Question

The budget committee of Clipboard Office Supply has assembled the following data. As the business manager, you must prepare the budgeted income statements for May

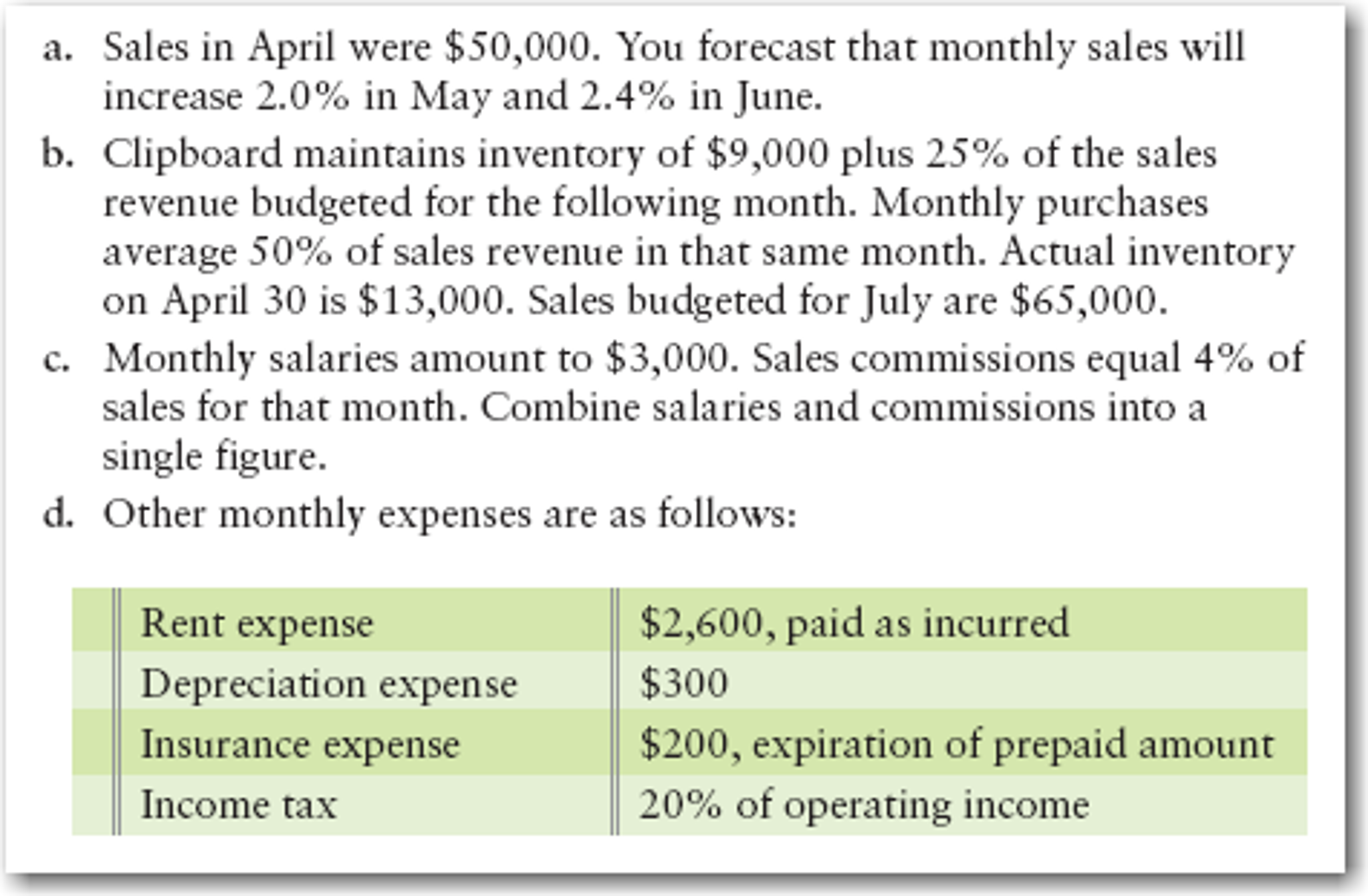

The budget committee of Clipboard Office Supply has assembled the following data. As the business manager, you must prepare the budgeted income statements for May and June 2011.

