Answered step by step

Verified Expert Solution

Question

1 Approved Answer

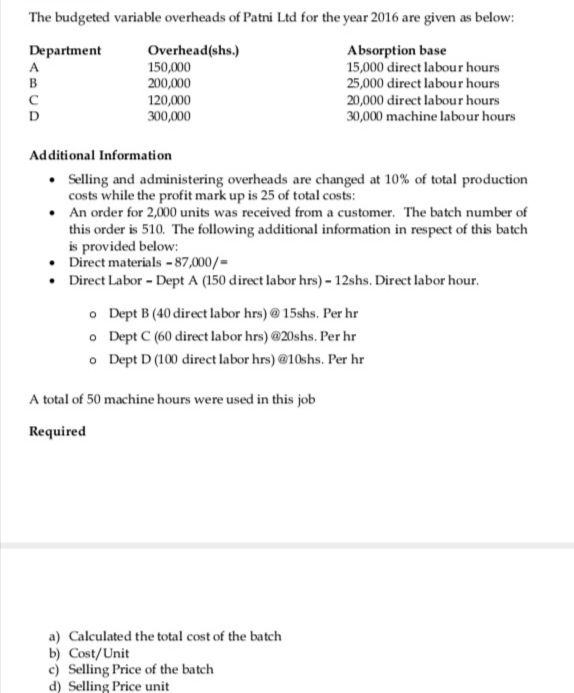

The budgeted variable overheads of Patni Ltd for the year 2016 are given as below: Department Overhead(shs.) Absorption base ABCD 150,000 200,000 120,000 300,000

