Answered step by step

Verified Expert Solution

Question

1 Approved Answer

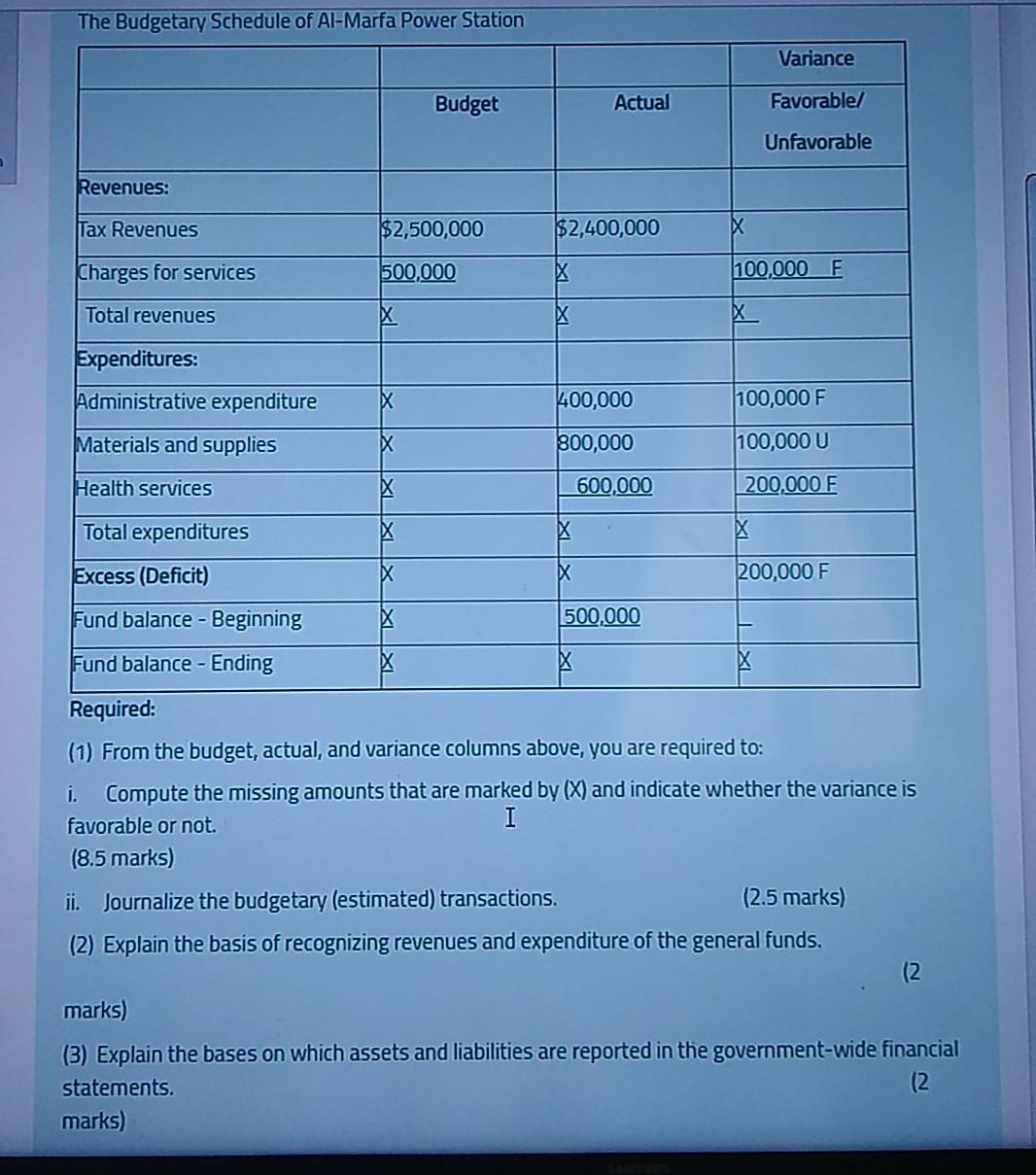

The Budgetary Schedule of Al-Marfa Power Station Variance Budget Actual Favorable) Unfavorable Revenues: Tax Revenues $2,500,000 $2,400,000 Charges for services 500,000 100,000 F Total revenues

The Budgetary Schedule of Al-Marfa Power Station Variance Budget Actual Favorable) Unfavorable Revenues: Tax Revenues $2,500,000 $2,400,000 Charges for services 500,000 100,000 F Total revenues X Expenditures: Administrative expenditure 400,000 100,000 F Materials and supplies 300,000 100,000 U Health services 600,000 200,000 F Total expenditures Excess (Deficit) w 200,000 F Fund balance - Beginning 500,000 Fund balance - Ending Required: (1) From the budget, actual, and variance columns above, you are required to: i. Compute the missing amounts that are marked by (x) and indicate whether the variance is favorable or not. I (8.5 marks) ii. Journalize the budgetary (estimated) transactions. (2.5 marks) (2) Explain the basis of recognizing revenues and expenditure of the general funds. marks) (3) Explain the bases on which assets and liabilities are reported in the government-wide financial statements. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started