The case has been uploaded and we need to answer the following questions:-

Q1.) What attributes made Gerard Kleisterlee an effective leader for Philips? Was

the company right to renew his contract in March 2007 when it still had over a year to run?

Q2.) Critically appraise Philips approach to mergers and acquisitions. Are people

right to expect them to do larger deal?

Q3.) Critically appraise Philips control and performance measurement systems, What other performance measures might you propose for the CE business?

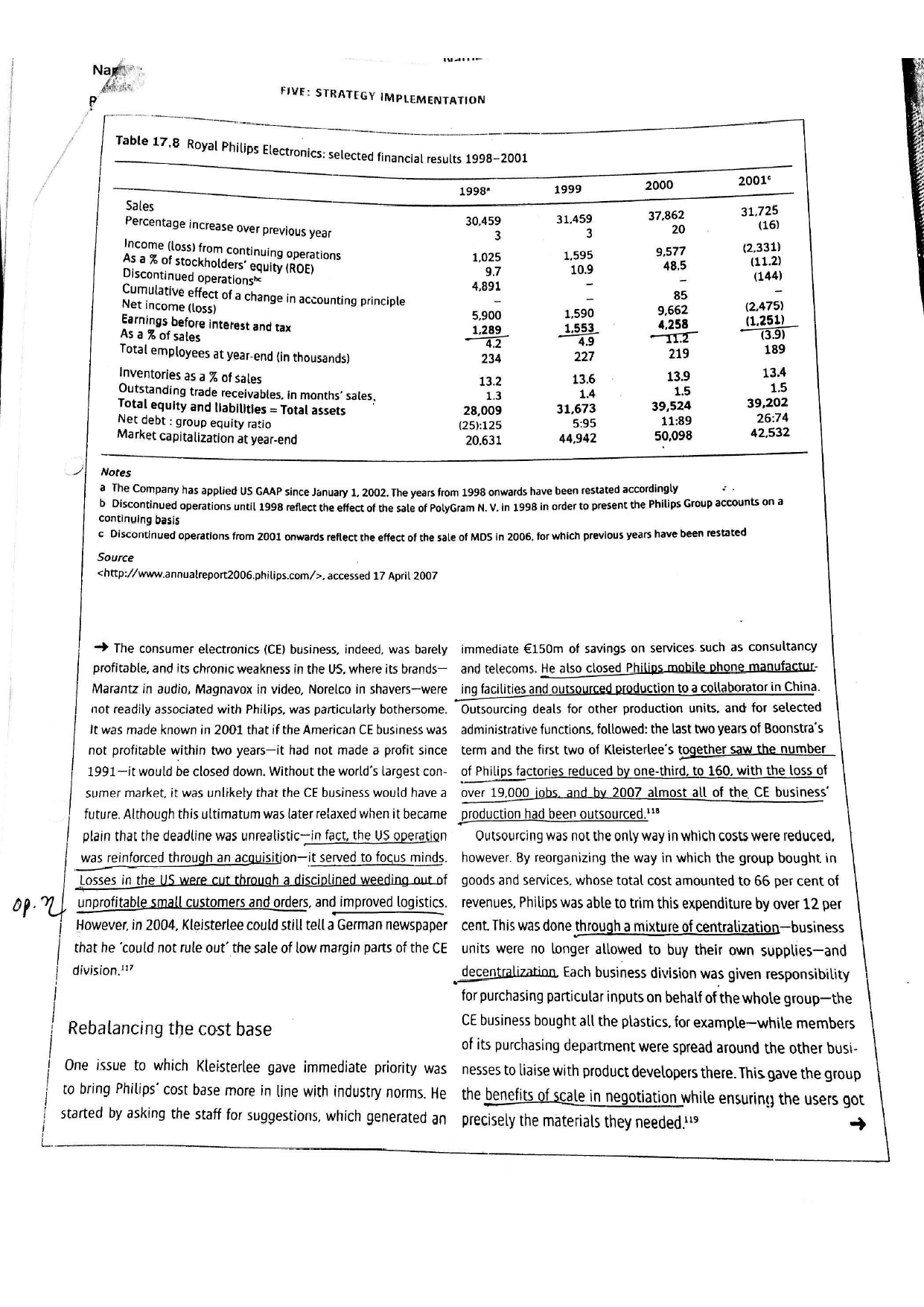

rnaround at Dutch conglomerate Royal Philips Electronics has a proud history The firm's unbridled passion for technology led it to become a of innovation in electrical goods and electronics. From its founda- highly diversified conglomerate that produced lighting, medical tion by Anton and Gerard Philips in 1891, as a manufacturer of systems, computers, semiconductors, TVs and their components. light bulbs, it had pioneered such products as X-rays, rotary elec- and a variety of other electronics items for consumer and busi- tric shavers, compact cassette tapes, CDs, and DVDs, accumulate ness use. However, it also ventured into other areas not strongly ing some 126,000 patents."Its innovativeness made Philips the connected to electronics, such as fertilizers, vitamin pills, turnit- largest consumer-electronics group in Europe. and a mainstay ure, and trumpets. Eventually, this diversity became difficult to of the Dutch economy. The philosophy of Frits Philips, the much- manage, and in 1990 the company was close to bankruptcy."" respected son of Anton, who ran the company from 1940 until The 1990s were marked by attempts by first Jan Timmer and then 1971, was to encourage inventiveness on the part of Philips' Cor Boonstra to rationalize Philips' portfolio. trim bureaucracy, and engineers; the company would then manufacture and attempt to enhance profitability. These culminated in record profits in 2000, sell the resulting products. when its semiconductor and consumer businesses in particular spin off P. T. O.17 : MAKING STRATEGY HAPPEN In June 2007. it was announced that Philips would acquire Color Kinetics to strengthen its leading position in LED lighting systems, components, and technologies. Royal Philips Electronics performed strongly in buoyant economic conditions. However, Kleisterlee is an imposingly tall man, impeccably dressed, with the following year, the Al-Qaeda attacks on New York in September, piercing blue eyes. A Catholic by upbringing. he acquired, during and the unwinding of the internet boom, led to a much tougher his time in Asia, an affinity with the teachings of the Chinese environment, and the firm recorded its worst ever loss (see Table philosopher Confucius, with whom he shares a birthday. He also 17.8 for a summary of financial results). On 30 April 2001. Gerard draws inspiration from Mahatma Ghandi and the Dalai Lama, in

