Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Buckeye Reservoir Beach Manufacturing Company produces a basic product that is modified to the needs of each customer. The modified product can have

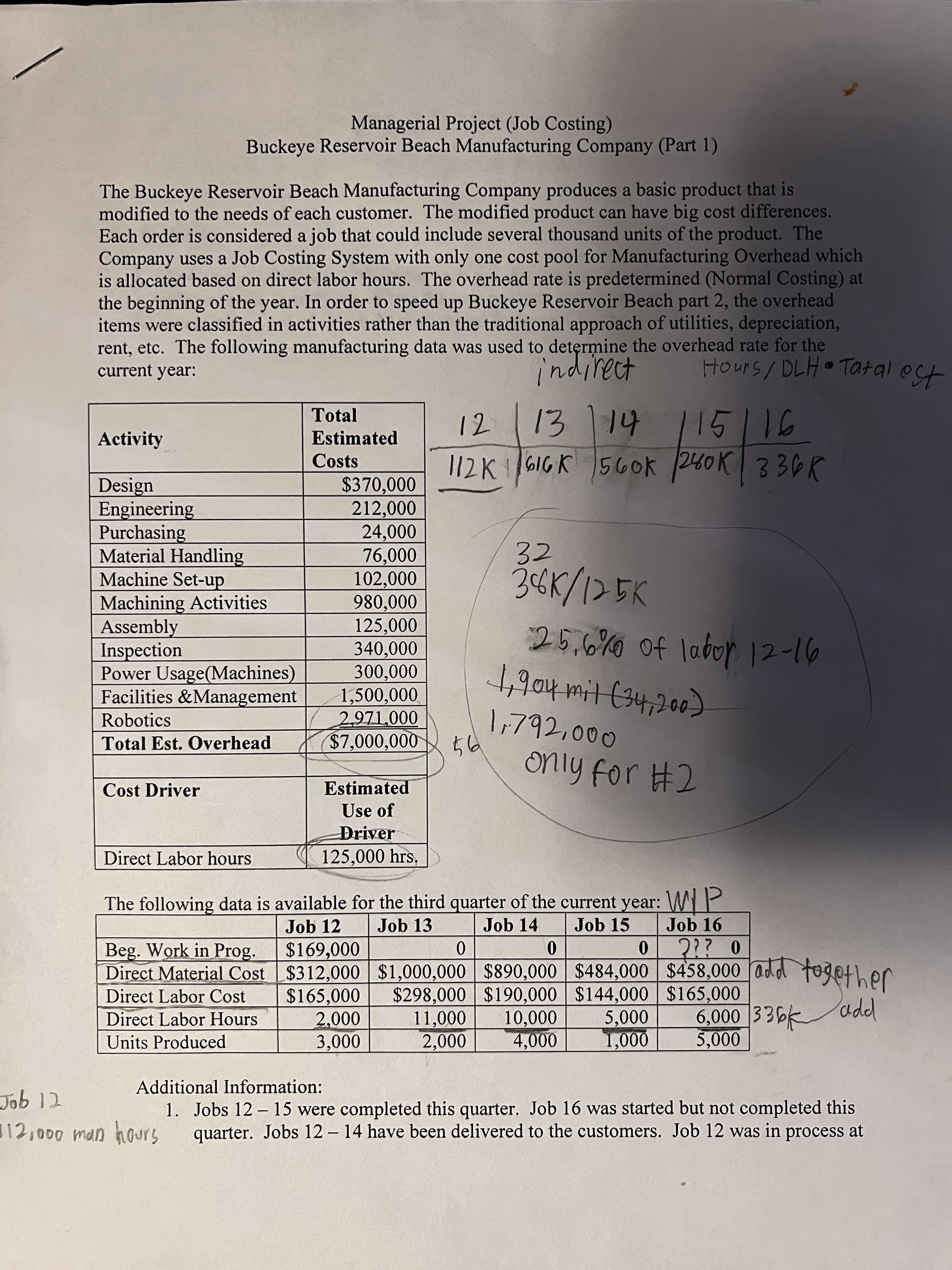

The Buckeye Reservoir Beach Manufacturing Company produces a basic product that is modified to the needs of each customer. The modified product can have big cost differences. Each order is considered a job that could include several thousand units of the product. The Company uses a Job Costing System with only one cost pool for Manufacturing Overhead which is allocated based on direct labor hours. The overhead rate is predetermined (Normal Costing) at the beginning of the year. In order to speed up Buckeye Reservoir Beach part 2, the overhead items were classified in activities rather than the traditional approach of utilities, depreciation, rent, etc. The following manufacturing data was used to determine the overhead rate for the current year: indirect Activity Design Engineering Purchasing Material Handling Machine Set-up Managerial Project (Job Costing) Buckeye Reservoir Beach Manufacturing Company (Part 1) Machining Activities Assembly Inspection Power Usage(Machines) Facilities & Management Robotics Total Est. Overhead Cost Driver Direct Labor Hours Units Produced Total Estimated Costs Job 12 312,000 man hours $370,000 212,000 24,000 76,000 102,000 980,000 125,000 340,000 300,000 1,500,000 2,971,000 $7,000,000 Estimated Use of Driver 125,000 hrs. Hours/ DLH Tatal est 12 13 14 15/16 112K 616K 560K 280K 336K 4,6 Direct Labor hours The following data is available for the third quarter of the current year: W/P Job 13 Job 14 Job 15 Job 16 Job 12 $169,000 Beg. Work in Prog. 0 0 0 ??? 0 Direct Material Cost $312,000 $1,000,000 $890,000 $484,000 $458,000 add together Direct Labor Cost $298,000 $190,000 $144,000 $165,000 $165,000 2,000 11,000 3,000 2,000 32 38K/125K 25.6% of labor 12-16 1,904 mil (34,200) 1,792,000 only for #2 10,000 4,000 5,000 1,000 6,000 336 add 5,000 Additional Information: 1. Jobs 12 - 15 were completed this quarter. Job 16 was started but not completed this quarter. Jobs 12-14 have been delivered to the customers. Job 12 was in process at the beginning of the quarter and was included in last year's inventory at a cost of $169,000 as shown above. 2. Round to the nearest dollar on Financial Statements and to the nearest cent on per unit calculations. Requirements: 1. Complete a Job Costing Sheet for each job showing the detailed amount of direct and indirect costs in each job. Show the cost per unit within each job. Complete a Cost of Goods Manufactured Statement for the period. 