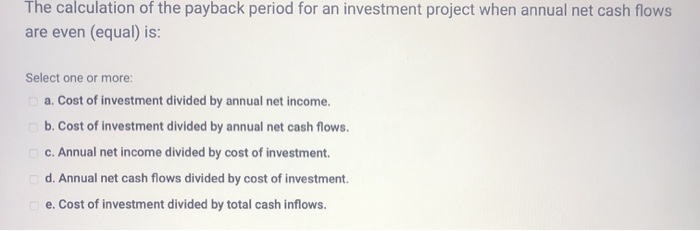

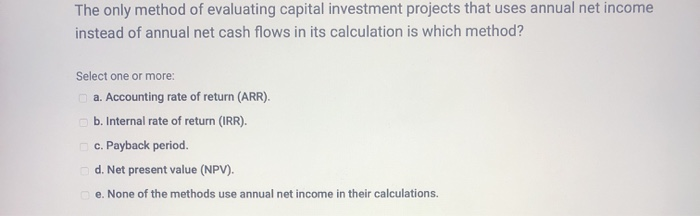

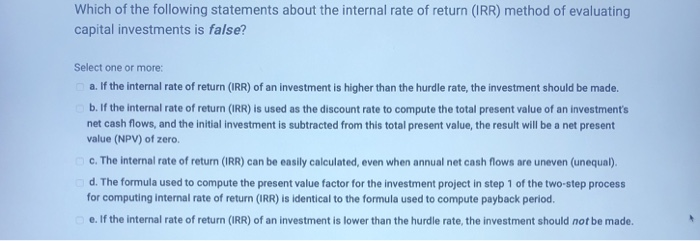

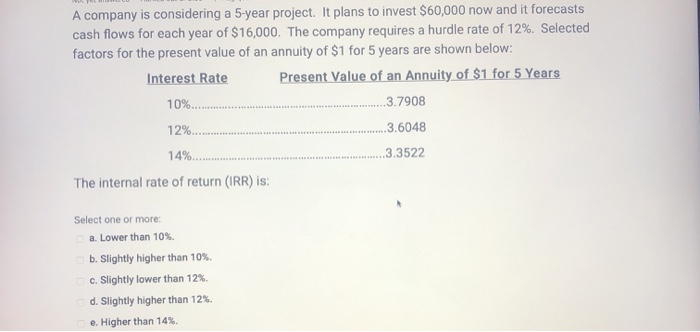

The calculation of the payback period for an investment project when annual net cash flows are even (equal) is: Select one or more: a. Cost of investment divided by annual net income. b. Cost of investment divided by annual net cash flows. c. Annual net income divided by cost of investment. d. Annual net cash flows divided by cost of investment. e. Cost of investment divided by total cash inflows. The only method of evaluating capital investment projects that uses annual net income instead of annual net cash flows in its calculation is which method? Select one or more: a. Accounting rate of return (ARR). b. Internal rate of return (IRR). c. Payback period. d. Net present value (NPV). e. None of the methods use annual net income in their calculations. Which of the following statements about the internal rate of return (IRR) method of evaluating capital investments is false? Select one or more: a. If the internal rate of return (IRR) of an investment is higher than the hurdle rate, the investment should be made. b. If the internal rate of return (IRR) is used as the discount rate to compute the total present value of an investment's net cash flows, and the initial investment is subtracted from this total present value, the result will be a net present value (NPV) of zero c. The internal rate of return (IRR) can be easily calculated, even when annual net cash flows are uneven (unequal). d. The formula used to compute the present value factor for the investment project in step 1 of the two-step process for computing internal rate of return (IRR) is identical to the formula used to compute payback period. e. If the internal rate of return (IRR) of an investment is lower than the hurdle rate, the investment should not be made. A company is considering a 5-year project. It plans to invest $60,000 now and it forecasts cash flows for each year of $16,000. The company requires a hurdle rate of 12%. Selected factors for the present value of an annuity of $1 for 5 years are shown below: Interest Rate Present Value of an Annuity of $1 for 5 Years 10% .3.7908 12% 3.6048 14% .3.3522 The internal rate of return (IRR) is: Select one or more: a. Lower than 10% b. Slightly higher than 10%. c. Slightly lower than 12% d. Slightly higher than 12% e. Higher than 14%