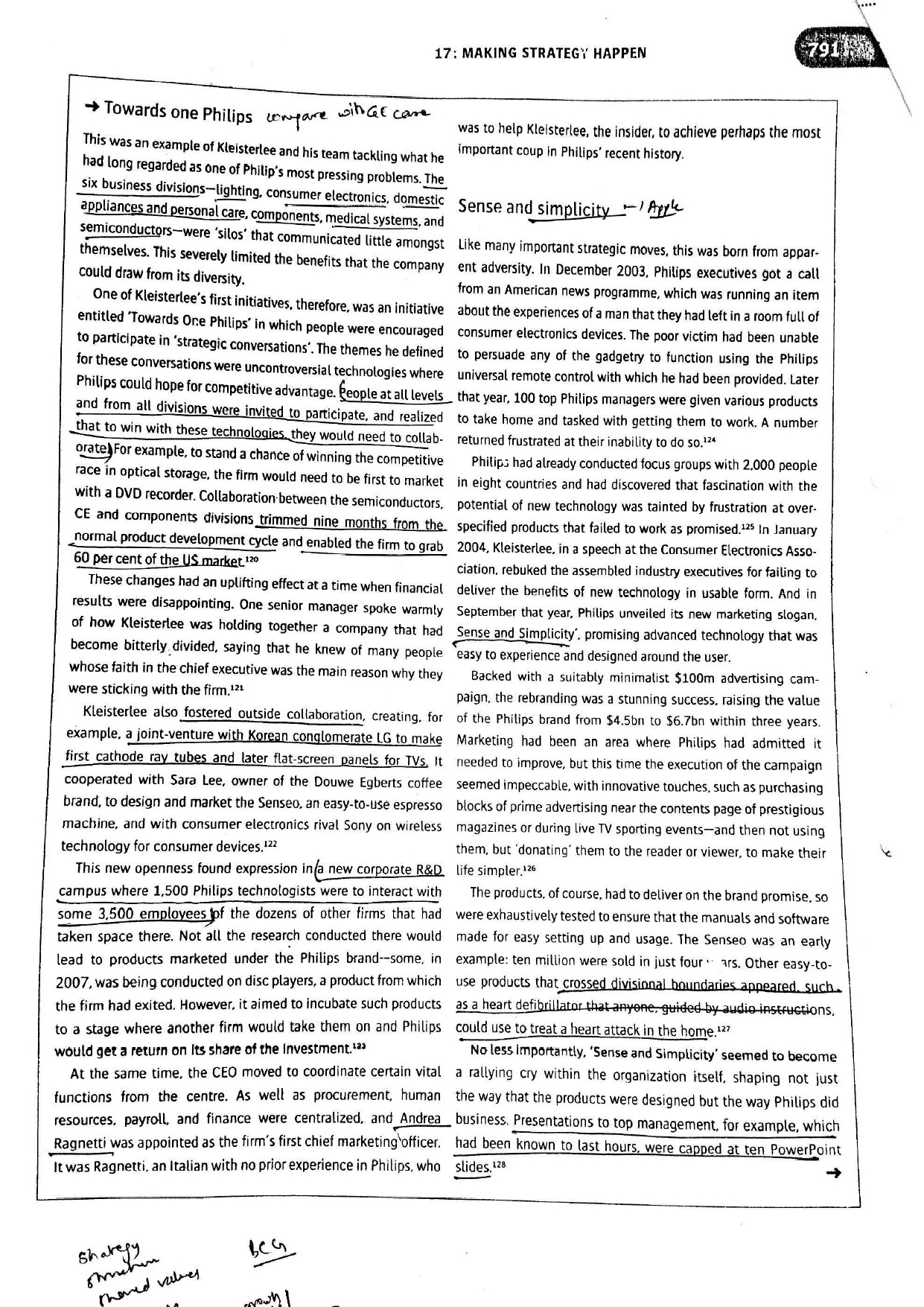

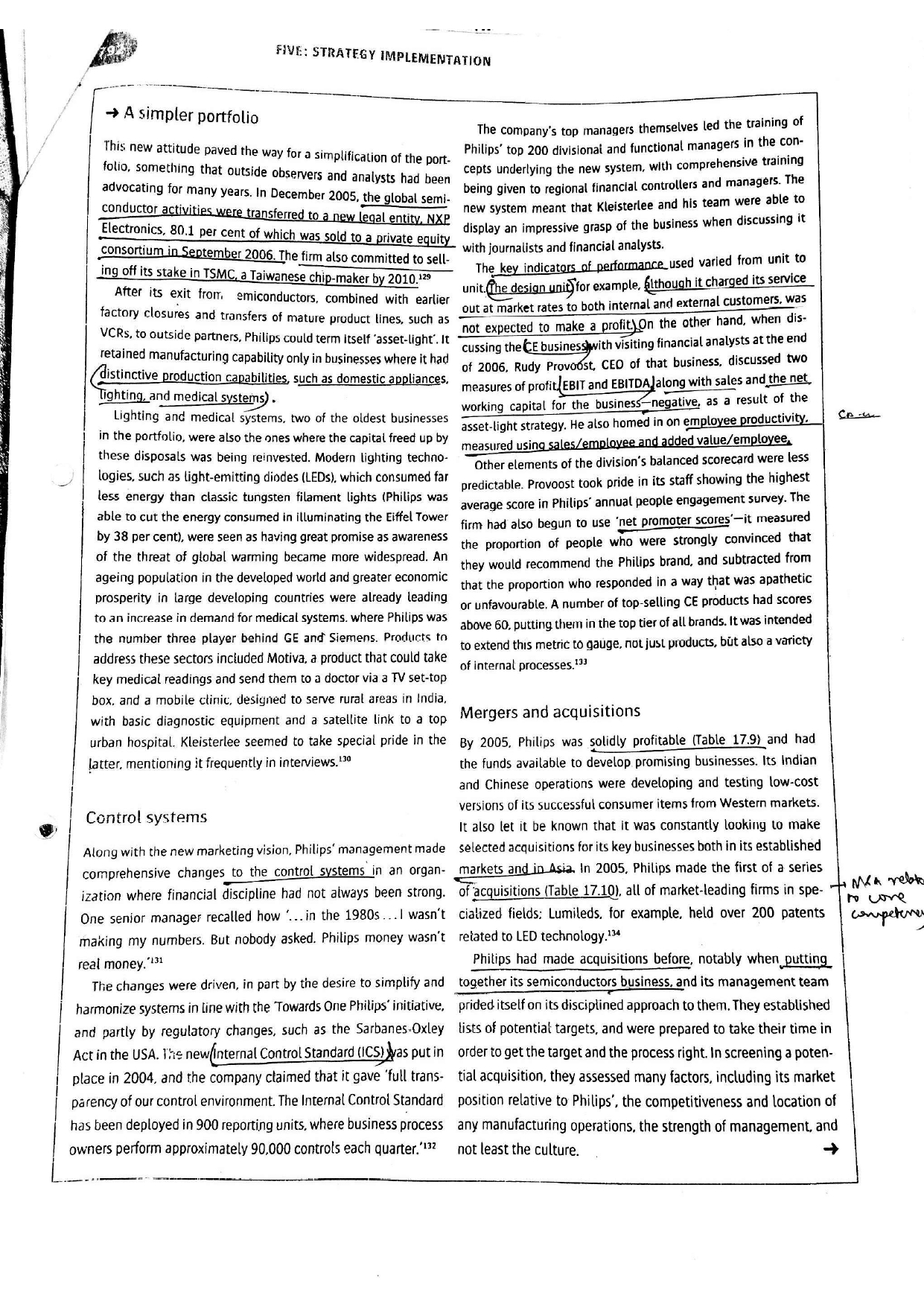

, accessed 17 April 2007 The consumer electronics (CE) business, indeed, was barely immediate E150m of savings on services such as consultancy profitable, and its chronic weakness in the US. where its brands- and telecoms. He also closed Philips mobile phone manufacture Marantz in audio, Magnavox in video, Norelco in shavers-were ing facilities and outsourced production to a collaborator in China. not readily associated with Philips, was particularly bothersome. Outsourcing deals for other production units, and for selected It was made known in 2001 that if the American CE business was administrative functions. followed: the last two years of Boonstra's not profitable within two years-it had not made a profit since term and the first two of Kleisterlee's together saw the number 1991-it would be closed down. Without the world's largest con- of Philips factories reduced by one-third, to 160. with the loss of sumer market. it was unlikely that the CE business would have a over 19,000 jobs. and by 2007 almost all of the CE business' future. Although this ultimatum was later relaxed when it became production had been outsourced." plain that the deadline was unrealistic-in fact, the US operation Outsourcing was not the only way in which costs were reduced, was reinforced through an acquisition-it served to focus minds. however. By reorganizing the way in which the group bought in Losses in the US were cut through a disciplined weeding out of goods and services, whose total cost amounted to 66 per cent of op . 2 unprofitable small customers and orders, and improved logistics. revenues, Philips was able to trim this expenditure by over 12 per However, in 2004, Kleisterlee could still tell a German newspaper cent. This was done through a mixture of centralization-business that he could not rule out' the sale of low margin parts of the CE units were no longer allowed to buy their own supplies-and division. 117 decentralization. Each business division was given responsibility for purchasing particular inputs on behalf of the whole group-the Rebalancing the cost base CE business bought all the plastics, for example-while members of its purchasing department were spread around the other busi- One issue to which Kleisterlee gave immediate priority was nesses to liaise with product developers there. This gave the group to bring Philips' cost base more in line with industry norms. He the benefits of scale in negotiation while ensuring the users got started by asking the staff for