2. The Buckeye Reservoir Beach Manufacturing Company produces a basic product that is modified to the needs of each customer. The modified product can have big cost differences. Each order is considered a job that could include several thousand units of the product. The Company uses a Job Costing System with only one cost pool for Manufacturing Overhead which is allocated based on direct labor hours. The overhead rate is predetermined (Normal Costing) at the beginning of the year. In order to speed up Buckeye Reservoir Beach part 2, the overhead items were classified in activities rather than the traditional approach of utilities, depreciation, rent, etc. The following manufacturing data was used to determine the overhead rate for the current year: indirect Activity Design Engineering Purchasing Material Handling Machine Set-up Managerial Project (Job Costing) Buckeye Reservoir Beach Manufacturing Company (Part 1) Machining Activities Assembly Inspection Power Usage(Machines) Facilities & Management Robotics Total Est. Overhead Cost Driver Direct Labor Hours Units Produced Total Estimated Costs Job 12 312,000 man hours $370,000 212,000 24,000 76,000 102,000 980,000 125,000 340,000 300,000 1,500,000 2,971,000 $7,000,000 Estimated Use of Driver 125,000 hrs. Hours/ DLH Tatal est 12 13 14 15/16 112K 616K 560K 280K 336K 4,6 Direct Labor hours The following data is available for the third quarter of the current year: W/P Job 13 Job 14 Job 15 Job 16 Job 12 $169,000 Beg. Work in Prog. 0 0 0 ??? 0 Direct Material Cost $312,000 $1,000,000 $890,000 $484,000 $458,000 add together Direct Labor Cost $298,000 $190,000 $144,000 $165,000 $165,000 2,000 11,000 3,000 2,000 32 38K/125K 25.6% of labor 12-16 1,904 mil (34,200) 1,792,000 only for #2 10,000 4,000 5,000 1,000 6,000 336 add 5,000 Additional Information: 1. Jobs 12-15 were completed this quarter. Job 16 was started but not completed this quarter. Jobs 12 - 14 have been delivered to the customers. Job 12 was in process at the beginning of the quarter and was included in last year's inventory at a cost of $169,000 as shown above. 2. Round to the nearest dollar on Financial Statements and to the nearest cent on per unit calculations. Requirements: 1. Complete a Job Costing Sheet for each job showing the detailed amount of direct and indirect costs in each job. Show the cost per unit within each job. Complete a Cost of Goods Manufactured Statement for the period. 2.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To address the requirements described in these images lets proceed step by step Firstly we will calculate the predetermined overhead rate POR which is necessary for assigning manufacturing overhead co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started