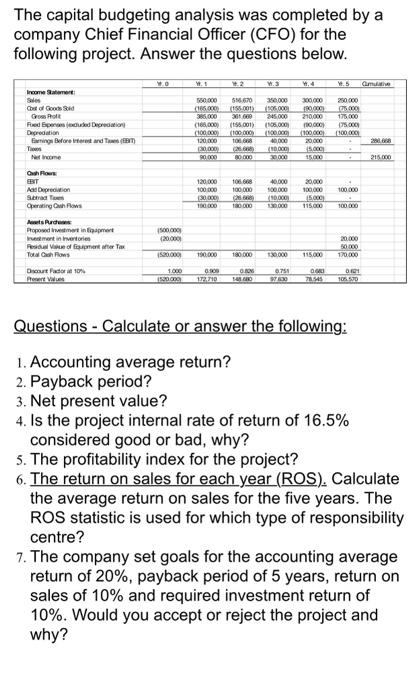

The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. Income Sale Chef Goods Growo Fred Speedded Depreciation Deprecation Etenings Before enterest and Team 550.000 5.670 350.000 300.000 (6.001566.000 386.000 3066245.000 210,000 C. 158.001) (100 000 100 000 2000 120.000 30.000 . BD 3.000 90.000 250.000 5.000 175.000 0.000 100 000 2000 000 215.000 120.000 100 000 20.000 1000 106 100 000 28 100 000 40.000 900.000 100D 150000 20,000 100,000 5000 115.000 100.000 Add Direction Stra Operating how wisuda Proposed in remontin to Pesicule of meer Tax Total shows Decout Fedora 10 0.00 20.000 20.000 50 000 170.000 120.000 190.000 180.000 TO 115.000 . 0.75 1000 200 172.710 Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS). Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20%, payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why? The capital budgeting analysis was completed by a company Chief Financial Officer (CFO) for the following project. Answer the questions below. Income Sale Chef Goods Growo Fred Speedded Depreciation Deprecation Etenings Before enterest and Team 550.000 5.670 350.000 300.000 (6.001566.000 386.000 3066245.000 210,000 C. 158.001) (100 000 100 000 2000 120.000 30.000 . BD 3.000 90.000 250.000 5.000 175.000 0.000 100 000 2000 000 215.000 120.000 100 000 20.000 1000 106 100 000 28 100 000 40.000 900.000 100D 150000 20,000 100,000 5000 115.000 100.000 Add Direction Stra Operating how wisuda Proposed in remontin to Pesicule of meer Tax Total shows Decout Fedora 10 0.00 20.000 20.000 50 000 170.000 120.000 190.000 180.000 TO 115.000 . 0.75 1000 200 172.710 Questions - Calculate or answer the following: 1. Accounting average return? 2. Payback period? 3. Net present value? 4. Is the project internal rate of return of 16.5% considered good or bad, why? 5. The profitability index for the project? 6. The return on sales for each year (ROS). Calculate the average return on sales for the five years. The ROS statistic is used for which type of responsibility centre? 7. The company set goals for the accounting average return of 20%, payback period of 5 years, return on sales of 10% and required investment return of 10%. Would you accept or reject the project and why