suggestions, which generated an precisely the materials they needed.'917: MAKING STRATEGY HAPPEN 791 Towards one Philips compare with care was to help Kleisterlee, the insider, to achieve perhaps the most This was an example of Kleisterlee and his team tackling what he important coup in Philips' recent history. had long regarded as one of Philip's most pressing problems. The six business divisions-lighting, consumer electronics, domestic Sense and simplicity ' Ark appliances and personal care, components, medical systems, and semiconductors-were 'silos' that communicated little amongst Like many important strategic moves, this was born from appar- themselves. This severely limited the benefits that the company ent adversity. In December 2003, Philips executives got a call could draw from its diversity. from an American news programme, which was running an item One of Kleisterlee's first initiatives, therefore, was an initiative about the experiences of a man that they had left in a room full of entitled 'Towards One Philips' in which people were encouraged consumer electronics devices. The poor victim had been unable to participate in 'strategic conversations'. The themes he defined to persuade any of the gadgetry to function using the Philips for these conversations were uncontroversial technologies where universal remote control with which he had been provided. Later Philips could hope for competitive advantage. People at all levels that year, 100 top Philips managers were given various products and from all divisions were invited to participate, and realized to take home and tasked with getting them to work. A number that to win with these technologies. they would need to collab- returned frustrated at their inability to do so.124 prate For example, to stand a chance of winning the competitive Philips had already conducted focus groups with 2.000 people race in optical storage. the firm would need to be first to market in eight countries and had discovered that fascination with the with a DVD recorder. Collaboration between the semiconductors, potential of new technology was tainted by frustration at over- CE and components divisions trimmed nine months from the specified products that failed to work as promised. 125 In January normal product development cycle and enabled the firm to grab 2004. Kleisterlee. in a speech at the Consumer Electronics Asso- 60 per cent of the US market. 