, guaranteed or accepted by

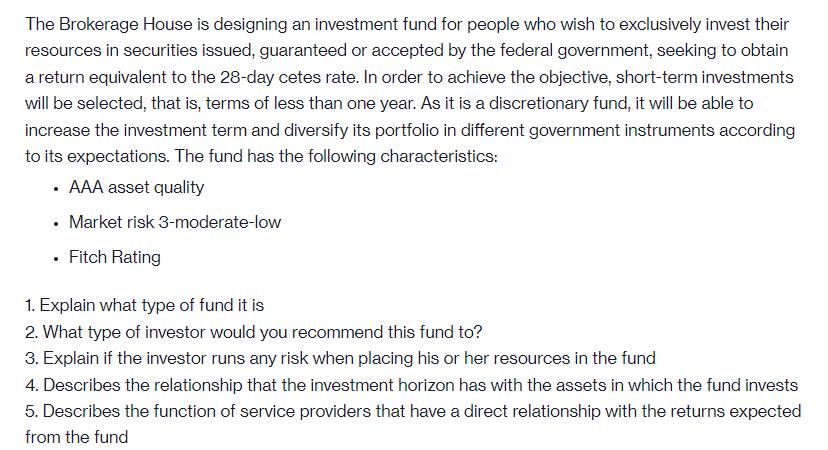

The Brokerage House is designing an investment fund for people who wish to exclusively invest their resources in securities issued, guaranteed or accepted by the federal government, seeking to obtain a return equivalent to the 28-day cetes rate. In order to achieve the objective, short-term investments will be selected, that is, terms of less than one year. As it is a discretionary fund, it will be able to increase the investment term and diversify its portfolio in different government instruments according to its expectations. The fund has the following characteristics: AAA asset quality Market risk 3-moderate-low Fitch Rating . . 1. Explain what type of fund it is 2. What type of investor would you recommend this fund to? 3. Explain if the investor runs any risk when placing his or her resources in the fund 4. Describes the relationship that the investment horizon has with the assets in which the fund invests 5. Describes the function of service providers that have a direct relationship with the returns expected from the fund

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Type of Fund This fund is a fixedincome investment fund that primarily focuses on shortterm government securities with a target return equivalent to the 28day Cetes rate It is designed to provide inve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started