Prepare Clipboard Office Supplys budgeted income statements for May and June. Show cost of goods sold computations. Round all amounts to the nearest $100. (Round amounts ending in $50 or more upward, and amounts ending in less than $50 downward.) For example, budgeted May sales are $51,000 ($50,000 x 1.02), and June sales are $52,200 ($51,000 x 1.024)

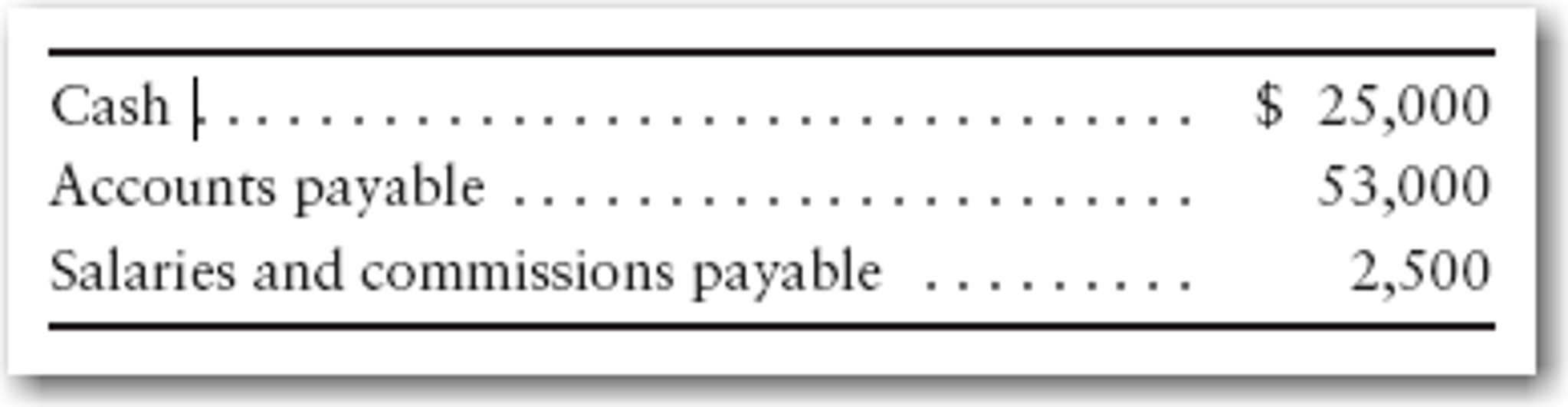

Clipboard Office Supplys sales are 75% cash and 25% credit. (Use the rounded sales values.) Credit sales are collected in the month after sale. Inventory purchases are paid 25% in the month of purchase and 75% the following month. Salaries and sales commissions are also paid half in the month earned and half the next month. Income tax is paid at the end of the year. The April 30, 2011, balance sheet showed the following balances:

R1. Prepare schedules of (a) budgeted cash collections, (b) budgeted cash payments for purchases, and (c) budgeted cash payments for operating expenses. Show amounts for each month and totals for May and June. Round your computations to the nearest dollar.