120 ciation, rebuked the assembled industry executives for failing to These changes had an uplifting effect at a time when financial deliver the benefits of new technology in usable form. And in results were disappointing. One senior manager spoke warmly September that year, Philips unveiled its new marketing slogan, of how Kleisterlee was holding together a company that had Sense and Simplicity'. promising advanced technology that was become bitterly divided, saying that he knew of many people easy to experience and designed around the user. whose faith in the chief executive was the main reason why they Backed with a suitably minimalist $100m advertising cam- were sticking with the firm. 12 paign, the rebranding was a stunning success, raising the value Kleisterlee also fostered outside collaboration, creating. for of the Philips brand from $4.5bn to $6.7bn within three years. example, a joint-venture with Korean conglomerate LG to make Marketing had been an area where Philips had admitted it first cathode ray tubes and later flat-screen panels for TVs. It needed to improve, but this time the execution of the campaign cooperated with Sara Lee, owner of the Douwe Egberts coffee seemed impeccable, with innovative touches, such as purchasing brand, to design and market the Senseo. an easy-to-use espresso blocks of prime advertising near the contents page of prestigious machine, and with consumer electronics rival Sony on wireless magazines or during live TV sporting events-and then not using technology for consumer devices. 122 them, but 'donating' them to the reader or viewer, to make their This new openness found expression in a new corporate R&D. life simpler. 126 campus where 1,500 Philips technologists were to interact with The products, of course, had to deliver on the brand promise, so some 3.500 employees of the dozens of other firms that had were exhaustively tested to ensure that the manuals and software taken space there. Not all the research conducted there would made for easy setting up and usage. The Senseo was an early lead to products marketed under the Philips brand--some, in example: ten million were sold in just four . ars. Other easy-to- 2007, was being conducted on disc players, a product from which use products that crossed divisional boundaries appeared. such.. the firm had exited. However, it aimed to incubate such products as a heart defibrillator that anyone, guided by audio-instructions. to a stage where another firm would take them on and Philips could use to treat a heart attack in the home. 127 would get a return on Its share of the Investment. 123 No less importantly, 'Sense and Simplicity' seemed to become At the same time, the CEO moved to coordinate certain vital a rallying cry within the organization itself, shaping not just functions from the centre. As well as procurement, human the way that the products were designed but the way Philips did resources, payroll, and finance were centralized, and Andreabusiness. Presentations to top management. for example, which Ragnetti was appointed as the firm's first chief marketing officer. had been known to last hours, were capped at ten Powerpoint It was Ragnetti, an Italian with no prior experience in Philips, who slides. 