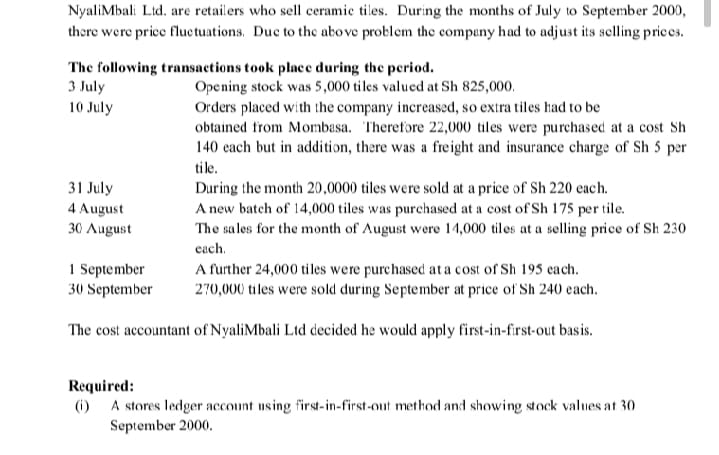

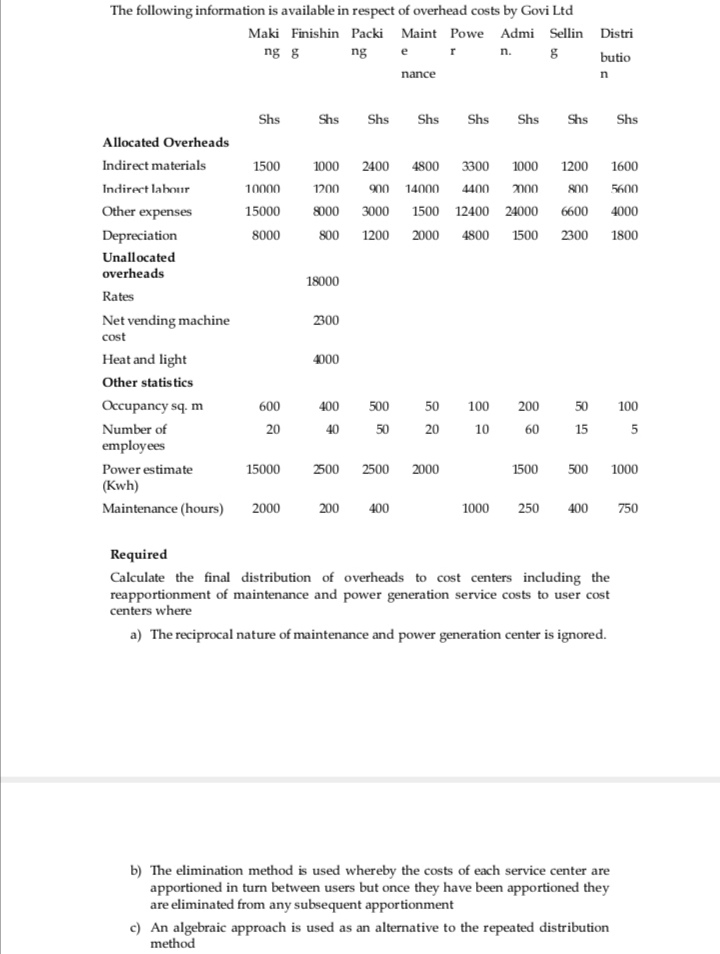

The budgeted variable overheads of Patni Ltd for the year 2016 are given as below: Department Overhead(shs.) Absorption base ABCD 150,000 200,000 120,000 300,000 Additional Information 15,000 direct labour hours 25,000 direct labour hours 20,000 direct labour hours 30,000 machine labour hours Selling and administering overheads are changed at 10% of total production costs while the profit mark up is 25 of total costs: An order for 2,000 units was received from a customer. The batch number of this order is 510. The following additional information in respect of this batch is provided below: Direct materials - 87,000/= - Direct Labor Dept A (150 direct labor hrs) - 12shs. Direct labor hour. o Dept B (40 direct labor hrs) @ 15shs. Per hr o Dept C (60 direct labor hrs) @20shs. Per hr o Dept D (100 direct labor hrs) @10shs. Per hr A total of 50 machine hours were used in this job Required a) Calculated the total cost of the batch b) Cost/Unit c) Selling Price of the batch d) Selling Price unit NyaliMbali Ltd. are retailers who sell ceramic tiles. During the months of July to September 2000, there were price fluctuations. Due to the above problem the company had to adjust its selling prices. The following transactions took place during the period. 3 July 10 July 31 July 4 August 30 August 1 September 30 September Opening stock was 5,000 tiles valued at Sh 825,000. Orders placed with the company increased, so extra tiles had to be obtained from Mombasa. Therefore 22,000 tiles were purchased at a cost Sh 140 each but in addition, there was a freight and insurance charge of Sh 5 per tile. During the month 20,0000 tiles were sold at a price of Sh 220 each. A new batch of 14,000 tiles was purchased at a cost of Sh 175 per tile. The sales for the month of August were 14,000 tiles at a selling price of Sh 230 each. A further 24,000 tiles were purchased at a cost of Sh 195 each. 270,000 tiles were sold during September at price of Sh 240 each. The cost accountant of NyaliMbali Ltd decided he would apply first-in-first-out basis. Required: (i) A stores ledger account using first-in-first-out method and showing stock values at 30 September 2000. The following information is available in respect of overhead costs by Govi Ltd Maki Finishin Packi Maint Powe Admi Sellin Distri Allocated Overheads ng g ng er nance n. g butio n Shs Shs Shs Shs Shs Shs Shs Shs Indirect materials 1500 1000 Indirect labour 10000 Other expenses 15000 8000 Depreciation 8000 800 2400 4800 3300 1000 1200 1200 900 14000 4400 2000 800 5600 3000 1500 12400 24000 6600 4000 1200 2000 4800 1600 1500 2300 1800 Unallocated overheads 18000 Rates Net vending machine 2300 cost Heat and light 4000 Other statistics Occupancy sq. m 600 400 500 50 Number of 20 40 40 50 20 52 100 200 10 20 50 100 00 60 15 5 employees Power estimate 15000 2500 2500 2000 1500 500 1000 (Kwh) Maintenance (hours) 2000 200 400 1000 250 oo 400 750 70 Required Calculate the final distribution of overheads to cost centers including the reapportionment of maintenance and power generation service costs to user cost centers where a) The reciprocal nature of maintenance and power generation center is ignored. b) The elimination method is used whereby the costs of each service center are apportioned in turn between users but once they have been apportioned they are eliminated from any subsequent apportionment c) An algebraic approach is used as an alternative to the repeated distribution method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started