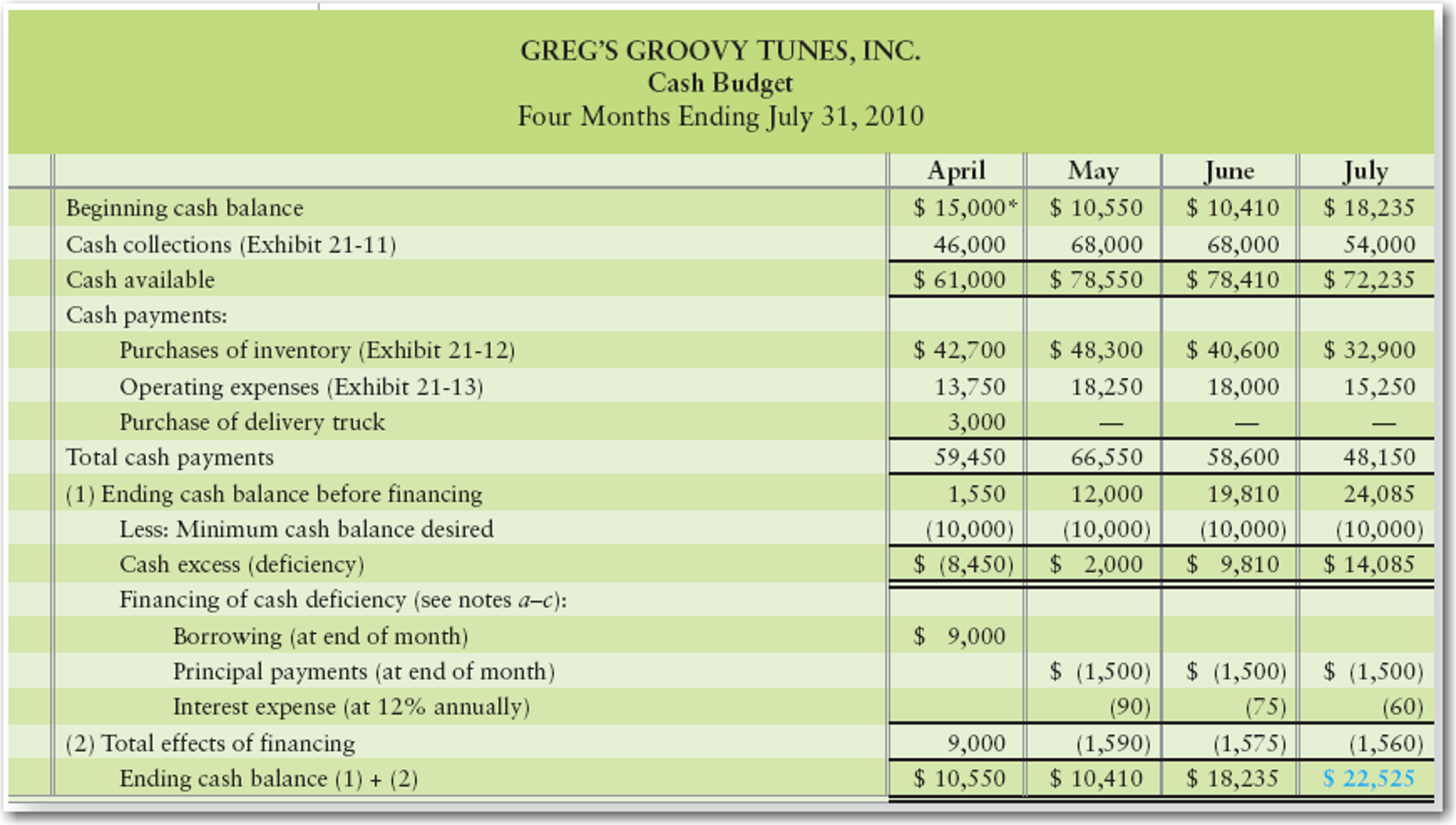

R2. Prepare a cash budget similar to the figure shown below. If no financing activity took place, what is the budgeted cash balance on June 30, 2011?

a. Sales in April were $50,000. You forecast that monthly sales will increase 2.0% in May and 2.4% in June. b. Clipboard maintains inventory of $9,000 plus 25% of the sales revenue budgeted for the following month. Monthly purchases average 50% of sales revenue in that same month. Actual inventory on April 30 is $13,000. Sales budgeted for July are $65,000. c. Monthly salaries amount to $3,000. Sales commissions equal 4% of sales for that month. Combine salaries and commissions into a single figure. d. Other monthly expenses are as follows: $2,600, paid as incurred Rent expense $300 Depreciation expense $200, expiration of prepaid amount Insurance expense 20% of operating income Income tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started