128 sharepy BCGFIVE: STRATEGY IMPLEMENTATION - A simpler portfolio The company's top managers themselves led the training of This new attitude paved the way for a simplification of the port- Philips' top 200 divisional and functional managers in the con- folio, something that outside observers and analysts had been cepts underlying the new system, with comprehensive training advocating for many years. In December 2005, the global semi- being given to regional financial controllers and managers. The conductor activities were transferred to a new legal entity, NXP. new system meant that Kleisterlee and his team were able to display an impressive grasp of the business when discussing it Electronics, 80.1 per cent of which was sold to a private equity with journalists and financial analysts. consortium in September 2006. The firm also committed to sell- ing off its stake in TSMC, a Taiwanese chip-maker by 2010.129 The key indicators of performance_ used varied from unit to After its exit from emiconductors, combined with earlier unit. (The design unit) for example, although it charged its service factory closures and transfers of mature product lines, such as out at market rates to both internal and external customers, was VCRs, to outside partners, Philips could term itself "asset-light'. It not expected to make a profit.)On the other hand, when dis- etained manufacturing capability only in businesses where it had cussing the CE businesswith visiting financial analysts at the end distinctive production capabilities, such as domestic appliances. of 2006. Rudy Provoost, CEO of that business. discussed two lighting, and medical systems) measures of profit.EBIT and EBITDA along with sales and the net. Lighting and medical systems, two of the oldest businesses working capital for the business-negative, as a result of the in the portfolio, were also the ones where the capital freed up by asset-light strategy. He also homed in on employee productivity. these disposals was being reinvested. Modern lighting techno- measured using sales/employee and added value/employee, logies, such as light-emitting diodes (LEDs), which consumed far Other elements of the division's balanced scorecard were less less energy than classic tungsten filament lights (Philips was predictable. Provoost took pride in its staff showing the highest able to cut the energy consumed in illuminating the Eiffel Tower average score in Philips' annual people engagement survey. The by 38 per cent), were seen as having great promise as awareness firm had also begun to use 'net promoter scores'-it measured of the threat of global warming became more widespread. An the proportion of people who were strongly convinced that ageing population in the developed world and greater economic they would recommend the Philips brand, and subtracted from prosperity in large developing countries were already leading that the proportion who responded in a way that was apathetic to an increase in demand for medical systems. where Philips was or unfavourable. A number of top-selling CE products had scores the number three player behind GE and Siemens. Products to above 60. putting them in the top tier of all brands. It was intended address these sectors included Motiva, a product that could take to extend this metric to gauge, not just products, but also a variety key medical readings and send them to a doctor via a TV set-top of internal processes. 13 box. and a mobile clinic, designed to serve rural areas in India, with basic diagnostic equipment and a satellite link to a top Mergers and acquisitions urban hospital. Kleisterlee seemed to take special pride in the By 2005. Philips was solidly profitable (Table 17.9) and had latter. mentioning it frequently in interviews.3 the funds available to develop promising businesses. Its Indian and Chinese operations were developing and testing low-cost Control systems versions of its successful consumer items from Western markets. It also let it be known that it was constantly looking to make Along with the new marketing vision, Philips' management made selected acquisitions for its key businesses both in its established comprehensive changes to the control systems in an organ- markets and in Asia, In 2005. Philips made the first of a series ization where financial discipline had not always been strong. of acquisitions (Table 17.10), all of market-leading firms in spe MA reb One senior manager recalled how '... in the 1980s ...I wasn't cialized fields: Lumileds. for example, held over 200 patents to core competere making my numbers. But nobody asked. Philips money wasn't related to LED technology.134 real money."131 Philips had made acquisitions before, notably when putting The changes were driven, in part by the desire to simplify and together its semiconductors business, and its management team harmonize systems in line with the Towards One Philips' initiative. prided itself on its disciplined approach to them. They established and partly by regulatory changes, such as the Sarbanes-Oxley lists of potential targets, and were prepared to take their time in Act in the USA. The new(internal Control Standard (ICS) was put in order to get the target and the process right. In screening a poten- place in 2004, and the company claimed that it gave 'full trans- tial acquisition, they assessed many factors, including its market parency of our control environment. The Internal Control Standard position relative to Philips', the competitiveness and location of has been deployed in 900 reporting units, where business process any manufacturing operations, the strength of management, and owners perform approximately 90,000 controls each quarter.'132 not least the culture.17: MAKING STRATEGY HAPPEN 793 Table 17.9 Royal Philips Electronics: selected financial results 2002-2006 2002 2002 2003ab 2004. 2005. 2006ab Sales 30,983 26,788 24,049 24.855 25,775 26.976 Percentage increase over previous year (2) (2) (10) Income (loss) from continuing operations 100 2.584 2.831 919 As a % of stockholders' equity (ROE) (3,184) (2,863) 1.0 18.5 18.1 Discontinued operations 19.1) (15.3) AA (22) (343) 609 252 37 1.464 Cumulative effect of a change in accounting principle Net income (loss) (14) (3.206) (3.206) 695 2.836 2,868 5,383 Earnings before interest and tax 442 943 830 1,156 1,472 1,183 As a % of sales 1.4 3.5 3.5 4.7 5.7 4.4 Total employees at year-end (in thousands) 170 170c 164c 162c 159' 122 Inventories as a % of sales 11.1 10.7 10.3 10.1 10.9 10.7 Outstanding trade receivables, in months' sales 1.3 1.3 1.3 1.3 1.4 1.5 uity and liabilities = Total assets 32.289 33,905 38.497 Net debt : group equity ratio 32,205 28,989 30,739 27:73 27:73 18:82 1:99 (5):105 (10):110 Market capitalization at year-end 21,309 21,309 29.648 25,003 31,536 31,624 Notes a Discontinued operations from 2001 onwards reflect the effect of the sale of MDS in 2006, for which previous years have been restated b Discontinued operations from 2002 onwards reflect the effect of the sale of Semiconductors in 2006. for which previous years have been restated c Including discontinued operations Source

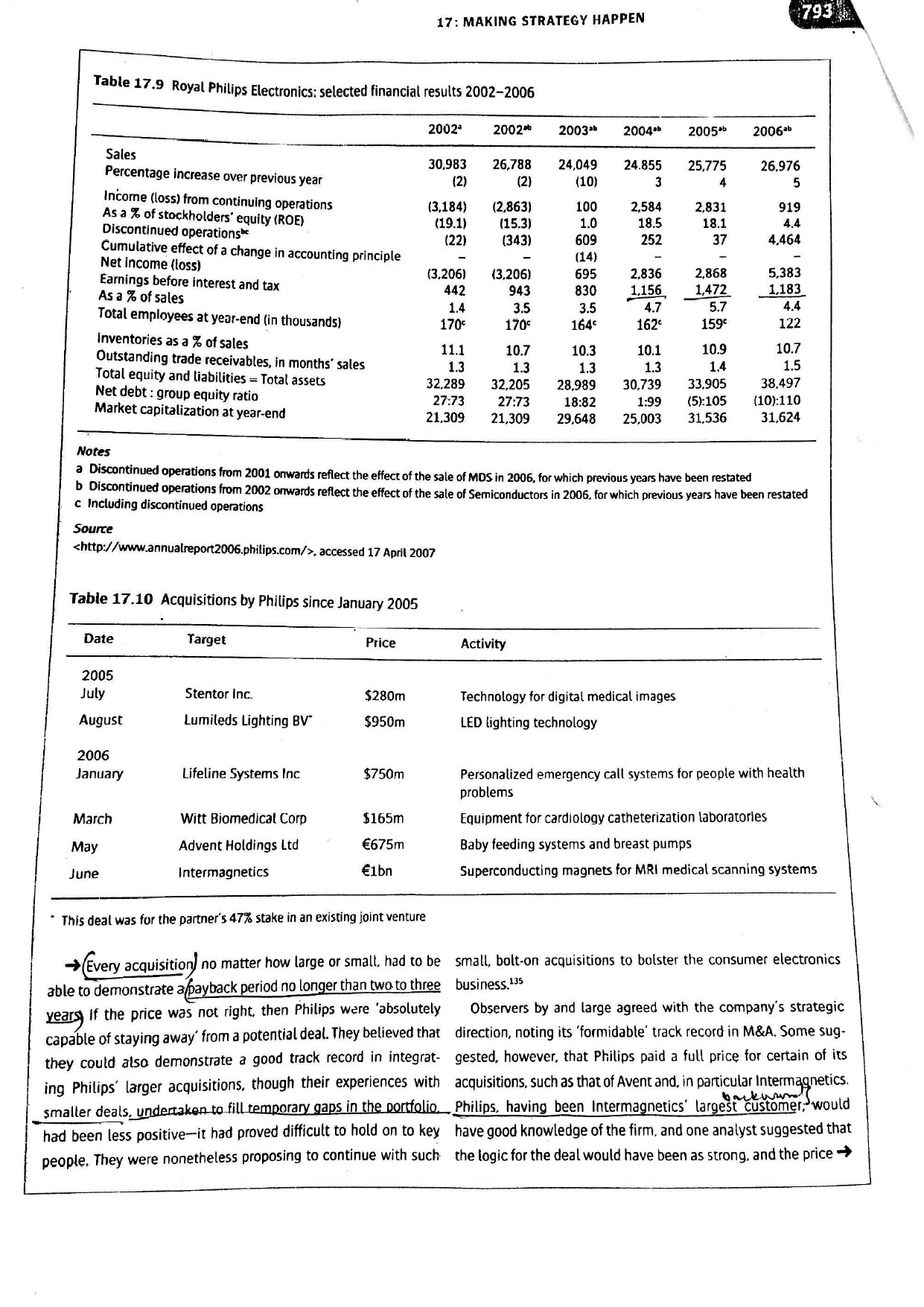

, accessed 17 April 2007 Table 17.10 Acquisitions by Philips since January 2005 Date Target Price Activity 2005 July Stentor Inc. $280m Technology for digital medical images August Lumileds Lighting BV $950m LED lighting technology 2006 January Lifeline Systems Inc $750m Personalized emergency call systems for people with health problems March Witt Biomedical Corp $165m Equipment for cardiology catheterization laboratories May Advent Holdings Ltd E675m Baby feeding systems and breast pumps June Intermagnetics E1bn Superconducting magnets for MRI medical scanning systems * This deal was for the partner's 47% stake in an existing joint venture ->Every acquisition) no matter how large or small, had to be small, bolt-on acquisitions to bolster the consumer electronics able to demonstrate a payback period no longer than two to three business. 135 years if the price was not right, then Philips were 'absolutely Observers by and large agreed with the company's strategic capable of staying away' from a potential deal. They believed that direction, noting its 'formidable track record in M&A. Some sug- they could also demonstrate a good track record in integrat- gested, however, that Philips paid a full price for certain of its ing Philips' larger acquisitions, though their experiences with acquisitions, such as that of Avent and, in particular Intermagnetics. smaller deals, undertaken to fill temporary gaps in the portfolio, Philips, having been Intermagnetics' largest customer, would had been less positive-it had proved difficult to hold on to key have good knowledge of the firm. and one analyst suggested that people. They were nonetheless proposing to continue with such the logic for the deal would have been as strong, and the priceFIVE: STRATEGY IMPLEMENTATION much lower, two or three years beforehand. Another sug- ing it on M&As, but pressure was mounting for it to pull off a gested that Philips might have been able to replicate Lifeline's really large deal-E3bn or more-of the kind already achieved by personal emergency technology, which complemented its-exist- ing Motiva product, in-house.'S its main competitors in medical systems by Fortune, the top American business publication, had named Gerard Kleisterlee as its Europe Businessman of the Year for The situation in 2007 2006. He had welcomed the honour of having his photograph on the magazine's front page, suggesting that it would help By April 2007, Philips had clearly come a long way since the tor- the company's sales in the USA. and that it demonstrated to rid times of 2002. The portfolio had been simplified: intriguingly. Americans that Europe was truly capable of change-but that as one journalist pointed out. this left the firm with a structure 'his' achievement was really that of the entire group. In March that the founding Philips brothers would have found familiar. The 2007, his tenure as CEO was extended from October 2008 until people that had criticized Philips for sticking to its low-margin CE April 2011. 139 business 'despite having had their ass kicked so many times' had fallen silent. Philips' management, for its part, was convinced that consumer electronics gave it vital leverage in negotiations with powerful retailers, such as Wal-Mart, that were crucial to the distribution of its other products. 137 No longer exposed to the highly cyclical semiconductor industry. Philips could look forward to stable profitability. In fact. one key issue preoccupying its management was(how to use the funds at its disposal;the company was debt-free, with further cash injections to be expected as it sold off its remaining stakes in some of the businesses from which it had withdrawn. It was committed to either returning the cash to shareholders or spend